PCI 2020 pinpoints areas to improve on

Just a few days ago, the northeastern province of Quang Ninh licensed a $500 million photovoltaic cell technology project funded by Jinko Solar Hong Kong. The investor attained the investment certificate within only 24 hours, making it one of the top highlights in the local administrative reform.

Nguyen Tuong Van, Chairman of Quang Ninh People’s Committee, said that Quang Ninh’s achievement results from its special efforts in 2020. In a year of unprecedented hardships, the province supported struggling firms with a central focus to improve the local business landscape.

“Quang Ninh is the first province to recruit senior state managers via competitive exams. We made strong administrative reform to help reduce costs for businesses, and increased land access and site clearance for them. Moreover, we strengthened IT application and development of e-government towards creating a digital government and smart city,” he added.

|

Game changers

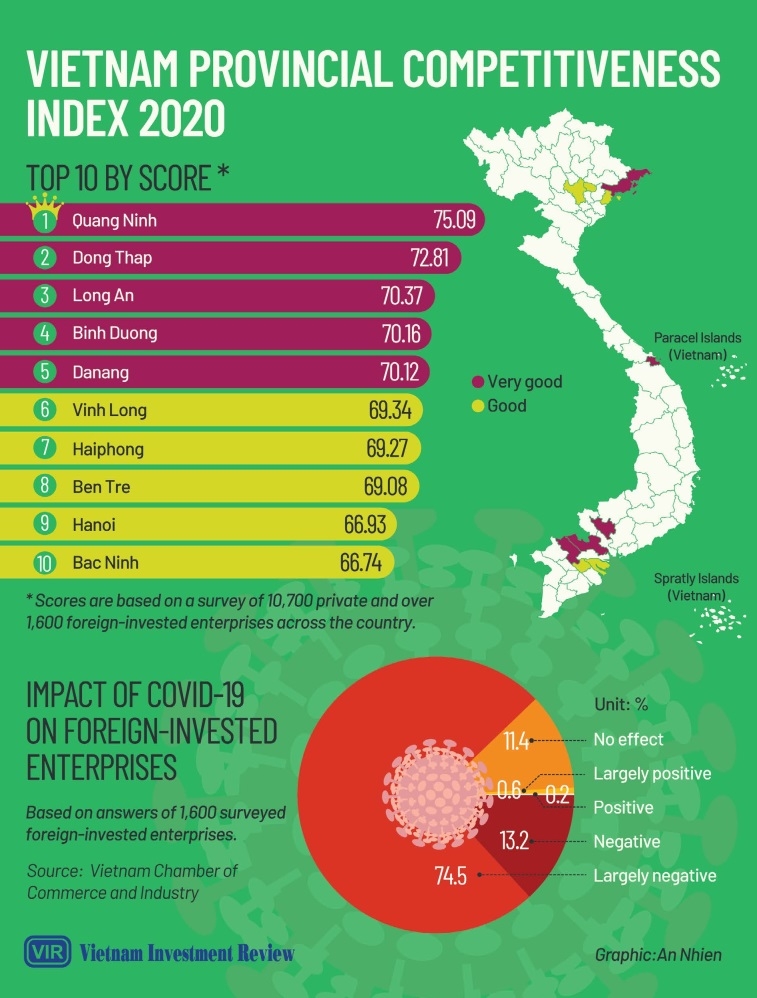

With such strong reform, Quang Ninh tops 2020’s Provincial Competitiveness Index (PCI) ranking, scoring 75.09 points. With an overall PCI score increase of 1.69 points, the province broke its own record to secure top position for the fourth consecutive year. It is also the only province to surpass 75 points in the PCI rankings since 2010.

Dong Thap and Long An provinces in the Mekong Delta region round out the top three performers of 2020 thanks to significant improvements in administrative reform, market entry, and reduced informal charges. Other top performers include Binh Duong, Danang, Vinh Long, Haiphong, Ben Tre, Hanoi, and Bac Ninh.

Dau Anh Tuan, director of the PCI project, said that the 2020 results show an improving trend over time. “It was the fourth year in a row that the median province scored at least 60 points on the 100-point scale. The consolidation of scores over time is also quite remarkable.”

Even lower performers are catching up to the provinces at the top. Notably, while the highest-ranking provinces score around 75 points (aggregate PCI) and 73 points (core PCI), the lowest-ranked provinces score around 60 points (aggregate PCI) and 56.5 points (core PCI).

In the past five years, positive changes have been observed in reduced informal charges, well maintained law and order, increased productivity, and significant administrative improvement.

For instance, as shown in the report, the private sector’s perception of the efficacy of the fight against corruption and informal charges at the provincial level is increasing. The share of firms reporting that they paid informal charges in 2020 dropped to 44.9 per cent from a high of 66 per cent in 2016. The burden of informal charges has shrunk over time, with 84.4 per cent of firms rating it as at an acceptable level in 2020, compared to 79.2 per cent of firms in 2016.

Regarding being proactive and creative in local policy implementation, in 2020 a record 81 per cent of respondents approved of provincial authorities’ flexibility in creating an enabling business environment for the private sector, surpassing the prior high mark the previous year.

Future improvement in question

Despite recognisable advances and lasting advantages like stable political institutions, the 2020 PCI shows some remaining weaknesses in Vietnam’s foreign investment attraction vis-à-vis competitors in tax rates, active role in policymaking, and others areas that need further attention in order to strengthen the business climate.

As competition from regional rivals such as China, Thailand, Singapore, Indonesia, and Malaysia seems to stiffen, and tempered optimism for the future is seen among foreign-invested enterprises (FIEs), any advancement in the areas are so important for Vietnam and its localities. The pandemic has created an uncertain economic environment, thus making FIEs more reluctant to commit to expanding their operations in Vietnam, the report explained. The business thermometer shows that only 41 per cent of businesses in the survey plan to increase the size of their operations in the coming years, compared to 53 per cent in 2019.

During 2020, around 87 per cent of both foreign and domestic firms experienced some pandemic-related business setback in 2020. Specifically, the share of FIEs reporting losses increased from 34.3 per cent in 2019 to 47.1 per cent this year — the highest rate ever recorded by the survey.

USAID/Vietnam acting mission director Brad Bessire told VIR, “There is still room for future improvement – even for a province with a score of 75, there is still another 25 to aim for to reach the top score. From the report, by province, we know exactly which areas are still in need of further improvements.”

Improvements in overall governance this year seems to be stalling, which means persistent reform efforts will be needed to produce substantive outcomes. There is still room for improvement in transparency, effectiveness of enforcement at district and departmental levels, reducing regulatory compliance costs through strengthened administrative procedure reform, curtailing the burden of inspections, and further reducing informal charges, Bessire added.

Nguyen Quang Vinh, general secretary of the Vietnam Chamber of Commerce and Industry also told VIR, “There is still room for more improvements, but it is not easy. Cities and provinces, even Quang Ninh, have to find new breakthroughs for their reforms in order to achieve it.”

| Recent PCI reports have raised the alarm of a steady decline in the size of FIEs. While the number of investors had been increasing, the average size of employment and investment capital has fallen. Some experts warn that many small FIEs are entering Vietnam solely to serve as satellites – suppliers for larger foreign-invested projects. Such FIEs may crowd out domestic suppliers and prevent the domestic sector from integrating into global value chains (Malesky, Phan, & Pham 2019). In 2019, there were early signs of a halt in that downward trend (Malesky & Pham 2020). Unfortunately, in 2020, possibly due to the impact of COVID-19, the trend made quite a dramatic U-turn. For the first time since the creation of the PCI-FDI, the percentage of FIEs with employment of fewer than five workers exceeded 10 per cent, reaching 10.8 per cent from 9.1 per cent in 2019. The next category (5-9 employees) also saw an increase from 10.6 to 11.3 per cent. This reversal can also be seen in the size of investment capital. In 2019, the share of firms with equity of less than $21,700 was only 9.8 per cent. One year later, the corresponding figure is an unprecedented 13.1 per cent. At the other end of the spectrum, only 3.7 per cent of respondents reported equity between $8.7-21.7 million, and only 4.6 per cent reported equity size exceeding $21.7 million. The corresponding figures in 2019 were 5.0 and 5.1 per cent, respectively. Like many businesses around the world, FIEs seem to have shed labour and checked their capital investment in order to stay afloat during the economic downturn. |

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Latest News

More News

- VNPAY and NAPAS deepen cooperation on digital payments (February 11, 2026 | 18:21)

- Vietnam financial markets on the rise amid tailwinds (February 11, 2026 | 11:41)

- New tax incentives to benefit startups and SMEs (February 09, 2026 | 17:27)

- VIFC launches aviation finance hub to tap regional market growth (February 06, 2026 | 13:27)

- Vietnam records solid FDI performance in January (February 05, 2026 | 17:11)

- Manufacturing growth remains solid in early 2026 (February 02, 2026 | 15:28)

- EU and Vietnam elevate relations to a comprehensive strategic partnership (January 29, 2026 | 15:22)

- Vietnam to lead trade growth in ASEAN (January 29, 2026 | 15:08)

- Japanese business outlook in Vietnam turns more optimistic (January 28, 2026 | 09:54)

- Foreign leaders extend congratulations to Party General Secretary To Lam (January 25, 2026 | 10:01)

Tag:

Tag:

Mobile Version

Mobile Version