New opportunities abound for Singaporean telecoms

How have digital transformation trends around the world been affecting business and investment trends among Singaporean technology companies?

|

| George Choo, president of the Association of Telecommunications and Technology Industry of Singapore |

With the trend of business processes and solutions moving towards a more digital economy direction, we have attracted more companies to become members and this has risen to about 100 corporate members, including telecommunications and ICT network infrastructure companies from Singapore.

Some of the companies with the association are small- and medium-sized companies doing project works for ICT-related network cabling. There are three big telecoms groups in Singapore, namely SingTel, StarHub, and M1.

When we liberalised the telecommunication market, other players emerged such as Simba, Circle.life, and others. There are also a number of global telecom companies headquartered in Singapore such as Telecom Malaysia, British Telecom, and Telstra.

In the digitalisation trend, we started to use fintech, the Internet of Things, finance/banking, and data collection. It is growing faster, especially data centres because when you use apps on mobile devices, and banks get e-payments through fintech, you need data flow.

When you use more mobile devices as an effect from 4G to 5G, the flow of information and data is of a bigger size. So it means that data centres will keep growing.

I can foresee that in the next 5-10 years we’ll be continuing the journey even faster because of this adoption. We can see that there is another phase of accelerated growth for us. We can see that there is another phase of accelerated growth for us in the coming years for the 6G era.

Do you see strong prospects for Singaporean telecoms groups or investors in the Vietnamese market, especially when data centres are being made a priority?

There are numerous good opportunities in Vietnam, as the country has a useful geographic location and a huge potential domestic market.

Singapore does not have companies like Samsung of South Korea, but it has companies that can do subcontract manufacturing or equipment suppliers for related industries. Now we are in the days of the cloud, data centres, and edge computing. Thus, more opportunities are coming. When you put things on the cloud side, you actually need high-end and better devices to meet the need.

Vietnam has a strong strategy for the development of data centres and there are various companies possibly exploring the opportunities of doing business and investment in data centres in Vietnam.

However, there are challenges in Vietnam as well in power generation and skill workforce. Also, the government policy on digitalisation and information communications need to be adjusted to attract foreign investment.

How can the Singaporean government and your association support member companies to expand globally, including Vietnam?

Many ongoing business activities will be held and will become more active not only in Vietnam and Singapore, but also in the region. We participate in trade shows and other events in the industry.

One of them will be the Vietnam Business Exchange Summit in November in Ho Chi Minh City. This is to facilitate business exchanges between Vietnamese and Singapore companies, with technology to be among the key sectors of interest.

I see growing competition as many businesses in different areas are coming in to tap into more opportunities in Vietnam.

As part of activities to support our member companies, in August we came to Vietnam to better understand industry development in Vietnam, players who are interested in and also look at different issues, as well as what national policies are there to encourage them. We also learned about cybersecurity to protect data because this is in the country’s interest.

The Vietnamese government has its own policy because it needs to definitely protect companies here. Given that the country wants to engage in more investment to help the industry move to a higher level of tech and sustainability, Vietnam needs to let investors better understand the business climate and policy by giving them sufficient guidelines.

In addition, better co-ordinations among different government agencies need to be looked into to facilitate a higher quality of foreign investment.

| Singapore to have new President Tharman Shanmugaratnam will become the ninth President of Singapore after winning 70.4 per cent of votes in the September 1 election. |

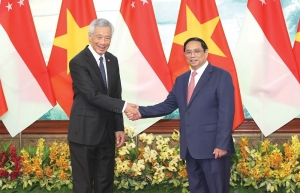

| Interest rises for Singapore’s businesses Vietnam and Singapore have upgraded their bilateral connectivity framework agreement to include new areas, making it more favourable for businesses of both nations to intensify trade and investment ties. |

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Related Contents

Latest News

More News

- SK Innovation-led consortium wins $2.3 billion LNG project in Nghe An (February 25, 2026 | 07:56)

- THACO opens $70 million manufacturing complex in Danang (February 25, 2026 | 07:54)

- Phu Quoc International Airport expansion approved to meet rising demand (February 24, 2026 | 10:00)

- Bac Giang International Logistics Centre faces land clearance barrier (February 24, 2026 | 08:00)

- Bright prospects abound in European investment (February 19, 2026 | 20:27)

- Internal strengths attest to commitment to progress (February 19, 2026 | 20:13)

- Vietnam, New Zealand seek level-up in ties (February 19, 2026 | 18:06)

- Untapped potential in relations with Indonesia (February 19, 2026 | 17:56)

- German strengths match Vietnamese aspirations (February 19, 2026 | 17:40)

- Kim Long Motor and AOJ Suzhou enter strategic partnership (February 16, 2026 | 13:27)

Tag:

Tag:

Mobile Version

Mobile Version