China’s huge stimulus package to affect Vietnam's key industries

|

In addition, the bank is extending credit access to securities firms, insurers, and investment funds, allowing them to tap into capital for stock and bond purchases.

"The broader-than-expected package offering more funding and interest rate cuts marks the latest attempt by policymakers to restore confidence in the world's second-largest economy after a slew of disappointing data has raised concerns of a prolonged structural slowdown," stated Reuters on September 25.

As China remains Vietnam's largest trading partner, with bilateral trade exceeding $170 billion last year and $38 billion in the first eight months of this year, these measures are expected to boost Vietnam's exports.

"The increase in domestic demand in China, driven by the stimulus, will open up more opportunities for Vietnam’s key export sectors," noted Yuanta Securities.

Agriseco Securities echoed this sentiment, highlighting that rubber and seafood exports are likely to benefit the most. Vietnam’s basa fish and shrimp, popular in the Chinese market, are well-positioned to see rising demand.

Doan Chi Thien, a board member at Navico, one of the largest basa fish producers and exporters in the Mekong Delta province of An Giang, observed that exports to China have already started improving in the third quarter.

"China used to rely heavily on imports from Ecuador and India, but recently, they’ve shifted towards Vietnam, drawn by competitive pricing and superior quality," Thien said.

Navico has already seen a positive increase in export volumes compared to last year and expects prices to rise further as China’s stimulus takes hold.

Nguyen Van Hung, CEO of a Vietnamese lobster exporter, also reported double-digit growth in orders from China, attributing this to favourable policy changes and a surge in demand.

Vietnam’s seafood exports to China exceeded $1 billion in the first eight months of 2024, up 17 per cent on-year, according to customs data.

The Vietnam Association of Seafood Exporters and Producers anticipates further growth in the coming months, particularly with the holiday and Lunar New Year periods approaching.

Rubber exports, which reached $1.1 billion over the same period, are also expected to benefit from China’s stimulus, as the recovery of its manufacturing sector - especially the automotive industry - drives demand for raw materials.

On the import front, Agriseco analysts suggest that prices for some key inputs may fall as Chinese production ramps up. Among Vietnam’s top five imports from China, textile and footwear materials ranked third, totalling nearly $10.2 billion in the first eight months of 2024.

With input costs accounting for 48-50 per cent of production expenses in Vietnam’s footwear sector, any reduction in material costs would significantly enhance the competitiveness of local firms, especially following a challenging first half of the year.

Steel, another key sector, is expected to see indirect benefits from China’s stimulus.

Earlier this year, China’s property market downturn resulted in weak domestic demand for steel, prompting Chinese producers to offload excess supply into neighbouring markets, including Vietnam. This led to a sharp increase in competition and a significant decline in steel prices. Steel imports from China into Vietnam amounted to $4.7 billion in the first eight months, a 44 per cent increase from the same period last year.

MB Securities reports that prices for construction steel and hot-rolled coil (HRC) in August were down 24 per cent and 21 per cent, respectively, from the start of the year - marking the lowest levels in five years. However, a senior executive at a Vietnamese steel company said China’s stimulus measures, particularly those aimed at reviving the property sector, could help warm up the market, boosting steel demand and easing pressure on Chinese steelmakers to export.

"Chinese steel producers will feel less pressure to flood other markets with excess supply," he noted.

China's stimulus has already had an immediate impact on steel prices. According to Kallanish, HRC prices from China jumped by $30-40 per tonne following the policy announcements.

Traders have described this surge as 'irrational', given the previous months of declines. Vietnamese buyers, who have recently turned to South Korean and Japanese suppliers for HRC, may face rising prices ahead.

Nevertheless, analysts caution that while market reactions have been swift, the full effects of China’s policies may take longer to materialise.

"Historically, China has introduced numerous stimulus packages aimed at boosting its economy and real estate sector, but the impact has often been underwhelming," remarked an industry insider.

While financial markets and commodity prices are quick to respond to policy shifts, the actual economic benefits depend on how effectively China’s economy - particularly its struggling real estate sector - absorbs the stimulus.

| China's Geely to build $168 million automobile facility with Tasco in Thai Binh Chinese automaker Geely Auto Group (Geely) has signed a joint venture agreement with Tasco JSC for the manufacturing and assembly of automobiles in Vietnam. |

| China seeks favourable conditions to expand automotive investments in Vietnam China has called for policies to create a more favourable business environment for its automotive companies to expand their investments in Vietnam. |

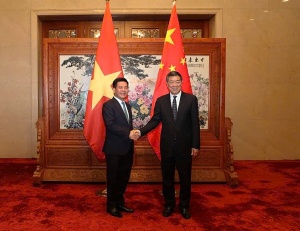

| Vietnam urges China to expand market access for agricultural products and strengthen trade ties Vietnamese Minister of Industry and Trade Nguyen Hong Dien has proposed that China expand its market access for Vietnamese agricultural products, including citrus fruits, custard apples, and rose apples. |

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Related Contents

Latest News

More News

- Kurz Vietnam expands Gia Lai factory (February 27, 2026 | 16:37)

- SK Innovation-led consortium wins $2.3 billion LNG project in Nghe An (February 25, 2026 | 07:56)

- THACO opens $70 million manufacturing complex in Danang (February 25, 2026 | 07:54)

- Phu Quoc International Airport expansion approved to meet rising demand (February 24, 2026 | 10:00)

- Bac Giang International Logistics Centre faces land clearance barrier (February 24, 2026 | 08:00)

- Bright prospects abound in European investment (February 19, 2026 | 20:27)

- Internal strengths attest to commitment to progress (February 19, 2026 | 20:13)

- Vietnam, New Zealand seek level-up in ties (February 19, 2026 | 18:06)

- Untapped potential in relations with Indonesia (February 19, 2026 | 17:56)

- German strengths match Vietnamese aspirations (February 19, 2026 | 17:40)

Tag:

Tag:

Mobile Version

Mobile Version