European investor-sentiment on Vietnam improves

The BCI nudged up to 45.1 points in the third quarter of 2023, from 43.5 points the previous quarter. While still below the 50-point threshold for four straight quarters, this small rise indicates emerging positive economic momentum.

Business sentiment appears to be in flux. Between the second and third quarters, there was a three percentage point drop in pessimism regarding the current situation, while positive and neutral perspectives increased by six and four percentage points respectively.

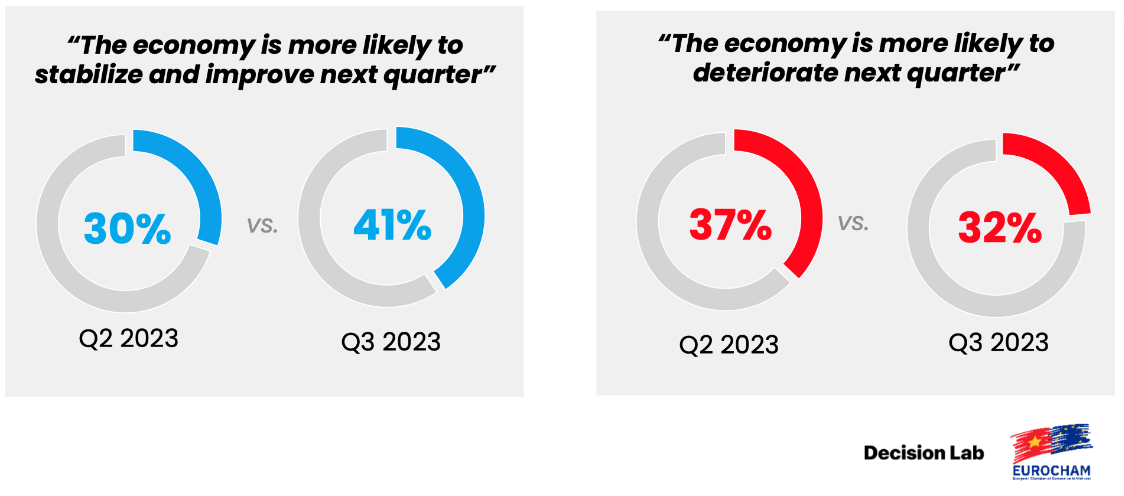

Furthermore, the third-quarter survey revealed a shift in projections for the quarter to come. Compared to responses in the second-quarter survey, there was an 11 percentage point rise in businesses anticipating economic stabilisation and growth for the upcoming quarter. On the other hand, businesses projecting a negative trend reduced by five percentage points.

|

Approaching year-end, hope and caution persist. Though Vietnam's third-quarter GDP grew a promising 5.3 per cent on-year, companies continue to be cautious. Expectations regarding increased revenue or orders remained stable, with no change from the previous quarter. Just 22 per cent of companies plan to expand their teams in the fourth quarter. Only 16 per cent expect an increase in investments.

In addition, Vietnam's global investment appeal remains strong. A notable 63 per cent of European businesses in the survey positioned Vietnam within their top 10 destinations for foreign direct investment (FDI). Even more striking, 31 per cent ranked Vietnam among their top three, while an impressive 16 per cent hailed it as their foremost investment destination. Reflecting this confidence, over half of those surveyed plan to increase their exposure to Vietnam by the end of the year.

Yet hurdles persist. A substantial 59 per cent cited administrative difficulties as their main challenge when operating in Vietnam. Challenges such as uncertainties in rules and regulations, hurdles in permit acquisition, and strict visa and work permit requirements for foreign workers also stood out as prominent barriers.

To improve the nation's attractiveness to FDI, 58 per cent of respondents said streamlining bureaucracy is key, 48 per cent advocated for enhancing the regulatory environment, one-third called for upgrading transport infrastructure, and 22 per cent emphasised easing visa and work permit requirements for foreign experts.

|

Sustainability is also a rising priority for European companies in Vietnam, with 80 per cent citing environmental, social, and governance (ESG) alignment as highly or moderately important. However, major obstacles remain when translating priorities into practice. Regulatory uncertainty, infrastructure gaps, and insufficient government support were cited as hindrances to implementing sustainability measures locally.

Additionally, only 20 per cent of firms are proactively preparing for impending EU green regulations, such as the Carbon Border Adjustment Mechanism. Meanwhile, 38 per cent currently have no plans for alignment. This distinct lack of preparedness not only poses challenges domestically but can hinder international competitiveness, especially in the crucial EU market.

Commenting on the BCI, Gabor Fluit, EuroCham's chairman, said, "It's clear. Team Europe stands firmly behind Vietnam. Nearly one-third of our members rank Vietnam as a top-three investment location, which sends a powerful message about our faith in this partnership."

However, he noted challenges remain. "While we saw promising third-quarter GDP and FDI growth, issues persist - especially with exports and real estate. Addressing administrative burdens, unclear regulations, and permit issues is crucial. We remain committed to open dialogue to effectively tackle these concerns together."

Fluit emphasised sustainability as a standout finding. "80 per cent of our members prioritise ESG alignment, which underscores a genuine commitment to responsible growth. By integrating green practices into business strategies, we pursue both development and progress."

The EuroCham chairman went on to say the alignment between European firms and Vietnam on sustainability objectives is commendable and pivotal. This shared commitment will be highlighted at EuroCham's 2023 Green Economy Forum in November, which will delve into actionable paths to a greener future.

| Amplifying EVFTA’s origin compliance The European Union has been one of Vietnam’s key trading partners since the early days of Vietnam’s economic reform period. The partnership marked a significant milestone in the history of its bilateral cooperation as the EU-Vietnam Free Trade Agreement (EVFTA) entered into effect in August 2020. |

| Vietnam remains attractive to European investors Vietnam remains appealing to European investors amidst the tough global situation, according to the latest report by The the European Chamber of Commerce in Vietnam. |

| Euro groups keen on smooth policy Businesses from the European Union are pinning high hopes on regulatory advances, such as with visa exemptions, so that they can unlock wide-ranging benefits through investment in Vietnam. |

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Related Contents

Latest News

More News

- SK Innovation-led consortium wins $2.3 billion LNG project in Nghe An (February 25, 2026 | 07:56)

- THACO opens $70 million manufacturing complex in Danang (February 25, 2026 | 07:54)

- Phu Quoc International Airport expansion approved to meet rising demand (February 24, 2026 | 10:00)

- Bac Giang International Logistics Centre faces land clearance barrier (February 24, 2026 | 08:00)

- Bright prospects abound in European investment (February 19, 2026 | 20:27)

- Internal strengths attest to commitment to progress (February 19, 2026 | 20:13)

- Vietnam, New Zealand seek level-up in ties (February 19, 2026 | 18:06)

- Untapped potential in relations with Indonesia (February 19, 2026 | 17:56)

- German strengths match Vietnamese aspirations (February 19, 2026 | 17:40)

- Kim Long Motor and AOJ Suzhou enter strategic partnership (February 16, 2026 | 13:27)

Tag:

Tag:

Mobile Version

Mobile Version