Acceleration of export orders help create momentum for Vietnam’s trade landscape

Figures from the Ministry of Industry and Trade (MoIT) showed that in June, total export turnover was estimated to be $29.3 billion, up 4.5 per cent on-month. In which, domestically invested exporters hit $8 billion, down 0.3 per cent; and foreign-invested exports (including crude oil exports) stood at $21.3 billion, up 6.4 per cent.

|

Also in June, the total import and export turnover of goods was estimated at $56.01 billion, up 3.6 per cent over the previous month and down 14.1 per cent over the same period last year.

Under the General Statistics Office’s (GSO) Q2 survey on enterprise performance, when it came to orders, 73.7 per cent of enterprises said they expected a rise and stability in orders in Q3. Only 26.3 per cent of respondents said they predicted a reduction in orders.

As for export orders, 72.9 per cent of enterprises said they expected a rise and stability in orders in Q3 as compared to Q2. Only 27.1 per cent of respondents projected a decrease in exports.

Since early this year, Vietnam-Taiwan joint venture Tam Viet Garments Co., Ltd. in Hanoi has seen an 8 per cent climb in export orders from Europe, which accounted for about 45 per cent of its export value last year, but only 35 per cent in the first half of this year.

“We have expanded our export markets to ASEAN, Japan, and South Korea, in addition to European countries. We are now also negotiating more export contracts for Q4 of this year,” said Tam Viet’s vice director Nguyen Hoang Huong. “Since early this year, we have also recruited more workers to fulfil the contracts on time.”

Though the company’s six-month export revenue increased about 7 per cent as compared to 15 per cent in the same period last year, Huong said it was “quite a positive figure” given the whole garment and textile industry is suffering a decline.

The MoIT reported that the garment and textile industry reaped an export turnover of $15.75 billion in the first six months of this year, down 15.3 per cent on-year. A number of other key export industries also faced the same plight, such as mobile phones and their spare parts at $24.29 billion, down 17.9 per cent; electronic products and their spare parts at $25.2 billion, down 9.3 per cent); and footwear at $10 billion, down 15.2 per cent.

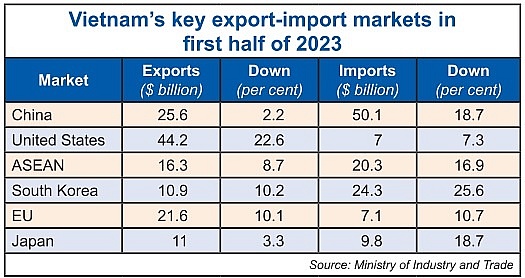

In the first six months of 2023, the Vietnamese economy’s total import and export turnover of goods was estimated to reach $316.65 billion, down 15.2 per cent on-year.

The export value is about $164.45 billion, down 12.1 per cent on-year, with domestic enterprises fetching $43.41 billion, down 11.9 per cent and accounting for 26.4 per cent of the economy’s total export turnover; and foreign-invested enterprises (including crude oil exports) standing at $121.04 billion, down 12.12 per cent and occupying 73.6 per cent of total.

The GSO said that though Vietnam’s export landscape was regaining momentum, it would continue facing risks until year’s end due to the world economy seeing slower-than-expected growth.

The World Bank last month predicted growth to sit at about 2.1 per cent in 2023, up by 0.4 per cent from the bank’s projection early this year. The Organisation for Economic Co-operation and Development has also made a global economic growth rate of 2.7 per cent for 2023, up 0.1 per cent from its March projection. Meanwhile, the International Monetary Fund has lowered its global growth to 2.8 per cent for 2023 from its 2.9 per cent forecast made in January.

Nguyen Hoang Huong of Tam Viet Garments said that she was expecting an export turnover of about 10 per cent on-year for the company in the whole 2023.

“However, we are worrying about the reduction of our export orders in Europe. Many partners have stopped orders with us due to their production shrinking. In fact, the export turnover from Europe has reduced from 45 per cent last year to 35 per cent in the first six months of this year and the rate may be 30 per cent in the second half of this year as Europe’s economy is not expected to strongly recover,” Huong said.

The Vietnam Textile and Apparel Association has also underlined massive challenges ahead for the industry.

“The Russia-Ukraine conflict is also affecting the industry, as Vietnam exports a large volume to Russia and Ukraine. In addition, the price of materials has also increased 20 per cent on average, and the situation is expected to continue in the coming months,” said Truong Van Cam, vice chairman of the association.

| Vietnamese bank rushes for digitalised products and services for import - export companies Several banks are exploring digital ways to simplify the hefty paperwork that comes with international trade to enhance operational efficiency and support export-import companies. Military Bank (MB) - one of Vietnam's largest commercial banks - is also accelerating its strength to bridge the gap between local enterprises and international markets and drive long-term resilience. |

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Related Contents

Latest News

More News

- State corporations poised to drive 2026 growth (February 03, 2026 | 13:58)

- Why high-tech talent will define Vietnam’s growth (February 02, 2026 | 10:47)

- FMCG resilience amid varying storms (February 02, 2026 | 10:00)

- Customs reforms strengthen business confidence, support trade growth (February 01, 2026 | 08:20)

- Vietnam and US to launch sixth trade negotiation round (January 30, 2026 | 15:19)

- Digital publishing emerges as key growth driver in Vietnam (January 30, 2026 | 10:59)

- EVN signs key contract for Tri An hydropower expansion (January 30, 2026 | 10:57)

- Vietnam to lead trade growth in ASEAN (January 29, 2026 | 15:08)

- Carlsberg Vietnam delivers Lunar New Year support in central region (January 28, 2026 | 17:19)

- TikTok penalised $35,000 in Vietnam for consumer protection violations (January 28, 2026 | 17:15)

Tag:

Tag:

Mobile Version

Mobile Version