Special economic zones help attracting investment into Vietnam

Special economic zones (SEZ), as per the survey’s findings, appear to be enablers of structural changes through a combination of ‘linkages’ and demonstration effects. Infrastructure is the crucial input expected of any SEZ. In most of the Mekong economies, SEZs are perceived to provide significant insulation from the uncertain external/outside environment.

Vietnam, in particular, over the past year has emerged as the sub-region’s FDI magnet. In 2015 alone the country reported $14.5 billion in disbursed FDI. Looking at investments in new projects and extensions to existing projects, a further $22.8 billion has been promised over the same period.

As a result of the continuous flow of FDI, the number of industrial zones (IZ) in the country has risen to around 400 in mid-2015 from the 219 in 2008. Among the 47 provinces that reported foreign investment inflows, the provinces of Ho Chi Minh City, Binh Duong, and Dong Nai have attracted the most capital, making the Southeast region the top FDI destination.

|

ANZ’s study is based on interviews conducted in Vietnam in April and May 2016 to analyse the business environment within various industrial parks. The interviews included 20 completely foreign-owned firms. Despite being part of the global production and supply chains, more than half of the respondents indicated that their production in Vietnam is geared for local consumption.

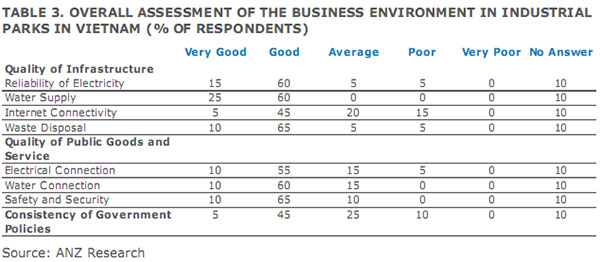

Survey respondents were broadly positive about the overall business environment in Vietnam’s IZs. Among the factors that attract firms to IZs tax incentives, efficiency of customs clearance, and the consistency of government policies were considered the most important. Public goods and services were mostly assessed as average or higher.

|

On the other hand, there are infrastructure challenges, such as internet connectivity, which seems to be more of an issue than the unreliable electricity supply. The consistency of government policies has also emerged as an issue. There are concerns about the constantly changing legal requirements and the foreign exchange rate policy.

All companies surveyed, except for a single commodity trader, said they had leased their sites in the IZs. Long-term lease contracts averaged 45 years. Companies mostly used their own financial sources to upgrade technology. However, capital is mobilised via FDI as well as the companies’ own sources.

In terms of labour, low skills and high turnover are considered to be the biggest problems. Foreigners accounted for less than 5 per cent of total employees within the IZs and work only in non-production capacity. Vietnamese workers make up all of the production workers in both low and semi-skilled categories.

Thus, formal training overwhelmingly targets local employees. However, less than half of the survey respondents said their firms have tie-up programs with universities or vocational institutions.

More than half the surveyed firms said they are selling on the domestic market, yet less than half of their manufacturing inputs were sourced locally. Around 40 per cent of the respondents’ production is intended for export. Thus, the high import content of manufactured goods indicate low value-addition. This is in line with statistical data on Vietnam’s goods trade, with exports making up around 83 per cent of the GDP, while imports were 85 per cent of the GDP as of 2015.

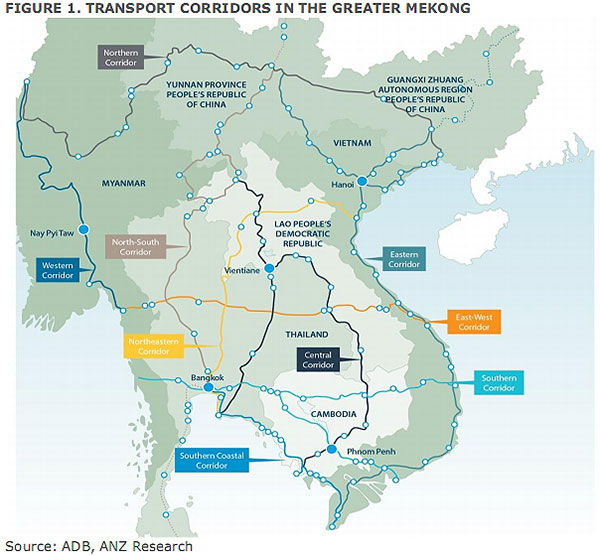

As expected, the transportation of inputs and products is mostly via land and sea routes. High costs and uncertain delivery dates are hence the top challenges in logistics. Most respondents also indicated that they have an administration team in the IZ. However, less than half of them conduct meetings at least once a year.

In sum, favourable tax incentives and consistency of governmental regulations appear to be the most import factors in assessing the business environment in Vietnamese IZs. While the local labour force carries out most of the production, a small share of foreigners is employed in non-production roles.

However, low skills and high turnover top the labour challenges. Although all of the firms surveyed are foreign-owned, technology upgrading is overwhelmingly funded domestically. The high import content of manufacturing for both the domestic and export markets are in line with low value-added production at the IZs in Vietnam.

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Latest News

More News

- US firms deepen energy engagement with Vietnam (February 05, 2026 | 17:23)

- Vietnam records solid FDI performance in January (February 05, 2026 | 17:11)

- Site clearance work launched for Dung Quat refinery upgrade (February 04, 2026 | 18:06)

- Masan High-Tech Materials reports profit: a view from Nui Phao mine (February 04, 2026 | 16:13)

- Hermes joins Long Thanh cargo terminal development (February 04, 2026 | 15:59)

- SCG enhances production and distribution in Vietnam (February 04, 2026 | 08:00)

- UNIVACCO strengthens Asia expansion with Vietnam facility (February 03, 2026 | 08:00)

- Cai Mep Ha Port project wins approval with $1.95bn investment (February 02, 2026 | 16:17)

- Repositioning Vietnam in Asia’s manufacturing race (February 02, 2026 | 16:00)

- Manufacturing growth remains solid in early 2026 (February 02, 2026 | 15:28)

Mobile Version

Mobile Version