Big deals making a mark within industrial real estate

The total value of corporate and property merger and acquisition (M&A) deals in the real estate and construction sectors in the first seven months reached about $1.4 billion, according to the Southeast Asia and Vietnam Real Estate M&A Market Overview report, released by EY-Parthenon in August.

|

| Big deals making a mark within industrial real estate, illustration photo/ Source: freepik.com |

M&A in real estate assets accounted for 65 per cent, with 24 deals with a total value of $874 million. Sixteen of these deals involved industrial zones (IZs) and 92 per cent of buyers are foreign investors, mainly from Taiwan, Singapore, and South Korea.

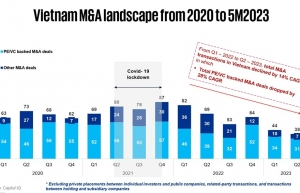

Dao Thien Huong, senior vice president of EY-Parthenon, said that foreign investors were turning to a defensive strategy in the face of a gloomy global market, causing the number of M&A transactions in Vietnam to decrease significantly compared to previously.

“However, we also note that many deals are under negotiation in Vietnam with the increase in domestic enterprises. It is expected that M&A activities in the Vietnamese market will be active again from 2024 onwards,” Huong said.

EY-Parthenon recorded more than 10 deals under negotiation with a value of up to billions of dollars that could be closed in the near future.

“We see many transactions that have been and are in the process of being negotiated with positive prospects. The main concern lies in finding a potential land bank with attractive value as well as having legal requirements, clearance compensation and development potential,” Huong said.

Industrial real estate and logistics infrastructure real estate is better positioned to overcome difficulties and recover from the impact of factors such as global mobility. The growth of online entertainment, e-commerce, the Internet of Things, and 5G are driving demand for assets such as industrial real estate, data centres, and last-mile logistics and warehouses.

EY-Parthenon believes that the trend of industrial real estate M&A deals in the near term will be medium-sized but large-scale to expand the portfolio in many key locations, meeting the diverse needs of foreign-invested companies with an average value of $100-200 million per deal.

“Foreign buyers will still be experienced funds and investors in Southeast Asia and Vietnam markets, while the domestic sector will have more private businesses with good financial potential and expand operations in industrial real estate,” Huong said.

The sellers are mostly domestic IZ investors with lots of land, which want to cooperate to draw in more customers.

VSIP Can Tho is expected to start construction at the end of this year, with a total investment of $160 million. This project would bring the network of VSIP, a joint venture between Singaporen group Sembcorp and Becamex IDC, to 14 IZs across 14 localities nationwide.

Meanwhile, Thai Binh People’s Committee last week proposed the approval of VSIP Thai Binh, which is expected to have a total capital of $212 million.

Frasers Property Vietnam is cooperating with Gelex Group to deploy IZs in north Vietnam, with the first phase to cost about VND6 trillion ($250 million). Announced in March, the first phase includes 80 ha of industrial land in prime locations providing more than 500,000 sq.m of products of ready-made factories, ready-built warehouses, and others.

Chong Chee Keong, managing director of Industrial at Frasers Property Vietnam, agreed that Vietnam has been one of the main beneficiaries of the wave of production displacement in recent years.

“Of course, the pandemic had given a good lesson for enterprises to diversify their business and not put all their eggs into one basket. Enterprises nowadays are more conscious, taking more time doing surveys, planning, and due diligence before they decide to set up their factory in Vietnam,” Keong said.

At the beginning of the year, ESR Group, one of the largest asset management companies in Asia-Pacific, led a group of investors into pouring capital into BW Industrial Development. BW Industrial was founded through cooperation between Warburg Pincus and Becamex IDC in 2018, with a prime land bank of 7.76 million sq.m in 35 projects located over 26 strategic economic locations across the country.

As well as foreign investors, many domestic investors are also actively developing IZs. Leaders from THACO in August visited Thai Binh province to discuss issues related to accelerating the development of its Thai Binh IZ.

In July, Hanaka Group started construction of Gia Binh II IZ in Bac Ninh province, with a scale of 250 ha and investment capital of nearly $168 million. Hanaka expects to deliver a clean site for sub-leasers to set up a warehouse and factory next year.

In August, Bac Giang province approved detailed planning projects for a series of IZs such as Nghia Hung, Hoa Phu’s expanded phase II, Xuan Cam-Huong Lam, Duc Giang, and Tien Son-Ninh Son.

Nguyen Van Nhan, general director of Amata Urban JSC, the developer of Song Khoai IZ in Quang Ninh, said that Amata’s complexes in Vietnam were still attracting superb investment, especially in high-tech processing and manufacturing.

“From the beginning of the year, Song Khoai IZ alone has attracted three projects worth $450 million. We expect to pull in 4-6 new more projects to the year-end with minimum capital of about $500 million. Most of the investors come from Japan, Taiwan, Europe, and South Korea,” Nhan said.

The appearance of Samsung, Intel, Pegatron, Foxconn, Luxshare, Goertek, and many others with projects up to billions of dollars has gradually turned Vietnam into an indispensable link in the global value chain. A series of large-scale projects have landed in Vietnam, including those for suppliers for Compal and Quanta Computer - component manufacturers for Apple.

Vietnam is also the base for many other global giant manufacturers such as Hong Kong-based Techtronic Industry, as well as Taiwan’s Boltun Corporation and QST International Corporation.

A report on the second quarter of 2023 from the Ministry of Construction said that the demand for renting IZs remained stable. In some provinces, there was a slight increase in demand in Bac Giang, Bac Ninh, and Quang Ninh due to the signing of contracts with many foreign partners earlier in the year.

The occupancy rate at existing IZs across the country is about 80 per cent in the north and over 85 per cent in the south. Besides that, the average land rental price for the whole rental cycle in IZs in the second quarter of 2023 increased by about 5-7 per cent over the same period last year, the report added.

| Concocting a defensive M&A strategy to build resilience Today’s economic situation can be a catalyst for opportunity through mergers and acquisitions to facilitate businesses to build resilience. Le Viet Anh Phong, financial advisory lead at Deloitte Vietnam, spoke with VIR’s Luu Huong about the strategies expected to prevail this year. |

| Fundraising challenges must be navigated in uncertain M&A market Warnings about a slowdown in the Vietnam merger and acquisition market, particularly for investment from private equity and venture capital (PE/VC), were raised in late 2022. As of now, we are experiencing one of the toughest downturns. |

| Strong recovery projected in Vietnam’s M&A arena in 2024 Vietnam’s merger and acquisition market has been slower than expected in 2023, but there is still growth compared to 2022. |

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Related Contents

Latest News

More News

- An Phat 5 Industrial Park targets ESG-driven investors in Hai Phong (January 26, 2026 | 08:30)

- Decree opens incentives for green urban development (January 24, 2026 | 11:18)

- Public investment is reshaping real estate’s role in Vietnam (January 21, 2026 | 10:04)

- Ho Chi Minh City seeks investor to revive Binh Quoi–Thanh Da project (January 19, 2026 | 11:58)

- Sun Group launches construction of Rach Chiec sports complex (January 16, 2026 | 16:17)

- CEO Group breaks ground on first industrial park in Haiphong Free Trade Zone (January 15, 2026 | 15:47)

- BRIGHTPARK Entertainment Complex opens in Ninh Binh (January 12, 2026 | 14:27)

- Ho Chi Minh City's industrial parks top $5.3 billion investment in 2025 (January 06, 2026 | 08:38)

- Why Vietnam must build a global strategy for its construction industry (December 31, 2025 | 18:57)

- Housing operations must be effective (December 29, 2025 | 10:00)

Tag:

Tag:

Mobile Version

Mobile Version