New study on electric vehicles reveals strong demand in Southeast Asia

|

| 37 per cent of Southeast Asian buyers are open to electric vehicles (Photo: Nissan IDS concept) |

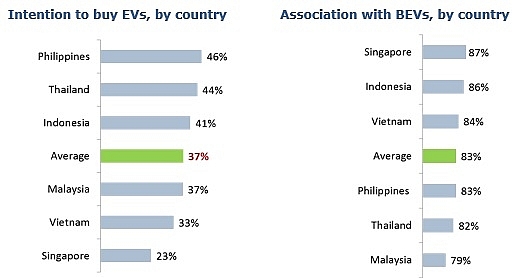

Consumer research in Singapore, Indonesia, Thailand, Malaysia, Vietnam, and the Philippines reveals that 37 per cent of prospective buyers are open to considering an electric vehicle as their next car.

Customers in the Philippines, Thailand, and Indonesia emerged as the most enthusiastic about electric cars.

With the right incentives, the region can accelerate the adoption of electric and electrified vehicles, the study shows.

At the Nissan Futures event, Nissan reiterated its commitment to driving the future of Southeast Asian mobility through its Nissan Intelligent Mobility vision for changing how cars are powered, driven, and integrated with society—with the goal of moving people to a better world.

The Japanese automotive giant announced that the new, 100 per cent electric Nissan LEAF, featuring a suite of advanced technologies showcasing Nissan ingenuity, will go on sale in seven markets in Asia and Oceania during the next fiscal year.

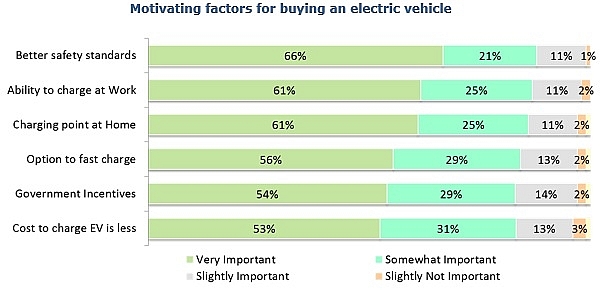

Safety and charging convenience

Across the region, two out of three consumers identified safety standards as the most important factor in purchasing an electric vehicle. Charging convenience was identified as the second-most important. Contrary to common perception, cost was not a deterrent—in fact, customers surveyed were willing to pay more to own an electric vehicle, compared with a comparable conventional car.

However, the study showed that lower costs would prompt more people to consider electric cars. Three in four respondents said they were ready to switch to electric vehicles if taxes were waived.

Other incentives that would sway consumers include the installation of charging stations in apartment buildings (70 per cent), priority lanes for electric vehicles (56 per cent), and free parking (53 per cent).

|

Significant association with electric vehicle technologies

Electric car ownership in Southeast Asia is still relatively low. Nonetheless, the survey shows that consumers are aware of differences among technologies such as battery electric vehicles (BEVs), plug-in hybrids, and Nissan’s e-POWER vehicles.

The highest association of electric vehicles is for BEVs at 83 per cent. Singapore, Indonesia, and Vietnam are most evolved in their understanding of BEVs. A significant presence of full hybrids in Malaysia and Thailand skews association of electric vehicles with hybrids.

|

Removing adoption barriers

While potential demand for electric vehicles is significant, adoption barriers remain, including a lack of knowledge. Range anxiety—the fear of running out of power—is the main barrier. Customers are also unsure about safety standards for electric vehicles.

“Leapfrogging in the electrification of mobility requires strong collaboration between public and private parties and a long-term approach tailored to each market’s unique situation,” Yutaka Sanada, regional senior vice president at Nissan, said at Nissan Futures. “Consumers in Southeast Asia have indicated that governments have a critical role to play in the promotion of electric vehicles.”

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Related Contents

Latest News

More News

- Long Thanh International Airport welcomes first Vietnam Airlines test flight (December 15, 2025 | 18:01)

- Foreign fruits flood Vietnamese market (December 09, 2025 | 13:22)

- Vietnam’s fruit and vegetable exports reach $7.8 billion in first 11 months (December 05, 2025 | 13:50)

- Vietnam shapes next-generation carbon market (November 26, 2025 | 15:33)

- PM urges Ho Chi Minh City to innovate and remain Vietnam’s economic locomotive (November 26, 2025 | 15:29)

- Experts chart Vietnam's digital finance path: high hopes, high stakes (November 14, 2025 | 10:56)

- Vietnam’s seafood imports surge 30 per cent in first 10 months (November 10, 2025 | 19:35)

- Vietnam’s durian exports hit $1 billion milestone (October 30, 2025 | 17:41)

- Beyond borders: Sunhouse and new era of Vietnamese brands on Amazon (October 28, 2025 | 10:46)

- Record-breaking trade fair set to open in Hanoi (October 15, 2025 | 15:59)

Tag:

Tag:

Mobile Version

Mobile Version