Accelerated public investment deemed the way out from steelmaking challenges

|

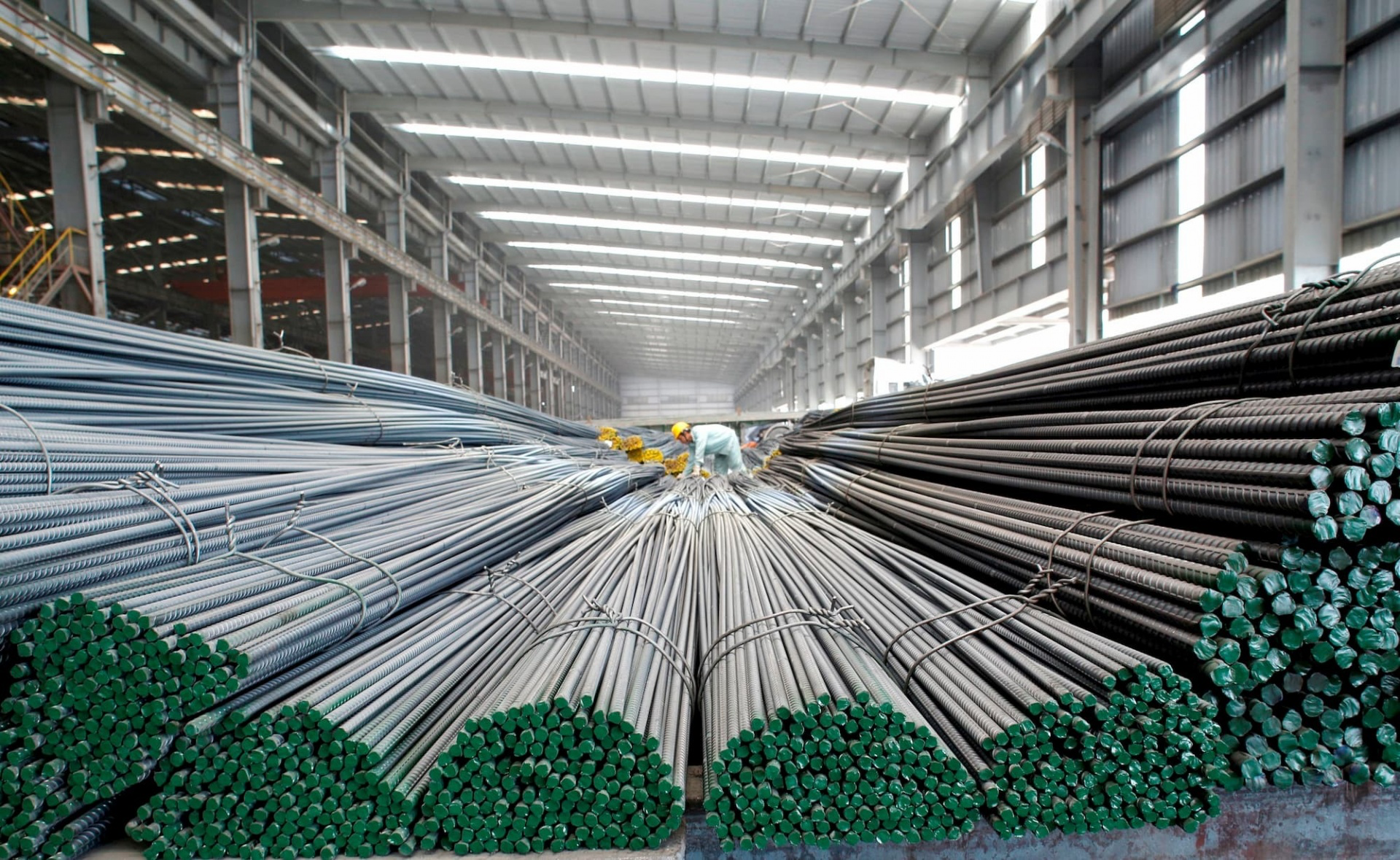

| Increased infrastructure funding can help markets such as iron and steel get through current hardships, photo Le Toan |

Do Duy Thai, chairman of the Board of Directors of Pomina Steel JSC, said the real estate market is likely to remain quiet until June 2024. “Therefore, the salvation of the steel market at the end of this year is mainly through public investment,” said Thai.

According to the Vietnam Steel Association (VSA), in the second quarter of 2023, consumption of construction steel reached only two million tonnes, which is the lowest since 2022 and 8 per cent lower than the first quarter. Particularly, in July, construction steel consumption decreased by 6 per cent compared to June and dipped 18 per cent over the same period last year. Along with that, the export volume decreased by 30 per cent compared to July 2022 to 105,000 tonnes, according to VSA chairman Nghiem Xuan Da.

“Never has the steel industry faced such difficulties in the past three years. So far in 2023, the domestic steel industry has faced difficulties as a series of enterprises reported losses and had to compete with cheap Chinese steel flooding into Vietnam,” said Da.

Factories continuously reduce selling prices to meet production and sales plans. The real estate market has not shown a positive signal yet, and few social housing projects have just been implemented. Meanwhile, the competition in selling price and market share of factories is increasingly fierce.

The Vietnam Steel Corporation announced that the consolidated revenue for the second quarter of 2023 reduced 29 per cent over the same period, with gross profit down 57 per cent on-year.

Meanwhile, Thai Nguyen Iron and Steel noted consolidated financial statements for Q2 witnessing a 39 per cent drop in revenue over the same period last year.

According to a KIS Vietnam Securities report released in July, Q3 is a challenging one for steel producers, with the average selling price lower and demand expected to be weak due to the rainy season. It estimated that input prices are expected to increase and profit margins may be affected. Total consumption may decrease 9 per cent on-quarter to 5.8 million tonnes.

The export channel can be a fulcrum for Vietnamese steel producers in the current quarter, with domestic demand expected to slow down, KIS added. The average export price may also be lower than in Q2, as steel prices between the US/Europe and Asia are increasingly narrowing from about $350-600 per tonne at the end of April to $140-340 per tonne now.

The prospect of public investment could still support the opening of domestic iron and steel consumption. In 2023, the National Assembly approved a public investment plan worth nearly $30 billion.

“Vietnam is a leader in Asia in terms of infrastructure investment. Vietnam is also in transition towards a high-income economy, and infrastructure plays a key role in achieving that goal. Therefore, increased public investment in infrastructure projects will be a traction force to help the domestic iron and steel market overcome difficulties by the end of this year,” said Pham Quang Anh, director of the Vietnam Commodity News Centre.

“The real estate market should gradually recover by the end of 2023, and it is also considered a favourable foundation for building material businesses. Thanks to the government’s contribution, steel manufacturing is expected to overcome difficulties in the year-end period and reaffirm its position as a key industry to develop the country’s economy,” said Anh.

Prime Minister Pham Minh Chinh on August 18 asked ministries and localities to strive to disburse at least 95 per cent of this year’s public investment volume and view public investment as a key solution to boost growth.

| Steelmakers encouraged to look to premium segment Although large steel firms have been urged to restructure away from construction steel towards industrial products to avoid getting bogged down in a depressed market, most still fail to have the capacity to do so. |

| Steel imports subject to stricter quality standards Enterprises advocated for a quality and type control procedure for imported steel into Vietnam in order to safeguard domestic steel. |

| Exporting pressures heaped onto steel enterprises When competing with China’s massive output, Vietnam’s exports of steel are being hampered. |

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Related Contents

Latest News

More News

- State corporations poised to drive 2026 growth (February 03, 2026 | 13:58)

- Why high-tech talent will define Vietnam’s growth (February 02, 2026 | 10:47)

- FMCG resilience amid varying storms (February 02, 2026 | 10:00)

- Customs reforms strengthen business confidence, support trade growth (February 01, 2026 | 08:20)

- Vietnam and US to launch sixth trade negotiation round (January 30, 2026 | 15:19)

- Digital publishing emerges as key growth driver in Vietnam (January 30, 2026 | 10:59)

- EVN signs key contract for Tri An hydropower expansion (January 30, 2026 | 10:57)

- Vietnam to lead trade growth in ASEAN (January 29, 2026 | 15:08)

- Carlsberg Vietnam delivers Lunar New Year support in central region (January 28, 2026 | 17:19)

- TikTok penalised $35,000 in Vietnam for consumer protection violations (January 28, 2026 | 17:15)

Tag:

Tag:

Mobile Version

Mobile Version