Fundraising challenges must be navigated in uncertain M&A market

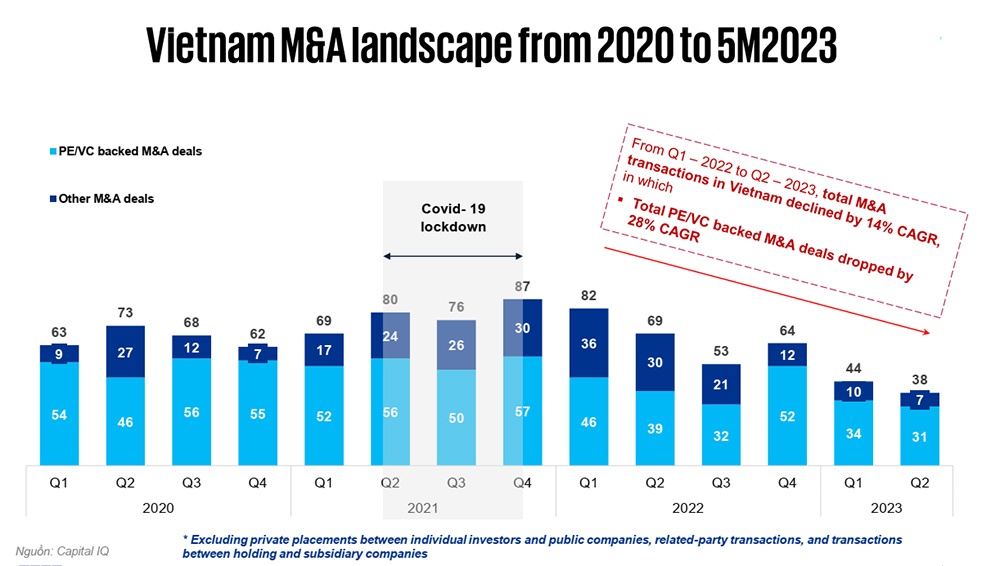

In 2022, overall deal volume dropped 14 per cent in comparison to 2021. This trend accelerated in the second half of 2022 and continued into the first five months of 2023, with deal volume falling more than 35 per cent compared to 2022. Looking at investments made by PE/VC, deal volumes in the first five months of 2023 dropped even further, reaching 74 per cent.

|

| Dinh The Anh - Partner, Deal Advisory; Head of Mergers and Acquisitions KPMG in Vietnam |

Across all sectors and stages, founders and managements are facing greater challenges in finding growth money than ever before. The deal process in the last two years has usually taken longer, with investors demanding more details and numbers to verify their investment thesis. The prospect of deal closings is nevertheless getting slimmer.

The first and foremost reason is a sudden shift in investors’ mindset towards business models with profitability sustainability. This shift is observed in different aspects. One common reaction we have seen from some PE/VCs is that they now only look at profitable companies and do not consider currently loss-making companies. Another group looks at companies with a shorter horizon path to profitability.

For example, if you plan to break even in 3-4 years, the chances of being considered by PE/VC will be much less compared to if you plan to break even in 1-2 years. This shift is causing trouble because if we look back at the Q4/2022, statistics from VNDirect Securities on listed companies of both the Hanoi and Ho Chi Minh City stock exchanges showed a 30.4 per cent drop in net profit.

Moving to 2023, as demands are not really coming back and certain cost components continue to stay high, we continue to see a 50 per cent decrease in net profit in the Q1/2023 in contrast to the same period last year (excluding banks and Vingroup’s ecosystem).

This backdrop lays out a short-term context in which corporates are facing huge pressure to grow their top line, and profitability is eroding. This may lead many of them to suffer from losses in 2022 and be unlikely to recover in 2023. Under that context, it would be very challenging to convince PE/VC that your corporate could move fast towards profitability.

|

Even if a PE/VC somehow agrees to the prospect set above, a second challenge arise: valuation. In most transactions, valuation is typically negotiated using the market approach or by discounting future cash flows. The former normally means both promoters and investors agree to use a multiple of sales or earnings, while the latter normally means Investors value the companies by discounting future potential cash flows.

Because of its simplicity when contrasted with discounting future cash flows, the market approach is very popular among PEs/VCs. A lower multiple could be agreed upon due to the decline in public benchmarks. However, a harder discussion would be which year’s sales or earnings performance should serve as the basis for the valuation discussion. Again, if we set the discussion under a deteriorating performance in 2023, the end result may not be a desired outcome for the promoter side.

Corporate managers still have a fresh memory of a sudden dry-out in the demand side during Q4/2022 and Q1/2023, which surprised quite a few. Market uncertainty is still there and thus it would be difficult to have a strong confidence in 2024 forecast and execution. Therefore, the valuation discussion regarding which year’s performance to use remains hard to address until we see more certainty in demand recovery.

Moreover, Vietnam is not the only country that has witnessed such a slowdown. Across Asia and Southeast Asia, PE/VC has retreated aggressively after a peak of deal making in 2021 and 2020. In Asia, the deal value dropped by 44 per cent in 2022 in relation to 2021, and a sharp fall of 50 per cent has been observed in Southeast Asia, according to the Asia-Pacific Private Equity Report 2023 from Bain & Company.

Slowing investment from PE/VC is a trend that should be temporary and can reverse course. Vietnam has always been a very bright spot thanks to the country’s high growth profile and strategic benefits in global supply chain. The Asia Development Bank forecasted the country’s 2023/2024 GDP growth at 6.5 per cent and 6.8 per cent respectively in April 2023, making it the highest growth forecast among all Southeast Asian countries.

In the short-term, the country’s export sector will surely rise with the recovery of global demand in 2024, and rebounding domestic consumption will be another major growth driver. Once PE/VC starts to see more visibility in corporate growth traction, we will see more investment following suit.

| Tech groups hope for boost via M&As Driven by acceleration in digital transformation, technology is emerging as a high-potential industry for merger and acquisition transactions in Vietnam. |

| Global CEOs resolute in M&As Global merger and acquisition (M&A) activities will likely rise later in 2023 as investors and executives look to balance short-term risks with their long-term business transformation strategies, according to PwC’s 2023 Global M&A Industry Trends Outlook. |

| Vibrant activity felt with real estate M&A Merger and acquisition activities in the first months of the year surged with several huge deals, signalling the Vietnamese market is ready to welcome foreign investors into projects thirsty for capital. |

| Concocting a defensive M&A strategy to build resilience Today’s economic situation can be a catalyst for opportunity through mergers and acquisitions to facilitate businesses to build resilience. Le Viet Anh Phong, financial advisory lead at Deloitte Vietnam, spoke with VIR’s Luu Huong about the strategies expected to prevail this year. |

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Related Contents

Latest News

More News

- KPMG launches tariff modeller in Vietnam to navigate US tariff risks (July 29, 2025 | 12:11)

- Removing hidden barriers to unlock ASEAN trade (June 29, 2025 | 11:31)

- New report charts path for Vietnam’s clinical trial growth (May 21, 2025 | 08:58)

- TTC Agris strengthens market position with investment in Bien Hoa Consumer JSC (May 19, 2025 | 10:14)

- World Bank to help SBV build shared database for banking industry (April 09, 2025 | 08:55)

- New trade alliances and investment hubs are redefining global power dynamics (April 03, 2025 | 17:00)

- ACCA and KPMG forge path for business leaders to pioneer ESG excellence (March 07, 2025 | 10:09)

- VietBank signs MoU with KPMG (February 26, 2025 | 18:47)

- Warrick Cleine MBE: an honour for services to British trade and investment in Vietnam (December 31, 2024 | 20:16)

- KPMG report offers fresh insight into leveraging AI (December 24, 2024 | 09:23)

Tag:

Tag:

Mobile Version

Mobile Version