Supporting industries seek newer policies

The Ministry of Industry and Trade (MoIT) last week said that after six years there had been mixed results regarding the target of supporting industries meeting at least 45 per cent of domestic production demand.

|

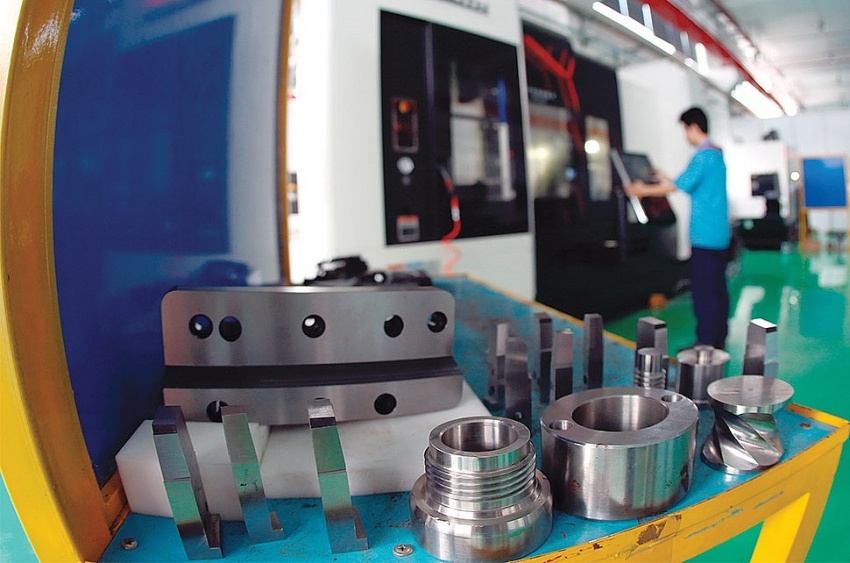

| Supporting industries seek newer policies, illustration photo |

Domestically produced metal components have broadly met this target in the manufacturing of cars, motorcycles, and power and agricultural machines. However, industries such as electronics, IT, telecommunications, and speciality electronics have met demand with only 15 per cent of their domestic production, falling way short of the overall aim.

Ho Thi Kim Ngan, a National Assembly deputy for Bac Kan province, said that Vietnam’s supporting industry had about 1,500 businesses, mainly in mechanics, electricity and electronics, plastics, rubber, and chemicals. However, in 2023, the business’s health seriously declined with significant falls in revenue.

“Vietnam’s supporting industry enterprises have not yet grown enough to participate in the global production supply chain, especially foreign direct investment (FDI) manufacturers in Vietnam,” she said.

Meanwhile, if supporting industries do not grow, there will inevitably be a significant reliance on material imports, which will reduce the nation’s competitiveness and make it more difficult to maintain economic growth. Vietnamese supporting industry companies are currently struggling against competitors worldwide.

Nguyen Quang Huan, an NA deputy for Binh Duong province said, “Vietnam’s supporting industries are still weak and unable to meet domestic production needs. Some of Vietnam’s strong industries such as electronics, textiles, footwear, vehicle and motorbike assembly, etc. are heavily dependent on imported raw materials, which lead to high production costs, and low added value,”

Minister of Industry and Trade Nguyen Hong Dien said that despite the implementation of preferential policies, supporting industries still have many limitations. “State investment resources from the central to local levels are few and difficult to access, and often overlap with each other. Often conditions to enjoy incentives are quite strict and not suitable, making it very difficult for businesses to access and meet the requirements to enjoy the policy,” he said. “A limitation of Vietnam’s FDI attraction policy is that it is neither binding nor encouraging for foreign-invested enterprises (FIEs) to increase knowledge transfer to domestic enterprises.”

Most local suppliers are small- and medium-sized, and supporting industrial products with high-technology is still mainly provided by FIEs. To serve the needs of domestic production and assembly, Vietnam still imports a large value deficit of components and spare parts.

Nguyen Van Toan, vice chairman of the Association of Foreign-Invested Enterprises said, “What support can domestic enterprises provide to cooperate with foreign-led companies? I think it is necessary to build research and development centres for domestic enterprises. So far, any development has been supported by large domestic corporations capable of leading such changes. Therefore, if we want to develop, we need to issue more support policies soon.”

FIEs may have several satellites in Vietnam, but they genuinely need to raise the localisation ratio to guarantee competitive selling prices between them and to avoid relying too much on vendors, Toan added. “They urge Vietnam to establish more factories and promote the growth of the auxiliary sector. Goods must satisfy the requirements of both price and quality to be competitive,” he said.

Minister Dien added that it was necessary to review the legal system so that policies that have been issued can come to life, businesses can absorb them, and see growth from there.

Localities must also provide improvements to help these businesses find premises, infrastructure, and support in terms of capital, and human resource training. Dien emphasised the importance of revising the Foreign Investment Law and several related laws to draw in foreign investors. There must be a mechanism to bind, cooperation with domestic supporting industry enterprises.

“The MoIT will continue to advise on policy synchronisation, including research to develop a Law on key industries including mechanical manufacturing, processing, electronics, chemicals, and energy that are temporarily considered the foundation of Vietnam’s industry and the driving force for the country’s industrialisation and modernisation process,” Dien said.

| Joseph Uddo, chairman, American Chamber of Commerce (Hanoi)

Vietnam remains well-positioned to capture significant investment as companies increasingly seek to diversify their global supply chains. Like all major sourcing locations, Vietnam needs to continuously evaluate what its competitive advantage is. We believe Vietnam needs to prioritise labour and engineer training, sustainable practices, work permits for foreign engineers, and the country’s ability to support a more vertical industry, particularly as companies are looking to diversify tier two and three suppliers from China. We recommend removing barriers to foreign investment in professional and vocational training to assist the development of important skills and capabilities in the workforce. The government is also urged to provide better support for small and medium manufacturers. These companies are part of critical supporting industries, but their individual investments are small. Current Department of Planning and Investment metrics often do not favour such investors, causing delays in licensing and permissions. These companies are often premium employers of skilled and professional labour and are critical to building the support system that global manufacturers need here. To capture the diversification opportunities, our members also urge the government to quickly develop a better regime for approving brownfield ventures (purchases or leases existing production facilities to launch a new production activity). International manufacturers struggle to sell facilities they have already built/invested in, and potential buyers have trouble getting purchases approved and executed, and business licences intended in brownfield facilities approved. A functioning brownfield market is an important facilitator for investment here. Improvements in supply chain financing (facilitation of cash needs during manufacturing transactions) are needed and will help grow investment in Vietnam. In most competing markets, a customer purchase order is sufficient documentation for a bank to provide short-term financing, enabling a manufacturer to obtain materials and perform operations prior to receiving payment from the customer. Muto Shiro, chairman Japanese Chamber of Commerce and Industry in Vietnam

The key to Vietnamese economic development is to strengthen the cooperation between local enterprises and foreign-invested enterprises (FIEs) and see how many local companies can participate in the value chain of foreign firms. According to a survey of ours, the local content ratio of Japanese companies in Vietnam has only increased by 10 per cent over the past 10 years, which needs to be further accelerated. In order to encourage Vietnamese companies to enter the value chain of FIEs, we believe that it would be more effective for the Vietnamese government to find and develop Vietnamese companies with technological capabilities, introduce them to foreign manufacturers, and provide opportunities for business matching. At present, we are co-hosting supporting industries exhibitions with Vietrade and others. Every year, we also publish a directory of excellent Vietnamese suppliers, which are fully utilised by the procurement personnel of Japanese manufacturers. In this way, it is expected that the quality and technology of local Vietnamese companies will improve, and more companies will participate in the supply chain of FIEs. We believe that the measures to boost Vietnam’s local manufacturing industry and to promote competition will contribute to improving industrial competitiveness. As members of Vietnam’s local manufacturing industry increases, the number of companies which can supply products that meet quality standards will also increase. It is necessary to strengthen institutions that develop industrial human resources. Japanese companies provide extensive in-house education and on-the-job training, and are praised in terms of human resource development. However, the competition for human resources is intensifying, and the outflow of trained talent is increasing due to the lure of competitors. When recruiting personnel, it is desirable to have personnel with basic education and technical training. Therefore, we hope that public human resource development institutions, such as universities and vocational training schools, will strengthen their functions and actively collaborate with Japanese companies. Ngo Ngoc Khanh, vice chairman Vietnam Industry Supporting Alliance

With the goal set forth, Vietnam should achieve the criteria of an industrial country with modern industry and high average incomes by 2030, but the Law on Supporting Industries has yet to be promulgated. Major foreign-invested enterprises here are always followed by vendor companies and supporting industry manufacturers from those countries, while Vietnam’s supporting enterprises are mainly small- and medium-sized enterprises (SMEs), so it is very difficult for local players to compete with foreign ones. Very few Vietnamese enterprises can become large vendors of the top chains, we only participate a minimal part. Local suppliers are struggling with green transition and sustainable development. These SMEs do not have enough resources and finance to do it soon, unless receiving some assistance from the government. In recent months, orders have increased but not by many, because manufacturing capacity and equipment are poor. We expect some preferential policies for industrial enterprises from the government to provide financial support, for example reducing domestic tax rates, which will contribute to increasing the localisation rate of industrial products. There needs to be a preferential loan policy for SMEs to upgrade machinery, update new technologies, and receive advanced technology transfer. This is because currently the machinery and equipment for supporting SMEs are middle-class or even low-end, so the country cannot achieve the goal by 2030. In other countries, when top enterprises invest, they have to commit the localisation rate very early. In Vietnam, we still do not have many constraints on this. So we need to have policies that both encourage and support and connect business-to-business trade between lead manufacturers and vendors. |

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Related Contents

Latest News

More News

- Kurz Vietnam expands Gia Lai factory (February 27, 2026 | 16:37)

- SK Innovation-led consortium wins $2.3 billion LNG project in Nghe An (February 25, 2026 | 07:56)

- THACO opens $70 million manufacturing complex in Danang (February 25, 2026 | 07:54)

- Phu Quoc International Airport expansion approved to meet rising demand (February 24, 2026 | 10:00)

- Bac Giang International Logistics Centre faces land clearance barrier (February 24, 2026 | 08:00)

- Bright prospects abound in European investment (February 19, 2026 | 20:27)

- Internal strengths attest to commitment to progress (February 19, 2026 | 20:13)

- Vietnam, New Zealand seek level-up in ties (February 19, 2026 | 18:06)

- Untapped potential in relations with Indonesia (February 19, 2026 | 17:56)

- German strengths match Vietnamese aspirations (February 19, 2026 | 17:40)

Tag:

Tag:

Mobile Version

Mobile Version