OTT takes advantage of cinema slump

|

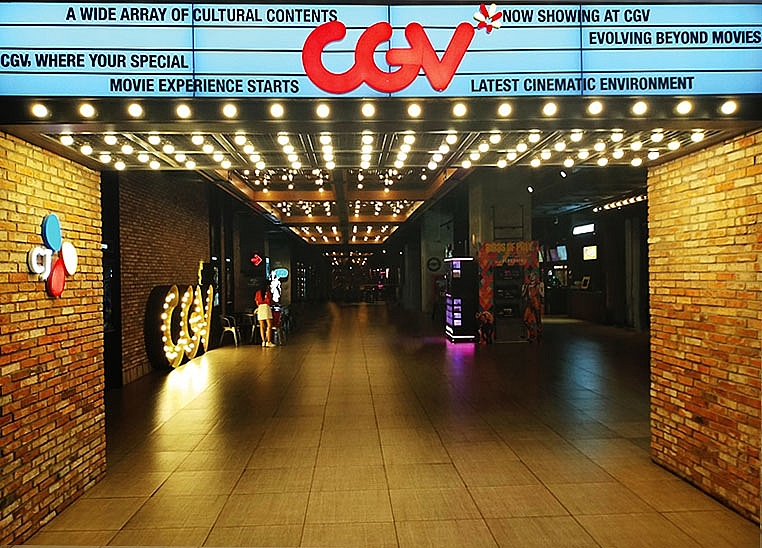

| Cinemas have pleaded for rent reductions until they can receive customers and get back up-and-running, Photo: Le Toan |

After the government’s social distancing policy was applied nationwide on April 1, the entire cinema system across the country had to suspend its operation, causing huge damage in revenue for enterprises operating in the sector.

According to statistics from South Korea’s CGV Vietnam, which currently holds around 45 per cent of Vietnam’s film market, by March 25, its total revenue dropped to 20 per cent on-year. In March, CGV’s revenue was only VND76 billion ($3.3 million) while the figure in the same period last year amounted to VND350 billion ($15.6 million). This month, the company will continue to report a plunge, expected to earn only 30 per cent of what it made in the previous month or even nothing at all, if the social distancing policy is extended to the end of April.

Ngo Thi Bich Hanh, deputy general director of BHD Co., Ltd., a film distributor and theatre operator with eight cinemas across the country, said that the company has no revenue, but still has massive expenses for rent, wages, and other costs. “If the pandemic to last for a longer time, the company will have to lay off employees while maintaining operations and earning at least a minimum revenue to keep the cinemas alive,” Hanh said.

Meanwhile, Galaxy JSC has to shoulder VND5-10 billion ($215,000-430,000) per month for similar expenditures while waiting to reopen its cinemas.

Despite the backing of South Korean conglomerate CJ, CGV Vietnam’s burdens are the heaviest as it is currently the leading film distributor and movie theatre operator in the country.

According to Nguyen Quoc Khang, PR representative of CGV, along with the role of a film distributor, the group also produces movies as has been known for the two acclaimed films Chi chi em em and the Lat mat series. Thus, if the company’s 64 cineplexes in 22 cities and provinces nationwide cannot generate revenue, film production will also be suspended.

At present, CGV is looking for rent reductions from its partners to offset the current difficulties. Following this inquiry, Vincom shopping centres have exempted rent during the closing time for cinemas. Moreover, some other shopping centres decided to reduce rents by 20-30 per cent in February and March for the company.

While restaurants and coffee chains can take advantage of the online business model to offset a part of their revenue loss, copyright issues and the need for other permissions make online film trading impossible for cinemas. At present, CGV has licences to screen films from Paramount Pictures, Warner Bros., Walt Disney Pictures, and 20th Century Fox. However, since some of them have their own online channels, these publishers do not want to show their films via CGV’s online channel.

Hanh of BHD forecast that the movie industry in Vietnam will face immense challenges to recover even after the pandemic is under control as presently production is a non-starter. “The six upcoming months will be considered the most difficult in the history of the local film industry,” Hanh said.

Film producers also forecast that there could be a shortage of films for cinemas even after the crisis. Massive local blockbusters like Bi mat cua gio, Chi Muoi Ba, Trang Ti, and Lat mat have all had to change their launch plans.

OTT services skyrocket

Contrary to the dim prospects of cineplexes, over-the-top (OTT) services like FPT Play and Netflix are forecast to benefit from the pandemic. As people are not leaving their homes, watching movies or TV shows are the only replacements for cinemas. The New York Times said that OTT services’ global earnings during this year’s first quarter spiked by 30 per cent on-year. Taking advantage of this, Netflix has stepped up advertising in Vietnam via social networks such as Facebook and YouTube. As a result, its global revenue is forecast to increase by 31 per cent this year, according to the newswire.

FPT Play also recorded great growth in the past months. A representative of the application said that its user numbers have risen by 30 per cent since early January. Moreover, paid subscribers in March also grew by 29 per cent on-year and 23 per cent on-month.

However, people had a preference for OTT services even before the pandemic swooped down on the cinema industry. In 2019, the total global revenue of these services was $59 billion, far exceeding the revenue of cineplexes across the world ($42.2 billion).

According to the Hollywood Reporter, the most worrying trend arising from this development is that studios now tend to partner up with OTT companies instead of cinemas as before. As a result, cinemas are now even more vulnerable and will have a hard time rebounding after the pandemic.

The same is true for Vietnam. According to the Ministry of Information and Communications (MIC), OTT services recently saw about 50 per cent in average growth rate, while pay-TV grew by 4-5 per cent only in the past several years.

Tax avoidance

As Netflix has been steadily gaining market share in Vietnam over the past years, and is doing especially the coronavirus outbreak, its tax duties in the country remain a big concern for the local authorities. More than eight months since the last meeting with the MIC, the company has been quiet about officially entering Vietnam.

At the meeting with Minister of Information and Communications Nguyen Manh Hung, Netflix’s managing director of Asia-Pacific Yu Chuang Kuek asserted that the corporation has a genuine wish to operate in Vietnam and promised pay its tax obligations in full to the local government. At the same time, the United States-based company worked with the General Department of Taxation on registration and declarations. Nevertheless, as of now, Netflix has no official presence in Vietnam, except for adding Vietnamese subtitles to many of its titles.

According to the latest data published by the MIC, Netflix’s annual turnover in the Vietnamese market is about $30 million, none of which actually goes to the local tax authorities. In case its revenue rises by the 31 per cent as estimated by The New York Times, it could make around $40 million this year in the country.

However, it remains questionable whether Netflix will pay taxes in Vietnam. In contrast with local OTT providers, Netflix is not under the supervision of the local authorities, meaning the company does not have to perform any duties like local counterparts. This has caused unfair competition for a long time.

Meanwhile, local OTT companies have been dealing with many kinds of tax to maintain their operations. In addition to the corporate income tax rate of 20 per cent, they have to pay 10 per cent copyright tax and 5 per cent VAT for an overseas movie or TV show.

Vu Anh Tu, executive vice president of FPT Telecom JSC, the owner of the local streaming application FPT Play, told VIR, “Thanks to running advertisements in Vietnam, they have easily lured in a sizeable number of local users, charging them from overseas.”

Ngo Thi Bich Lien, director of local media company BHD Star Cineplexes said that it is necessary to create equality between local and international companies, as these big groups simply do not pay enough tax, which leads to major challenges for local groups in the same segment. “They have to take responsibility for what they earn in Vietnam, like us,” Lien said.

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Related Contents

Latest News

More News

- VIFC in Ho Chi Minh City officially launches (February 12, 2026 | 09:00)

- VNPAY and NAPAS deepen cooperation on digital payments (February 11, 2026 | 18:21)

- Vietnam financial markets on the rise amid tailwinds (February 11, 2026 | 11:41)

- New tax incentives to benefit startups and SMEs (February 09, 2026 | 17:27)

- VIFC launches aviation finance hub to tap regional market growth (February 06, 2026 | 13:27)

- Vietnam records solid FDI performance in January (February 05, 2026 | 17:11)

- Manufacturing growth remains solid in early 2026 (February 02, 2026 | 15:28)

- EU and Vietnam elevate relations to a comprehensive strategic partnership (January 29, 2026 | 15:22)

- Vietnam to lead trade growth in ASEAN (January 29, 2026 | 15:08)

- Japanese business outlook in Vietnam turns more optimistic (January 28, 2026 | 09:54)

Tag:

Tag:

Mobile Version

Mobile Version