Key localities stepping up industrial real estate moves

Germany-invested Framas Group has rented a 20,000-square-metre ready-built factory in KTG Industrial Nhon Trach 2, in the southern province of Dong Nai. Framas Group specialises in manufacturing high-quality plastic parts with customers including Nike and Adidas. Fabian Urban, director of footwear technology at Framas Vietnam, said that the reason for choosing Vietnam to open a factory is that the facilities are superior to other locations. “The establishment of this new factory is part of the group’s wider strategy to develop the footwear sector in the Vietnamese market,” said Urban.

Meanwhile, Danish jewellery brand Pandora on May 12 signed an MoU to build a new jewellery crafting facility in Vietnam-Singapore Industrial Park III (VSIP) in the southern province of Binh Duong, 40km north of Ho Chi Minh City.

According to Jeerasage Puranasamriddhi, chief supply officer at Pandora Production Co., Ltd., the new factory will be the company’s third manufacturing site and its first outside Thailand.

“We scouted countries all over the world before deciding on Vietnam and Binh Duong province. The nation has a rich craftsmanship history and we will be able to access a large group of craftspeople. Binh Duong and VSIP provide great infrastructure and we are grateful for the support we have received from the local authorities and the VSIP team,” said Puranasamriddhi.

According to statistics from the Ministry of Planning and Investment, Vietnam currently has 575 industrial zones (IZs) established in 61 provinces and cities, mainly concentrated in the key economic regions. Vietnam’s IZ system is the destination of thousands of businesses from 122 countries and territories around the world.

With the government’s incentives, competitive labour costs, stable political environment, positive economic outlook and signed free trade agreements, the north is considered the top choice for manufacturers looking to move out of the Chinese market while maintaining proximity to the main factories operating in the neighbouring country.

|

Nationwide strength

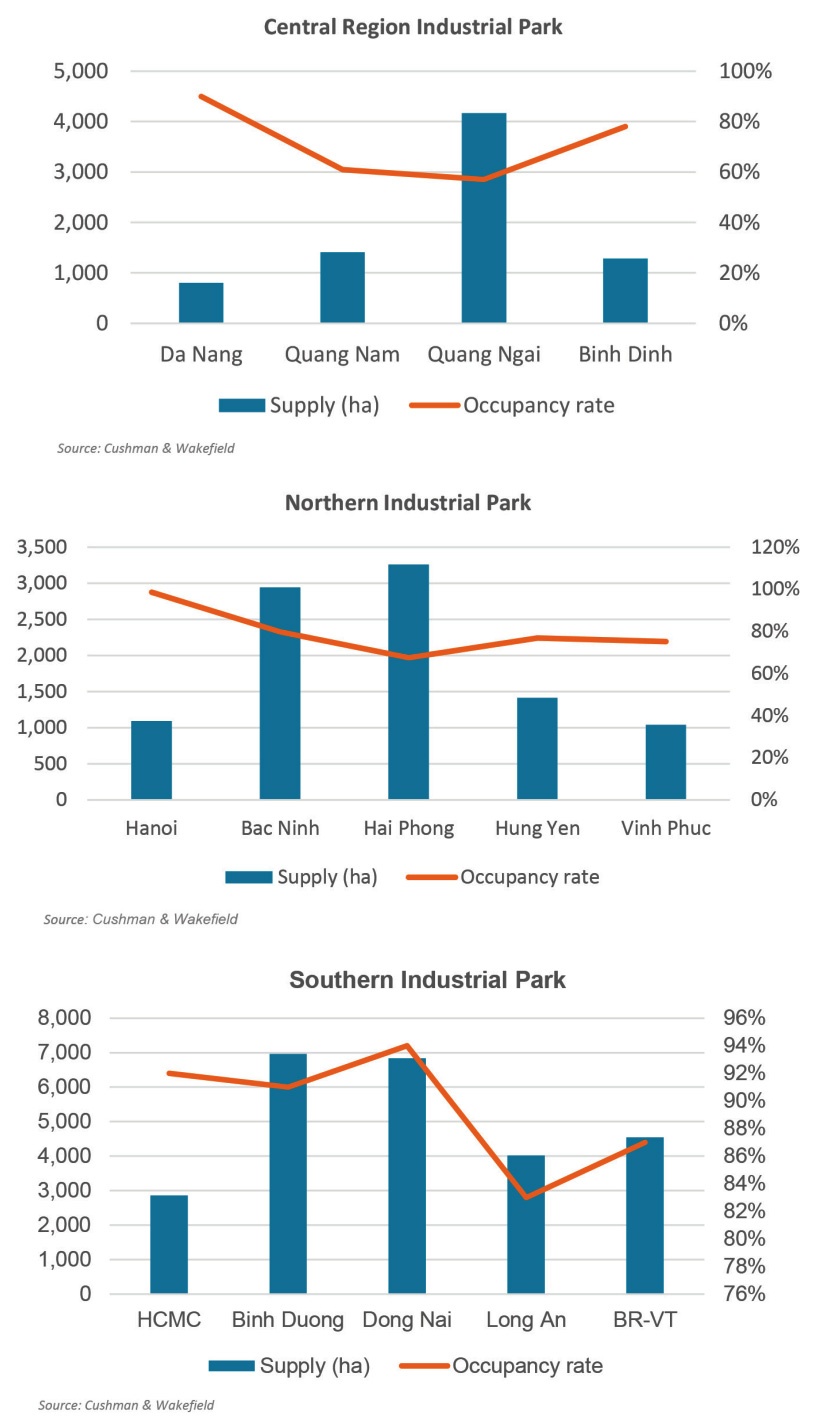

Although developing later than the southern market, the northern industrial provinces have more advantages in attracting advanced high-tech industries, according to the latest report from Cushman & Wakefield Vietnam. Most of the IZ projects in the five key provinces there have been filled in a stable manner, with an average rate of about 80 per cent, with the average rental price in Hanoi being the highest compared to other areas.

The central region of Vietnam meanwhile includes 14 cities and provinces, in which industrial activities are concentrated in Danang and Quang Nam, attracting international developers thanks to its large land bank, competitive prices, and dense seaport system. Most of the IZs operating in the central region are developed by domestic corporations. The total supply of IZs in the four city and provinces of Danang, Quang Nam, Quang Ngai, and Binh Dinh reaches more than 7,500 hectares with an occupancy rate of about 67 per cent. The average rental price in these central areas is still quite affordable, at only around 30 per cent of the rent in the north and 25 per cent in the south.

Danang is emerging as a strong destination attracting a large number of foreign investors. Arevo Inc. from the United States is looking to invest in a 3D printer factory with the total investment of $135 million in Danang Hi-Tech Park. Danang is also home to the $110 million United States Enterprises, which will be a semiconductor manufacturing plant.

Other activities include EPE Packaging Vietnam, funded by a Japanese group at $300,000 in the expanded Hoa Khanh Industrial Park; and Fujikin Danang Research Development and Production Centre, with an investment of $35 million and located in Danang Hi-Tech Park.

The southern region, meanwhile, is still considered the most vibrant economic region in the country. It has always led in growth rate and attractiveness, with a concentration of traditional industries such as rubber and plastic or textile industries. The region is the most preferred destination for new manufacturers entering the Vietnamese market.

The total area of industrial land in five key southern cities and provinces is more than 25,000ha. Ho Chi Minh City takes the lead in rental prices compared to others, reaching as much as twice as high as Binh Duong and Ba Ria-Vung Tau.

Despite being affected by social distancing in 2021, the occupancy rate of the region reached 89 per cent. The demand remains strong with big players like Coca Cola in Phu An Thanh Industrial Park and LEGO in VSIP.

However, according to Bui Trang, general director for Cushman & Wakefield Vietnam, distance and transport time are key factors in making investment decisions.

“The relatively long geographical distance from China does make the southern area less attractive for some investors looking to make the move. This poses an urgent need for the development of high-quality infrastructure in the south to enhance competitiveness compared to other economic regions,” said Trang.

|

Specialised products

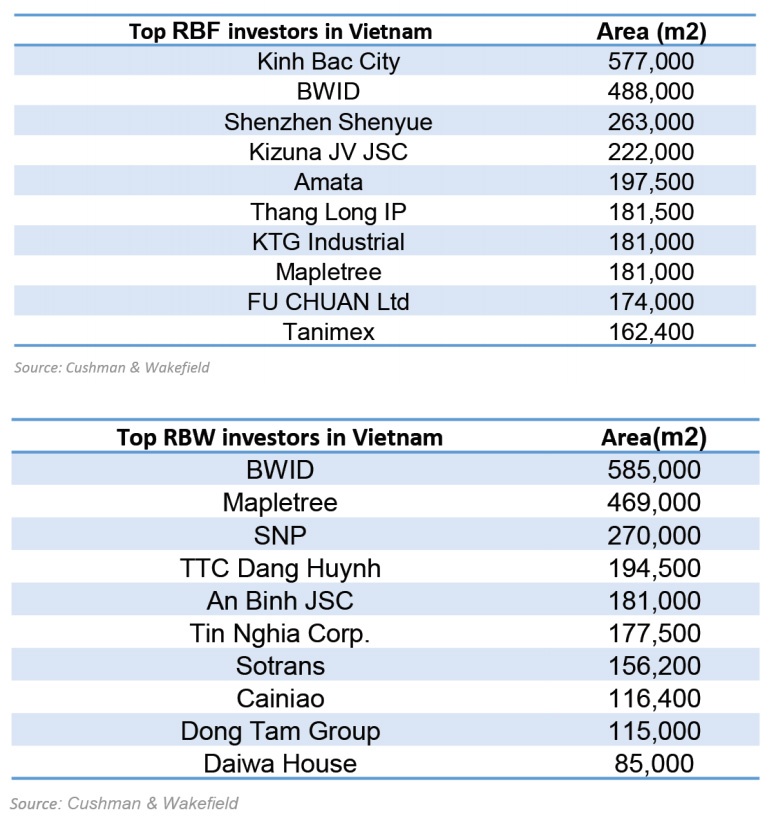

The supply of ready-built factories (RBFs) in all key cities and provinces has reached around 6.2 million sq.m, with an occupancy rate of about 79 per cent. The supply is mainly developed by domestic investors, and some foreign investors from the US, Singapore, and Japan. Outstanding projects completed in the past year include the Kizuna high-rise factory in Long An at more than 50,000sq.m, and Frasers Property in Binh Duong, with about 40,000sq.m of new supply. The RBF market continues to operate effectively. In Q1, the average rent of RBF returned to pre-pandemic levels of about $4 per sq.m per month, and has grown by nearly 5 per cent on-year.

As of the first quarter, the supply of ready-built warehouses (RBWs) in 14 cities and provinces across the country reached more than 5.2 million sq.m, with the occupancy rate reaching about 90 per cent. Due to the demand for warehouses arising from supply chain disruptions last year, the average rent of RBWs has witnessed positive growth. In the first quarter of 2022, the average rental price hit $3.40 per sq.m per month.

Meanwhile, over the last three years, major cities in Vietnam have witnessed growth in the demand for fast 24-hour delivery, which has in turn driven the need for warehouses located closer to residential areas. These warehouses can be small but must be close to the end consumer and located in multiple locations in the city, and high demand makes a supply with good locations scarce.

The flexible industrial space market is a relatively new offering, and most companies are doing more research. This model could help reduce damage to the supply chain in unpredictable situations and help the process of getting goods to customers become more seamless.

“The sharing and flexible economy is now quite popular in Vietnam. The proof is the success of the coworking office model over the years. We believe that this ready-built warehouse sharing model will also be received positively by the market,” said Trang of Cushman & Wakefield.

With the boom of the e-commerce industry in recent years, many domestic and foreign investors are also still constantly looking for quality logistics properties to meet the increasing demand for related growth.

The logistics market will grow greatly in the next 5-10 years, according to Trang. The strong growth of the middle-class population with rising disposable income, and the strong pervasiveness of e-commerce today, will be the demand sources driving the development of the logistics market.

“We expect that the industrial sector will continue to be the most attractive one in 2022 and foreign investor interest in Vietnam will continue to be strong,” said Trang.

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Tag:

Tag:

Related Contents

Latest News

More News

- Sembcorp Development secures licence for VSIP in Khanh Hoa (December 31, 2025 | 18:54)

- Prodezi Long An advances towards integrated eco-centric industrial park model (December 26, 2025 | 11:16)

- Amata to develop $185 million Amata City Phu Tho (December 23, 2025 | 17:49)

- Work starts on Nhat Ban – Haiphong Industrial Zone Phase 2 (December 19, 2025 | 16:43)

- Becamex – Binh Phuoc drives sustainable industrial growth (November 28, 2025 | 15:22)

- South Korean investors seek clarity on IP lease extensions (November 24, 2025 | 17:48)

- CEO shares insights on Phu My 3 IP’s journey to green industrial growth (November 17, 2025 | 11:53)

- Business leaders give their views on ESG compliance in industrial parks (November 15, 2025 | 09:00)

- Industrial parks pivot to sustainable models amid rising ESG demands (November 14, 2025 | 11:00)

- Amata plans industrial park in Ho Chi Minh City (November 04, 2025 | 15:49)

Mobile Version

Mobile Version