Time ticks on population advantage

Kubo Yoshitomo, senior representative in Vietnam for the Japan International Cooperation Agency, told VIR last week that Vietnam urgently needs to take advantage of the existing golden population period for national development. He highlighted that further investment in supporting industries is crucial to meet the demands of foreign investors.

“If Vietnam can both capitalise on its golden population structure and invest in developing supporting industries, it would be ideal for attracting more foreign direct investment,” Yoshitomo said.

|

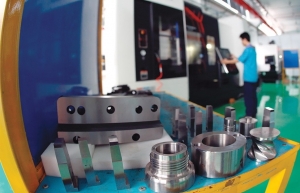

| Time ticks on population advantage, Source: Shutterstock |

Vietnam entered its golden population period in 2007. This phase, typically lasting 30-35 years, is marked by the proportion of people of working age (15-64 years) being higher than the proportion of dependents. The country is expected to exit this phase and enter its ageing population period in 2036.

“Vietnam is focusing on attracting high-tech investments, particularly in semiconductors and chips, in a bid to become a high-tech manufacturing hub. However, the golden population alone is not enough, as the country cannot develop high technology overnight. It is essential to build a strong foundation for high-tech growth.”

Yoshitomo also emphasised that for manufacturing investors, one of the key considerations is how Vietnam is developing its supporting industries.

“If these industries remain weak as they are now, the country will struggle to pull in more high-quality foreign investment,” he said. “It is crucial to improve education and training quality. In the past, Japan invested heavily in personnel, which laid the firm foundation for the development of major companies such as Sony, Panasonic, Toyota, Honda, and Canon.”

According to Vietnam Briefing, under consulting firm Dezan Shira & Associates, Vietnam’s localisation rate stands at only 36 per cent, lower than China and India, with limited local component procurement. Currently, about 500 firms in Vietnam are engaged in supporting industry production, accounting for just 0.2 per cent of the one million enterprises in the country. These figures are concerning when compared to other Southeast Asian nations.

For instance, Vietnam’s vehicle industry has experienced significant growth, driven by a rapidly expanding middle class. However, Vietnam Briefing noted that the production and assembly of automobiles remain at a basic assembly level, with a lack of specialisation.

“The weakness is partly due to limited technical capabilities, which do not meet the strict requirements of joint ventures,” it stated. “Another factor is the lack of production specialisation, leading to components produced in Vietnam costing 2-3 times more than in other countries in the region.”

A recent report by the Ministry of Industry and Trade (MoIT) showed that the number of enterprises in the supporting industry accounts for a minimal share, about 4.5 per cent of the total number of manufacturing and processing firms. These companies are predominantly foreign-invested, with their primary focus on exports.

Currently, more than 80 per cent of the goods imported into Vietnam support domestic production. In the first nine months of this year, the MoIT reported that Vietnam’s total import turnover reached an estimated $278.8 billion, a 17.3 per cent increase on-year.

Of this, production materials accounted for $261.5 billion, making up 94 per cent, with machinery and equipment comprising 47 per cent; materials 46.5 per cent; and consumer products $17.3 billion, or just over 6 per cent.

Muto Shiro, chairman of the Japanese Chamber of Commerce and Industry in Vietnam, noted that the key to Vietnam’s economic development lies in strengthening cooperation between local and foreign-invested enterprises and increasing the participation of local companies in the value chain of foreign firms.

“According to our survey, the local content ratio of Japanese companies in Vietnam has only increased by 10 per cent over the past decade, and this must be accelerated. It would be more effective for the Vietnamese government to identify and nurture local companies with technological capabilities, introduce them to foreign manufacturers, and provide opportunities for business matching,” Shiro said.

Vietnam has set a target for supporting industrial products to meet 70 per cent of the domestic demand for production and consumption by 2030, accounting for about 14 per cent of industrial output. By then, it aims to have 2,000 businesses capable of supplying assembly enterprises and multinational corporations in the country.

| Firms hold chances to boost supporting industries amid FDI inflows As Vietnam is emerging as a magnet for foreign businesses, domestic companies now have numerous opportunities to join global supply chains and develop supporting industries. |

| Supporting industries seek newer policies Vietnam’s supporting industries are failing to meet set targets, with a tendency to rely too much on overseas vendors instead of developing domestic suppliers, which is leaving foreign investors hesitant to enter the market. |

| Vietnam advised to develop aviation supporting industries Aviation industry experts have pointed out that while the number of aircraft and new airports has surged significantly, the supporting industry for the sector remains small and underdeveloped in Vietnam, failing to keep pace with international competitors. |

| Connections being improved for supporting industries Despite challenges in the market, supporting industry enterprises continue to receive positive news about export orders and are planning to expand production and factories. |

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Related Contents

Latest News

More News

- Kurz Vietnam expands Gia Lai factory (February 27, 2026 | 16:37)

- SK Innovation-led consortium wins $2.3 billion LNG project in Nghe An (February 25, 2026 | 07:56)

- THACO opens $70 million manufacturing complex in Danang (February 25, 2026 | 07:54)

- Phu Quoc International Airport expansion approved to meet rising demand (February 24, 2026 | 10:00)

- Bac Giang International Logistics Centre faces land clearance barrier (February 24, 2026 | 08:00)

- Bright prospects abound in European investment (February 19, 2026 | 20:27)

- Internal strengths attest to commitment to progress (February 19, 2026 | 20:13)

- Vietnam, New Zealand seek level-up in ties (February 19, 2026 | 18:06)

- Untapped potential in relations with Indonesia (February 19, 2026 | 17:56)

- German strengths match Vietnamese aspirations (February 19, 2026 | 17:40)

Tag:

Tag:

Mobile Version

Mobile Version