Savills Vietnam remains positive property prospects despite pandemic

|

| Neil MacGregor, managing director of Savills Vietnam is confident of the property market's prospects |

Vietnam has retained exceptional growth, despite being affected by various economic crises over the last 25 years. Besides being considered the sector of choice for investors in Vietnam, property remains the safest and most effective investment channel.

Even though COVID-19 might last into early 2021, Savills anticipates a strong recovery from 2021 to 2022 and beyond. Moreover, effective and timely government support, as shown through its effective pandemic response and recent stimulus policies, will provide further powerful leverage for real estate businesses and the national economy.

Since the mid-90s, the domestic property market has had a pattern of impressive growth, brief downturn, and recovery. However, the COVID-19 pandemic in the first half of 2020 negatively affected the market in an unprecedented manner.

1995 to 1998: Stabilising relations with the United States and officially joining ASEAN in 1995 marked successful milestones.

The transition from centrally planned to a market driven economy was establishing a robust platform for lasting change and growth.

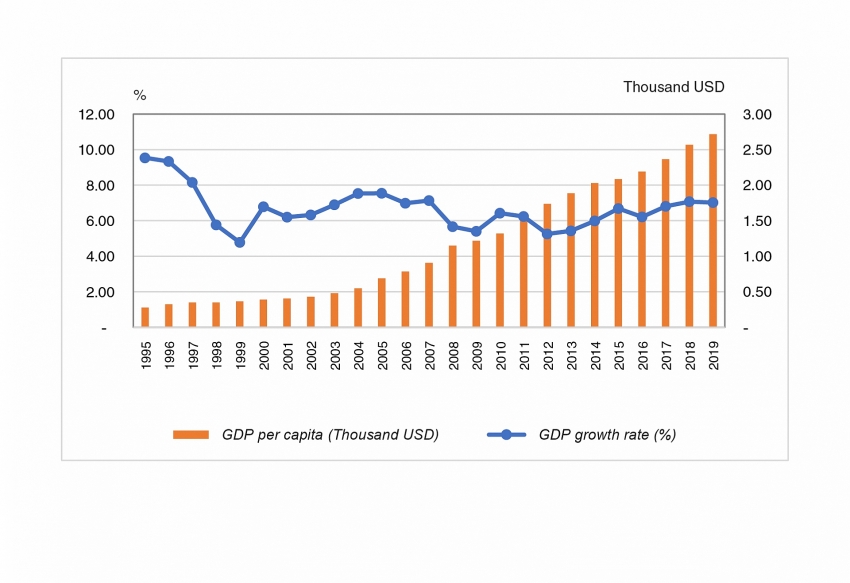

The General Statistics Office (GSO) shows growth in 1995 was 9.54 per cent, and 9.34 per cent in 1996, correlating with per capita GDP increasing from $277 in 1995 to $324 in 1996.

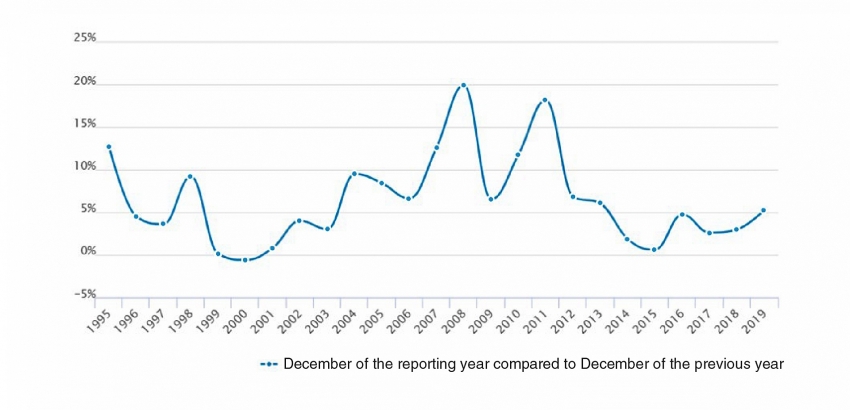

Inflation was reined in from 12.7 per cent in 1995 to 4.5 per cent in 1996 and 3.6 per cent in 1997.

At the same time, GDP growth and increased consumer confidence resulted in rising land prices, as the property market started to show signs of promise.

The domestic market then entered a prolonged slowdown with the onset of the Asian Financial Crisis in 1998 impacting the nascent market economy.

GSO data shows 5.76 per cent economic growth in 1998 while inflation reached 9.2 per cent. However, the limited market opening resulted in a proactive government response which helped successfully manage the crisis and enable a strong foundation for future growth.

1998 to 2008: The early years of the 21st century were characterised by further economic integration.

In 2001, the Vietnam-US Bilateral Trade Agreement (BTA) was ratified followed by Vietnam becoming a member of the World Trade Organisation (WTO) in 2006.

Back in 2000, Vietnam was considered the next "Asian Tiger" economy with per capita GDP growing to $396, compared to $328 in Laos and $283 in Cambodia. New national economic and macroeconomic policies saw 6.79 per cent GDP growth in 2000, up to 6.89 per cent in 2001, followed by robust GDP growth averaging 8.23 per cent per annual from 2004 to 2007.

Property market fluctuations inevitably followed. National economic indicators reflected a strong global economy, increased confidence in local economic recovery and steady increases of foreign direct investment (FDI).

Furthermore, effective government policies contributing to market performance saw land prices ramping up.

Significant price growth driven by increasing transactions led to the property market becoming everyone’s favourite investment channel.

However, land prices increasing significantly over the two most frantic periods of 2001 to 2003, and 2007 through 2008, started to exclude lower-income investor participation from Ho Chi Minh City and Hanoi.

Per capita GDP and GDP growth, 1995-2019

|

| Per capita GDP and GDP growth, 1995-2019 (Source: General Statistics Office) |

2008 to 2018: Growth punctuated by slowdown continued. In mid-2008, effects from the Global Financial Crisis led to a downward cycle in the domestic property market and land prices dropped by up to 40 per cent.

Property inventory in 2012 was over VND100 trillion ($4.35 billion), while property enterprises under bad debt increased. Rapidly rising inflation forced the State Bank to tighten monetary policies.

The government, by revising policies and releasing economic stimulus packages to attract investment, helped successfully navigate the crisis.

Social-housing-focused companies helped responsibly modify social housing policies and pricing. Together with government-supported VND30 trillion ($1.3 billion) credit packages, a real estate recovery started but inventory remained high. The market started to demonstrate sustained growth. Property segments bursting into life such as hotels and second homes ushered in new economic potential for provinces gifted with favourable geography and natural appeals such as Ba Ria -Vung Tau, Phu Quoc Island, Nha Trang, Halong, and in particular Danang.

Vietnam CPI, 1995-2019 (Source: The General Statistics Office) "> |

| Vietnam CPI, 1995-2019 (Source: The General Statistics Office) |

2018 to 2020: The latest World Bank report finds Vietnamese economic growth over the last two years has been mainly driven by high consumer demand and manufacturing-based export growth.

Economic data indicating 7 per cent real GDP growth in 2019, reflected one of the fastest-growing economies in the region.

While globalisation has positively affected Vietnam, the COVID-19 pandemic has caused extensive damage to global and local economies.

Fortunately, early and decisive measures from the government meant Vietnam was far less affected than other countries in the region. While fiscal policies were stable with GDP growth reaching 3.8 per cent in the first quarter of 2020, the pandemic, as it expanded, became more unpredictable.

The Asian Development Bank (ADB) estimates that Vietnam's GDP growth will reach 4.1 per cent in 2020. Although this is 0.7 per cent lower than their forecast in April, it remains the highest forecast growth in Southeast Asia. The World Bank anticipates 3 per cent GDP growth in 2020, and its 6.8 per cent growth forecast for 2021 shows confidence remains high in the local economy.

The Vietnamese economy is primed for recovery and the real estate sector is set to be one of the key beneficiaries in 2021 and beyond.

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Themes: Safe and Sound Vietnam

Related Contents

Latest News

More News

- More than $40 billion investment recorded in Asia-Pacific commercial real estate (February 18, 2026 | 19:58)

- Keppel co-hosts Home Hanoi Xuan festival in Hanoi (February 14, 2026 | 09:00)

- Saigon Centre gains LEED platinum and gold certifications (February 12, 2026 | 16:37)

- Construction firms poised for growth on public investment and capital market support (February 11, 2026 | 11:38)

- Mitsubishi acquires Thuan An 1 residential development from PDR (February 09, 2026 | 08:00)

- Frasers Property and GELEX Infrastructure propose new joint venture (February 07, 2026 | 15:00)

- Sun Group led consortium selected as investor for new urban area (February 06, 2026 | 15:20)

- Vietnam breaks into Top 10 countries and regions for LEED outside the US (February 05, 2026 | 17:56)

- Fairmont opens first Vietnam property in Hanoi (February 04, 2026 | 16:09)

- Real estate investment trusts pivotal for long-term success (February 02, 2026 | 11:09)

Tag:

Tag:

Mobile Version

Mobile Version