E-commerce cost too high for some

|

| E-commerce in Vietnam is currently costing its investors huge sums, but the rewards will be great for those who can weather the storm, Photo: Le Toan |

|

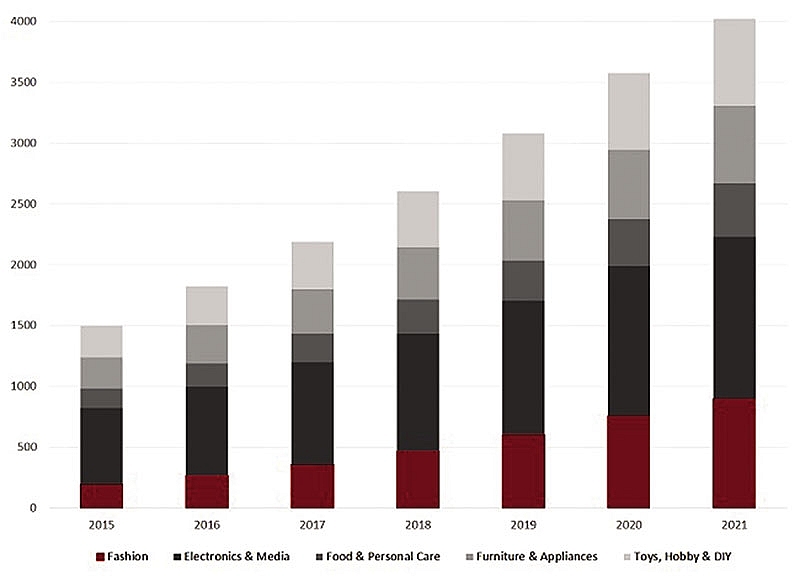

| Source: eshopworld data |

In the red

Vietnamese tech company VNG’s latest financial report showed that the firm incurred a loss of VND282 billion ($12.4 million) from its investment in Tiki.vn in 2017, seven times higher than the loss suffered in 2016. VNG’s total losses in its Tiki.vn venture amount to VND323 billion ($14.21 million) since it bought 38 per cent of the platform in 2016 for VND384 billion ($16.8 million).

Shopee’s parent company, Sea Ltd., also recorded trebled quarterly losses on the back of rising e-commerce spending. In particular, sales and marketing expenses for the e-commerce segment increased by 177.1 per cent to $127.2 million in this year’s first quarter. The increase in marketing efforts was part of a strategy to fully capture the market growth opportunities and was primarily connected to shipping offers and other promotions used to lure new users.

Despite making losses, e-commerce companies are still flush with money after fresh rounds of funding, ready to step up the game. In the beginning of 2018, JD.com announced its investment into Vietnamese e-commerce platform Tiki. The investment amount is reported to be around $44 million, which is hardly even comparable to the huge investments of its competitors.

Chinese online retail giant Alibaba has recently injected another $2 billion into Lazada Group, boosting its total investment to $4 billion. Meanwhile, Sea raised about $884 million in its US initial public offering in October.

According to the Viet-nam E-commerce Association (VECOM), the Vietnamese e-commerce market enjoyed a growth rate of 25 per cent in 2017, which is expected to be sustained throughout the 2018-2020 period. Meanwhile, a Statista report shows that total e-commerce revenue is expected to reach $4 billion by 2021. Vietnam has all the ingredients for a thriving e-commerce economy thanks to a young population, rising incomes, and growing internet and smartphone adoption. This raises questions as to why e-commerce companies with good brand images and strong investment flows are still incurring losses.

A tough nut to crack

Ralf Matthaes, managing director of market research company Infocus Mekong, said that the biggest challenges for Vietnam’s e-commerce market are logistics, delivery, storage, and payment. This holds true for all companies in Vietnam.

“E-commerce platforms are showing losses largely due to the fragmented logistics chain. Considering that roughly 80 per cent of consumers pay cash on delivery, you can appreciate the huge financial logistics required to just collect payment. Hence the losses,” he noted.

Unlike many Southeast Asian nations, Vietnam is still new to credit and credit cards. The country also suffers from the lack of a nationally united logistics network. This creates a level of mistrust and inconsistent delivery, which slows down e-commerce growth.

“Until consumers start to use credit payments and until the logistics of delivery can be rectified, I see e-commerce doing business as usual, with numbers in the red, not black. Even if there is a huge spike in sales, these issues will only magnify and potentially get worse,” Matthaes added.

In addition, e-commerce companies have spent heavily on sales and marketing to promote their platforms, which can easily eat up profits. Many platforms suffered losses from special discount offers and promotion campaigns aimed to snag new customers. As a result, several local shopping sites like Beyeu, Deca, and Lingo ran out of money and had to close after only a few years.

E-commerce expert Le Thiet Bao said that this is a cash-burning battle for e-commerce companies. Those who have strong financial capabilities and the ability to hold on longer will be the winners.

Nguyen Ngoc Dung, deputy chairman of VECOM, said that e-commerce companies are also making losses to capture a bigger market share. They are in the investment stage, so it is very difficult to say how high losses will be and when they will make a profit.

According to the “Vietnam B2C E-Commerce Market 2018” report by Research and Markets, online transactions account for about 1 per cent of total retail sales in Vietnam. There is still a long way to go for the Vietnamese e-commerce market to reach its peak, so foreign companies like Alibaba, JD.com, and Sea have invested in the country, intensifying the competition.

Vietnam’s leading groups, including FPT, Vingroup, and The Gioi Di Dong, have also jumped on the bandwagon with e-commerce marketplaces such as Sendo.vn, 123mua.vn, Adayroi, and vuivui.com. Furthermore, the shift from bricks-and-mortar to omni-channel retailing has also prompted retailers such as AEON, Lotte, and Central Group to develop online marketplaces.

Lotte E-Commerce Vietnam opened in October 2016 in order to meet the rising trend of online shopping. The year 2017 saw Lotte E-commerce settle successfully in the local e-commerce market. Meanwhile, Central Group is also giving priority to e-commerce with three online platforms in Vietnam – nguyenkim.vn, robins.vn, and B2S.com.vn.

Moving forward

The ongoing investment by key players will help form an e-commerce ecosystem in Vietnam, thereby contributing to the development of the country’s e-commerce market.

Last week, DHL eCommerce also rolled out same-day metro deliveries known as DHL Parcel Metro Same Day in Ho Chi Minh City and Hanoi. The service allows Vietnamese online retailers to offer same-day delivery to consumers in both cities with real-time tracking and rescheduling of deliveries through DHL’s digital platform.

Thomas Harris, managing director of DHL eCommerce Vietnam, said that logistics makes up around 60-70 per cent of the e-commerce costs. Therefore, DHL eCommerce aims to offer services that can make online sales profitable.

“We often hear that Vietnam is 10 years behind other large markets in the region. However, with the launch of same-day deliveries, we expect to help the country to catch up with more mature markets within the next 3-5 years,” he said.

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Tag:

Tag:

Related Contents

Latest News

More News

- Vietnam financial markets on the rise amid tailwinds (February 11, 2026 | 11:41)

- New tax incentives to benefit startups and SMEs (February 09, 2026 | 17:27)

- VIFC launches aviation finance hub to tap regional market growth (February 06, 2026 | 13:27)

- Vietnam records solid FDI performance in January (February 05, 2026 | 17:11)

- Manufacturing growth remains solid in early 2026 (February 02, 2026 | 15:28)

- EU and Vietnam elevate relations to a comprehensive strategic partnership (January 29, 2026 | 15:22)

- Vietnam to lead trade growth in ASEAN (January 29, 2026 | 15:08)

- Japanese business outlook in Vietnam turns more optimistic (January 28, 2026 | 09:54)

- Foreign leaders extend congratulations to Party General Secretary To Lam (January 25, 2026 | 10:01)

- 14th National Party Congress wraps up with success (January 25, 2026 | 09:49)

Mobile Version

Mobile Version