US election result to affect trade measures

Economist Nguyen Tri Hieu said that Vietnam’s export-import sector would be the most affected by the US election result last week. The United States currently ranks as Vietnam’s second-largest goods export market, with turnover totalling $98.4 billion in the first 10 months of this year, while Vietnam imported $12.3 billion in goods from the US.

“To balance the trade equation, Vietnam should increase imports of key American products such as agricultural goods, high-tech equipment, and aircraft,” Hieu said.

Hieu also commented on the trajectory of the US dollar. “The USD is strengthening rapidly, in contrast to the goals of the BRICS nations (Brazil, Russia, India, China, and South Africa).” Although BRICS aims to create a currency to rival the USD, Hieu said, no currency has yet managed to do this. “Trump winning the presidency would likely strengthen the dollar further. I anticipate this strength will continue through 2024 and beyond,” he said

Bui Thi Quynh Nga, an analyst at Phu Hung Securities, said it is important for Vietnam to adopt proactive measures to mitigate risks from any US tariff policies. “Vietnam must prioritise attracting foreign investors with financial strength and advanced technology, fostering domestic growth and contributing to the economy. Strong oversight on foreign direct investment input and output is essential for sustainable development,” she said.

|

| US election result to affect trade measures |

Industries such as seafood, textiles, rubber, wood, and steel may face significant challenges if higher import costs lead to reduced US demand. Nga also said that currency fluctuations could add complexity, as a post-election dip in the exchange rate could occur if the Fed opts for rate cuts amid easing inflation.

“In the long term, expected USD inflows from trade and investment, combined with government measures, should keep the exchange rate stable,” she said.

Vietnam’s resilience in adapting to shifts in trade patterns offers some optimism. VPBank Securities (VPBankS) said that Vietnam was one of the few Southeast Asian nations to benefit from Trump’s initial trade policies. Should the US impose a 60 per cent tariff on Chinese goods, Vietnam could gain a larger export share to the US.

“Vietnam stands to increase its market share by supplying products affected by US tariffs on Chinese imports,” VPBankS said. “The domestic industrial real estate sector could be a significant beneficiary.”

However, increased competition is expected as China redirects surplus exports to low-tariff regions in East and Southeast Asia. “This shift could place considerable pressure on domestic producers in Vietnam,” VPBankS said. “Additionally, a potential devaluation of the yuan could introduce further challenges, pushing up the value of VND as the USD strengthens.”

Michael Kokalari, chief economist at VinaCapital, offered a positive outlook, saying that Vietnam’s exports may prove resilient regardless of rising tariffs or a weaker USD. “A weaker USD would boost Vietnamese exports to non-US markets, while a 10-20 per cent tariff on non-Chinese imports is unlikely to undermine Vietnam’s competitiveness,” he said.

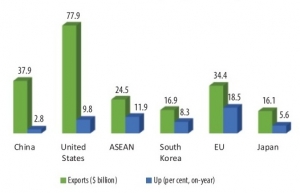

Standard Chartered also sees potential opportunities for Vietnam under Trump’s administration, should the US impose a 60 per cent tariff on Chinese imports. “Strong US consumer demand will continue to drive Vietnamese exports,” the bank said, highlighting Vietnam’s third-quarter exports to the US reached nearly $33 billion, bringing the total for the first nine months to approximately $88.2 billion, up 26 per cent on-year. Nearly 30 per cent of Vietnam’s total exports are directed to the US, a momentum analysts expect to carry into next year.

Economist Hieu explained the US stock market is experiencing a positive boost from the election, leading to significant gains that have a two-fold effect on Vietnam’s stock market. However, he also highlighted the risk of foreign investors reallocating funds.

“When the US stock market sees strong gains, foreign investors often gravitate back to their home markets, which could lead them to withdraw from Vietnam’s market,” he said. “This tug-of-war between investor optimism and the appeal of more traditional markets could be a key reason why Vietnam’s stock market has yet to see significant gains. These factors underscore the complexities Vietnam faces amid global financial trends shaped by the US.”

Another top concern is the potential impact on interest rates. Hieu said Trump’s previous stance on the US Federal Reserve’s monetary policy could mean a shift from an easing stance to a tighter monetary policy, which would involve the Fed raising interest rates, putting upward pressure on the exchange rate. “This may happen by the end of the year,” he added.

| Vietnam, US strengthen trade relations Deputy Minister of Industry and Trade Phan Thi Thang had a meeting with Deputy Assistant US Trade Representative (USTR) for Southeast Asia and the Pacific Sarah Elleman, within the framework of Vice State President Vo Thi Anh Xuan’s recent working visit to the US. |

| Progress made through US trade pact Vietnam’s trade with the US has continued to grow, driven by the two nations’ comprehensive strategic partnership, with the US gradually opening its market further to Vietnamese exports. However, concerns are emerging over potential increases in import taxes from next year depending on the result of November’s US presidential election. |

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Tag:

Tag:

Related Contents

Latest News

More News

- Raised ties reaffirm strategic trust (February 20, 2026 | 14:06)

- Sustained growth can translate into income gains (February 19, 2026 | 18:55)

- The vision to maintain a stable monetary policy (February 19, 2026 | 08:50)

- Banking sector faces data governance hurdles in AI transition (February 19, 2026 | 08:00)

- AI leading to shift in banking roles (February 18, 2026 | 19:54)

- Digital banking enters season of transformation (February 16, 2026 | 09:00)

- IFC to grant $150 million loan package for VPBank (February 13, 2026 | 09:00)

- Nam A Bank forms position as strategic member at VIFC through three key partnerships (February 12, 2026 | 16:39)

- Banks bolster risk buffers to safeguard asset quality amid credit expansion (February 12, 2026 | 11:00)

- VNPAY and NAPAS deepen cooperation on digital payments (February 11, 2026 | 18:21)

Mobile Version

Mobile Version