NovaGroup reform highlights strong F&B competition

VinaCapital last week successfully facilitated the acquisition of Nova F&B by an undisclosed Singaporean partner. This strategic move comes amidst NovaGroup’s ongoing restructuring efforts and marks the birth of IN Dining, the rebranded entity, in partnership with IN Hospitality.

|

| A PhinDeli shop under Nova F&B closes May 2023, Source: Ngoc Hien/ tuoitre.vn |

While the transaction aligns with NovaGroup’s focus on core business areas, it leaves behind a sense of regret as the food and beverages segment has been performing exceptionally well. Nova F&B achieved impressive results in its inaugural year, surpassing VND200 billion ($8.3 million) in revenue in 2021, with a gross profit margin exceeding 65 per cent.

Sources from NovaGroup confirm that Nova F&B had already reached a break-even point in 2022, making it a valuable asset within the conglomerate’s ecosystem.

However, NovaGroup chose to divest from the profitable venture due to internal restructuring efforts, focusing on core sectors like Novaland in real estate, Nova Services, and Nova Consumer for animal feed and consumer goods.

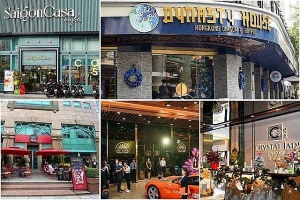

The IN Dining ecosystem, now comprising 46 operating outlets with 18 distinct brands, such as Saigon Casa, The Dome Dining & Drinks, Dynasty House, PhinDeli, Shri Restaurant & Lounge, Tib, JUMBO Seafood, Crystal Jade Palace, and Gloria Jean’s Coffees, will undergo a name change under the management of IN Holdings. It also owns large event and wedding venues like GEM Center, White Palace, and The Log Restaurant.

Nguyen Thanh Ha Ngoc, CEO of IN Holdings, highlighted the company’s decision to assume management of Nova F&B as driven by VinaCapital’s recognition of Vietnam’s burgeoning culinary market.

“With the rebranding of Nova F&B to IN Dining, we expect our expertise in operating renowned brands to reshape the industry with innovation and exceptional experiences,” she said.

Andy Ho, chief investment officer at VinaCapital, expressed confidence in IN Holdings’ industry experience and its ability to efficiently operate and expand the chain within the next two years.

He also highlighted the immense potential of the food and beverage sector in Vietnam, particularly due to the influx of foreign investments. In 2022 alone, the full-service restaurant segment witnessed a growth rate of 12 per cent in terms of revenue compared to the previous year, while the café/bar segment experienced a staggering 40 per cent increase. “Although the F&B market is fiercely competitive, there are not many major players in the restaurant chain sector, especially in the food segment. Currently, Golden Gates leads in terms of coverage, store scale, and revenue. While Golden Gates focuses on mid-range brands, IN Dining aims to cater to the high-end and fine-dining segments,” emphasised Ho.

In terms of competitors, Golden Gates currently leads the restaurant chain sector in terms of coverage, store scale, and revenue. However, the projected financials for 2023 indicate a concerning decline in revenue by 1.1 per cent and a staggering 75 per cent drop in profits compared to 2022. These figures raise doubts about the overall health of the fine-dining F&B sector and pose challenges for IN Dining’s ambitious transformation plan.

Data from Statista shows that the revenue in the F&B service activities segment of Vietnam’s accommodation, restaurants, and nightlife market is forecasted to decrease by a total of $2.1 million between 2023 and 2024. However, post-social distancing measures, the industry has experienced a strong rebound driven by domestic demand recovery and the return of international tourists.

Euromonitor projects an 18 per cent increase in market value in 2023 compared to 2022, reaching VND720 trillion ($30 billion), with further growth expected to reach VND938.3 trillion ($39 billion) by 2026.

Ngoc of IN Holdings stated, “The F&B market is highly attractive, but the competition is intensifying due to the increasing presence of world-renowned culinary brands. While many restaurants and chains continue to be established, the majority of owners operate at an individual level, lacking a long-term strategy for success. The shortage of skilled professionals and the need for digitalisation are important considerations for industry operators.”

The Vietnamese F&B market offers growth opportunities due to demographics, rising incomes, and dining interest. Additionally, Michelin’s entry brings global recognition and culinary excellence, thus IN Dining can capitalise on this to become a top player in high-end dining, driving industry growth. However, amidst saturation and competition, businesses need innovative strategies, strong brands, and digital investments to succeed, according to Ngoc.

| F&B groups snapping up new stores in bid for victory Consumer belt-tightening is not having much impact on the revenues of food and beverage businesses in Vietnam, with many maintaining stable growth rates. |

| VinaCapital facilitates acquisition of Nova F&B by Singaporean investor VinaCapital successfully orchestrates the acquisition of Nova F&B by a Singaporean partner, with IN Hospitality assuming the operational management of the renowned food and beverage company. |

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Tag:

Tag:

Related Contents

Latest News

More News

- Masan Consumer names new deputy CEO to drive foods and beverages growth (February 23, 2026 | 20:52)

- Myriad risks ahead, but ones Vietnam can confront (February 20, 2026 | 15:02)

- Vietnam making the leap into AI and semiconductors (February 20, 2026 | 09:37)

- Funding must be activated for semiconductor success (February 20, 2026 | 09:20)

- Resilience as new benchmark for smarter infrastructure (February 19, 2026 | 20:35)

- A golden time to shine within ASEAN (February 19, 2026 | 20:22)

- Vietnam’s pivotal year for advancing sustainability (February 19, 2026 | 08:44)

- Strengthening the core role of industry and trade (February 19, 2026 | 08:35)

- Future orientations for healthcare improvements (February 19, 2026 | 08:29)

- Infrastructure orientations suitable for a new chapter (February 19, 2026 | 08:15)

Mobile Version

Mobile Version