Skies clear over VIMC’s joint venture seaports

|

| Skies clear over VIMC’s joint venture seaports |

Statistics from the maritime and logistics services giant Vietnam Maritime Corporation (VIMC) show that Cai Lan International Container Terminal’s (CICT) revenues reached VND236 billion ($10.26 million) in the first eight months of 2020, an on-year increase of 45.8 per cent.

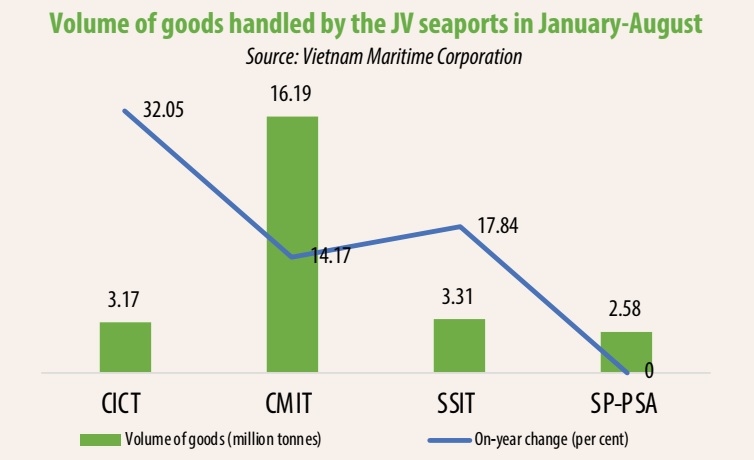

Located in the northeastern province of Quang Ninh, the facility was estimated to handle a total of 3.17 million tonnes of goods during the period, up 32.05 per cent against the corresponding period last year. This is a big improvement for the seaport, which is a joint venture seaport between VIMC and US-based Carrix, the parent company of SSA Marine. In previous years, CICT had to handle goods in bulk to survive.

During the period, the performance of VIMC’s three other joint venture ports also improved, although not to the extent hoped as profits mostly stayed negative, except for Cai Mep International Terminal (CMIT).

CMIT, which has Denmark’s APM Terminals as foreign stakeholder, witnessed on-year rises in both the volume of goods and revenue. Specifically, it handled more than 16.19 million tonnes of goods, up 14.17 per cent on-year, while revenues ascended 5.77 per cent to VND777.44 billion ($33.8 million).

Located in the Cai Mep-Thi Vai area of the southern province of Ba Ria-Vung Tau, CMIT is the most profitable joint venture seaport between VIMC and its partner. Between January and August, it posted a pre-tax profit of VND43.53 billion ($1.9 million).

Similarly, SSIT – a joint venture between VIMC and SSA Marine – reported on-year improvements of 17.84, 68.2, and 71.62 per cent in the total volume of goods, container throughput, and revenue. Also located in the Cai Mep-Thi Vai area, these are the highest increases among the joint venture (JV) seaports during the span.

The volume of goods and revenue figures of SP-PSA, a joint venture between VIMC and Singapore-based PSA, lying in the Cai Mep-Thi Vai area, was roughly the same as in the same period last year. The port remains in difficulties.

SP-PSA passed the January-August span with no container throughput. In 2019, the facility also reported no container throughput, although its volume of goods in bulk rose 11 per cent on-year to over 3.43 million tonnes in comparison with the estimated 1.54 million tonnes in 2016. The seaport was estimated to have made nearly $7.5 million in revenue during 2019, up 15 per cent on-year.

These figures more often than not speak of better performance at the JV seaports, despite COVID-19 disruptions. For instance, CMIT’s revenue between January and March dropped by VND1.4 billion ($60,870), yet the port still managed to improve revenue in the first eight months.

Nguyen Canh Tinh, CEO of VIMC, told VIR, “VIMC business lines have been hit by the ongoing health crisis. Interruptions in global trade links also had a negative impact on our seaports, logistics, and shipping business lines.”

Looking forward, the coming months may carry further difficulties for CICT and others when more terminals are put into operation at Lach Huyen International Seaport and Gemalink Seaport, which is expected to come into operation in late 2020 with a total annual capacity of 8.5 million TEUs, making it one of 20 largest seaports worldwide.

In spite of the challenge, the JV seaports will likely be able to boost their throughput and revenues thanks to the enforcement of the EU-Vietnam Free Trade Agreement which took effect in August.

Vietnam is the EU’s second-largest trade partner in ASEAN after Singapore, with trade in goods worth €45.5 billion ($53.9 billion) in 2019. The FTA is projected to help increase Vietnam’s GDP by 4.6 per cent and its exports to the EU by 42.7 per cent by 2025.

Additionally, the European Commission has forecast the EU’s GDP to increase by $29.5 billion by 2035, thus spurring demand for maritime transportation services.

Furthermore, the seaport segment attracts the most foreign investment in the transport sector, thus helping Vietnam’s seaports and those of VIMC to become a link in the global supply chains of global shipping lines and seaport operators.

These prospects have not gone unnoted as many investors from Japan, the US, and South Korea have expressed strong interest in acquiring state stakes in ports in the northern city of Haiphong, the central city of Danang, and Ho Chi Minh City.

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Related Contents

Latest News

More News

- Vietnam financial markets on the rise amid tailwinds (February 11, 2026 | 11:41)

- New tax incentives to benefit startups and SMEs (February 09, 2026 | 17:27)

- VIFC launches aviation finance hub to tap regional market growth (February 06, 2026 | 13:27)

- Vietnam records solid FDI performance in January (February 05, 2026 | 17:11)

- Manufacturing growth remains solid in early 2026 (February 02, 2026 | 15:28)

- EU and Vietnam elevate relations to a comprehensive strategic partnership (January 29, 2026 | 15:22)

- Vietnam to lead trade growth in ASEAN (January 29, 2026 | 15:08)

- Japanese business outlook in Vietnam turns more optimistic (January 28, 2026 | 09:54)

- Foreign leaders extend congratulations to Party General Secretary To Lam (January 25, 2026 | 10:01)

- 14th National Party Congress wraps up with success (January 25, 2026 | 09:49)

Tag:

Tag:

Mobile Version

Mobile Version