Stricter trade measures and tariff risks for Vietnam

How could the outcome of the US election impact Vietnam’s trade policies, particularly with regard to tariffs, considering ongoing US-China tensions?

|

| Frederic Neumann, chief Asia economist at HSBC, Photo: HSBC |

With Donald Trump’s victory in the US presidential election, Vietnam’s trade policies could be impacted significantly, albeit in a nuanced manner. The return of a Republican administration under Trump suggests a continuation of assertive trade rhetoric, similar to his first term, focusing heavily on rectifying trade imbalances and maintaining pressure on China.

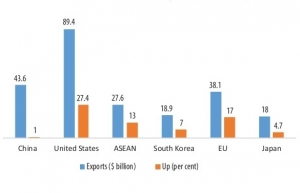

The US-China tensions are unlikely to ease, which will continue to push manufacturers to diversify their production bases, favouring hubs like Vietnam. This trend should benefit Vietnam’s exports and economy. However, with Trump’s administration back in power, there could be heightened scrutiny over Vietnam’s trade practices, particularly if it’s perceived as a channel for Chinese goods circumventing US tariffs. This risk raises the possibility of targeted tariffs or investigations directed at Vietnam.

Nonetheless, imposing widespread tariffs on Vietnamese exports would present challenges for the US, as it could increase costs for American businesses and consumers. The political feasibility of broad tariff measures remains limited, given the need to balance domestic economic interests.

Even if Vietnam were to face certain tariffs, its strong manufacturing base and competitive advantages would allow it to pivot and deepen trade ties with other regions, including Europe and emerging markets. Similar to how China adapted by diversifying its export destinations, Vietnam has the potential to mitigate any negative impact by strengthening partnerships beyond the US market.

In October, Indonesia banned sales of the new iPhone due to Apple’s failure to meet its investment commitments. How can Vietnam maintain its openness to foreign direct investment (FDI) while being selective and strategic?

FDI has played a crucial role in Vietnam’s economic growth, creating jobs, boosting high-paying opportunities, and driving industrial development. Vietnam’s openness to foreign investment has helped it become the fastest-growing economy in ASEAN this year, with similar momentum expected for next year. However, as competition for high-quality FDI increases, especially from countries like India, it’s important for Vietnam to strike a balance.

Investors must meet environmental and labour standards, but Vietnam should avoid being overly restrictive. The country can continue attracting foreign investment by focusing on sectors that align with its long-term development goals. For example, offering substantial incentives made sense when Vietnam was building its smartphone industry, but today, with a strong industrial base and infrastructure in place, new investors, including established players like Samsung, should pay market rates.

Vietnam is now in a position to be more strategic, evolving its policies to ensure that FDI contributes to sustainable growth while maintaining its attractiveness to global investors.

Which country is the major competitor of Vietnam in attracting FDI, particularly in high-tech industries, and why?

Within Asia, Vietnam’s main competitor for FDI, particularly in high-tech manufacturing, is Malaysia. Both countries have attracted significant foreign investment in supply chain manufacturing, especially electronics. Malaysia, in particular, has positioned itself as a key destination for semiconductor investment, a sector that Vietnam is eager to develop.

Other Southeast Asian nations, like Thailand, Indonesia, and the Philippines, have seen limited activity in this area, while India’s FDI is more focused on its domestic market. Bangladesh remains centred on low-cost garment production, and Indonesia attracts FDI primarily in natural resources.

As a result, Malaysia emerges as Vietnam’s closest competitor in attracting high-value FDI, particularly in semiconductors and other advanced manufacturing industries.

Some experts have suggested that Vietnam is at a stage similar to where China was 20 years ago. Do you think Vietnam can achieve the same level of infrastructure development as China in the next two decades, particularly in highways and metro systems?

It’s certainly possible, but Vietnam must approach infrastructure development more sustainably than China did. While China built its infrastructure at a rapid pace, it also faced issues such as overbuilding and rising debt. Vietnam should focus on avoiding these pitfalls by adopting a measured approach to its infrastructure projects.

Road and rail networks are essential, but Vietnam must also invest in other critical areas like water management, energy, and telecom infrastructure. Telecommunications are particularly important for Vietnam’s ambitions in AI and the data economy, but the country lags in this area. Port infrastructure is another priority that needs further investment.

China began prioritising infrastructure around 20-25 years ago, and Vietnam is now entering a similar phase. However, to avoid the debt issues China faced at the provincial level, Vietnam should implement stronger financial controls and involve the central government more in financing. Although Vietnam is already investing heavily in infrastructure, its rapid 7 per cent economic growth means the country must expand infrastructure by 10-15 per cent annually to keep pace.

While this will be challenging, Vietnam is entering a critical phase of infrastructure development that is necessary to support its continued growth.

| Vietnam outlines measures for 2025 trade ambitions The domestic economy is expected to see a significant trade surplus this year, driven by rising external demand and new trade targets set for next year. |

| US election result to affect trade measures Donald Trump’s return to the US presidency next year could have wide-ranging effects on the global economy, with Vietnam potentially benefiting from shifts in US trade policies while also facing tighter monetary and trade measures. |

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Tag:

Tag:

Related Contents

Latest News

More News

- Private capital funds as cornerstone of IFC plans (February 20, 2026 | 14:38)

- Priorities for building credibility and momentum within Vietnamese IFCs (February 20, 2026 | 14:29)

- How Hong Kong can bridge critical financial centre gaps (February 20, 2026 | 14:22)

- All global experiences useful for Vietnam’s international financial hub (February 20, 2026 | 14:16)

- Raised ties reaffirm strategic trust (February 20, 2026 | 14:06)

- Sustained growth can translate into income gains (February 19, 2026 | 18:55)

- The vision to maintain a stable monetary policy (February 19, 2026 | 08:50)

- Banking sector faces data governance hurdles in AI transition (February 19, 2026 | 08:00)

- AI leading to shift in banking roles (February 18, 2026 | 19:54)

- Digital banking enters season of transformation (February 16, 2026 | 09:00)

Mobile Version

Mobile Version