Dragon Capital spends $143.6 million on Sabeco shares

|

| Dragon Capital spent $143.6 million buying Sabeco's stake |

The deal took place after Sabeco reported a plunge in share value.

Previously, on December 18, 2017, Sabeco successfully sold 343 million shares, or 53 per cent stake, to Vietnam Beverage Co., Ltd. (a subsidiary of Thai Beverage) for VND110 trillion ($4.83 billion).

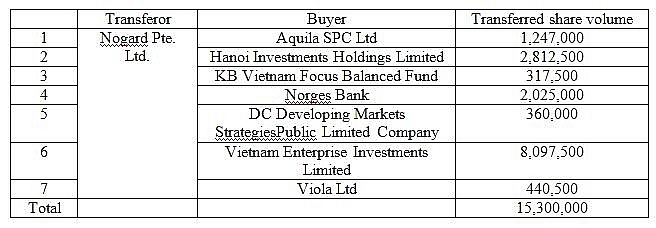

Detailed information about the deal was published by Vietnam Securities Depository (VSD) (See box below).

|

Ending the transaction session of March 15, Sabeco’s shares were valued at VND214,000 ($9.4), thus, Dragon Capital spent VND3.27 trillion ($143.6 million) on the deal.

In late February, a group of funds run by Dragon Capital, including Vietnam Enterprise Investments Ltd. (VEIL), Wareham Group Limited, Norges Bank, KB Vietnam Focus Balanced Fund, and Hanoi Investments Holdings Limited, spent over VND841 billion ($37 million) to buy 5.22 million shares in Phu Nhuan Jewelry JSC (HSX: PNJ).

Besides, in August 2017, Dragon Capital and VinaCapital completed the purchase of a 30 per cent stake, equaling six million shares, in FPT Retail, aiming to plunge deeper into the retail sector, especially the mobile retail segment.

Neither the deal’s value nor the share volumes transferred to Dragon Capital and VinaCapital were disclosed, however, according to rumours, Dragon Capital currently holds a 20 per cent stake in the mobile retailer.

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Tag:

Tag:

Related Contents

Latest News

More News

- Law on Investment takes effect (March 02, 2026 | 16:21)

- Ho Chi Minh City attracts nearly $980 million in FDI in early 2026 (March 02, 2026 | 10:57)

- Businesses bouncing back after turbulent year (February 27, 2026 | 16:42)

- VinaCapital launches Vietnam's first two strategic-beta ETFs (February 26, 2026 | 09:00)

- PM sets five key tasks to accelerate sci-tech development (February 26, 2026 | 08:00)

- PM outlines new tasks for healthcare sector (February 25, 2026 | 16:00)

- Citi report finds global trade transformed by tariffs and AI (February 25, 2026 | 10:49)

- Vietnam sets ambitious dairy growth targets (February 24, 2026 | 18:00)

- Vietnam, New Zealand seek level-up in ties (February 19, 2026 | 18:06)

- Untapped potential in relations with Indonesia (February 19, 2026 | 17:56)

Mobile Version

Mobile Version