MES scene growing in colour and hue

|

Market expansion services (MES) help goods and services, especially new products, to penetrate target markets deeper and help manufacturers capture the share they desire in the shortest time, through compilation of studies, logistics, distribution, and after-sales service strategies.

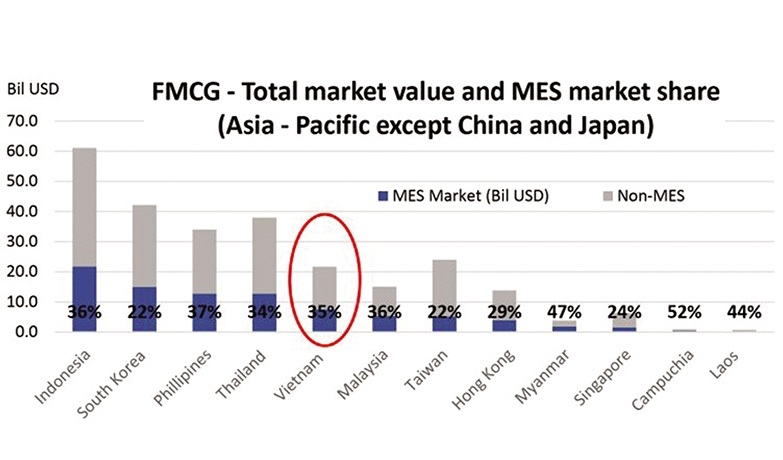

According to a report from Germany’s Roland Berger, which is Europe’s biggest management consultancy, the scale of MES in the fast-moving consumer goods (FMCG) sector in Asia is estimated at $272.6 billion. China, Japan, and Indonesia are the largest subscribers to MES services.

While Vietnam has yet to make it into the top three, the value of MES in the local FMCG sector was $7.5 billion in 2016, accounting for 35 per cent of the total valuation of the sector. The figure is expected to increase at an annual average of 10.9 per cent in 2016-2021 to $12.6 billion, according to Roland Berger.

In the healthcare sector, opportunities for MES providers may be even more attractive as Vietnam and Myanmar are currently the two leading markets in Southeast Asia in MES use, with about 77 per cent of healthcare enterprises using such services. Meanwhile, the figure in South Korea and Japan is 60-65 per cent.

Demand for MES is continuously increasing because corporates are focusing more on core competences, and supply chain efficiency is becoming more crucial due to mounting competitive pressure. Moreover, economic, social, and political fluctuations combined with the complex network of free trade agreements in the Asia-Pacific turn even more firms to MES.

In Vietnam, complex regulatory and legal systems are some of foreign investors’ biggest headache. The rules of the game, complex as they are, can be subject to change at any time, making it difficult to strategise. Even established companies may find this a challenge, let alone those who are just planning their entry.

Manufacturers of consumer goods, pharmaceutical products, specialty chemicals, and engineered products are all relying on MES providers to enter new markets or expand in existing ones quickly, successfully, and with limited risk.

Cost savings are a welcome spin-off as companies penetrating new markets often face soaring costs to overcome entry barriers. The local networks and on-the-ground experience of professional MES partners can help companies avoid fixed overheads while enhancing efficiencies.

“While small- and medium-sized enterprises often look for market knowledge, experience, and resources, multinationals and large corporations are increasingly seeking partners with a superior local network to drive growth and efficiency gains for such dynamic, emerging countries in Southeast Asia like Vietnam,” said Jorge Martin-Martinez, head of country management at MES provider DKSH Vietnam. “MES help companies find their way through the labyrinth of Vietnam’s practices and conditions when they first enter the market or plan to expand their business here.”

Almost all enterprises in the Vietnamese FMCG and healthcare sectors rely on the support of MES to improve distribution, despite them having dedicated teams and large funding going into sales and customer care activities.

Global expertise

There are several multi-national corporations providing MES in Vietnam. In FMCG, 3A Distribution, Mesa Group, and DKSH are the biggest names, while Zuellig Pharma, DKSH, and MEGA Lifesciences are the leading distributors in the healthcare sector.

A market leader in both areas, DKSH provides a full portfolio of services from sourcing, market analysis and research, and marketing and sales through distribution and logistics to after-sales services to the biggest corporations like Vingroup, P&G, and Nestlé.

“It is key to note the integrated nature of the service offering and make a distinction to trading houses and single service providers,” Martinez added.

DKSH is the link between manufacturers, brand owners and customers by operating the value chain and serving as the customer interface. Through daily interactions, DKSH provides clients with key marketing insights from customers in 800 business locations throughout Asia.

DKSH’s integrated approach allows clients to reduce both complexities and co-ordination costs, allowing a speedier entrance and expansion. At the same time, transparency and one-stop shopping ensure a consistent flow of information.

“Unlike traditional outsourcing providers, DKSH helps companies with primary or front-end business processes that involve a substantial level of direct customer contact,” Martinez explained, adding that DKSH is investing heavily in upgrading its facilities and operation processes in Vietnam, a key strategic market. “We also leverage data analytics to gain insights and uncover trends. By doing this, we will take a big step towards digital transformation to adapt to the changing market environment and deliver accelerated growth to our business partners,” he said.

Domestic contender

Meanwhile, as a local company, Digiworld’s offerings are a match to the services of DKSH. A Digiworld representative told VIR, “The company usually provides market reports to our partners to help them research and develop suitable products, and at the same time generates marketing plans to support the business of outlets in all Vietnamese cities and provinces.”

With human resources, warehouse infrastructure, logistics, enterprise resource planning, omnichannel capabilities, and thousands of sales points from electronics stores to supermarkets and pharmacies, Digiworld has been providing MES for 20 years now. It has a stellar track record in product distribution for various technology brands such as Dell, Acer, LG, Obi Worldphone, EATON, Intex, Freetel, and Wiko.

After the plunge into the pharmacy segment via acquisitions, Digiworld is distributing Kingsmen food supplements from Vinamedic, medicine from Unipharma, medical masks from Phu Bao Medical, and Domesco products.

“Digiworld continues expanding its product lineup and partner network, as shown by the recent addition of imported vitamin products for children,” the Digiworld representative said.

Multinational partners might consider DKSH, Mesa Group, Zuellig Pharma as the top choices for their advantage in global scale and value. However, Digiworld is a heavyweight competitor due to its extensive local knowledge which makes it uniquely capable of drafting marketing strategies, not to mention its extensive distribution system across the country.

One of the most outstanding recent achievements of Digiworld was utilising MES to bring Xiaomi’s hi-tech products to Vietnam. Xiaomi was a wholly new brand, unaware of the unique local trends and needs. The company also had no distribution system or a local marketing team, while facing heavy competition from more established rivals. Thanks to Digiworld covering these drawbacks, Xiaomi’s products are now available in most large retail stores in Vietnam.

With the incoming wave of manufacturing facilities transferring to Vietnam, more brands are expected to be present in the country, opening up opportunities for MES providers – and while established global providers are a safe bet, local competition is also worth a look.

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Related Contents

Latest News

More News

- State corporations poised to drive 2026 growth (February 03, 2026 | 13:58)

- Why high-tech talent will define Vietnam’s growth (February 02, 2026 | 10:47)

- FMCG resilience amid varying storms (February 02, 2026 | 10:00)

- Customs reforms strengthen business confidence, support trade growth (February 01, 2026 | 08:20)

- Vietnam and US to launch sixth trade negotiation round (January 30, 2026 | 15:19)

- Digital publishing emerges as key growth driver in Vietnam (January 30, 2026 | 10:59)

- EVN signs key contract for Tri An hydropower expansion (January 30, 2026 | 10:57)

- Vietnam to lead trade growth in ASEAN (January 29, 2026 | 15:08)

- Carlsberg Vietnam delivers Lunar New Year support in central region (January 28, 2026 | 17:19)

- TikTok penalised $35,000 in Vietnam for consumer protection violations (January 28, 2026 | 17:15)

Tag:

Tag:

Mobile Version

Mobile Version