Key advantages still front of mind for American investors

|

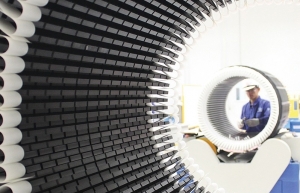

| US groups want to expand investing in digital transformation, healthcare, AI, finance, and lots more, photo Le Toan |

Powerful US groups gathered the Innovation and Private Capital Summit organised in late April in Hanoi to discuss fresh business opportunities.

Disclosing the company’s strategy for Vietnam, Nvidia vice president Steven Truong said, “Our goals are to focus on strategic spearheads for the country, including smart manufacturing, smart transport to deal with traffic jams, and healthcare. As Vietnam attracts many world-class manufacturing enterprises such as Samsung, Apple and others, the successful development of smart factories is extremely important.”

In late 2024, Nvidia announced that it will open a research and development centre and an AI data centre, expanding employment prospects for locals.

“There will be hundreds or thousands of companies in the near future that will succeed as quickly as the likes of VinBrain. This is the aspiration and dream not only of myself but also of the entire Nvidia Vietnam team,” Truong added.

At the event, Hiren Krishnani, investor relations director for Corporate Platforms at American stock exchange Nasdaq, also looked into working with Vietnamese firms.

“There are clear benefits to Vietnamese companies or Southeast Asian companies doing business in the United States. One of the biggest factors is valuation and liquidity. Being listed on our exchange can bring together analysts and big companies, so there are a lot of benefits when joining the world’s largest capital market.”

Warburg Pincus is also building new plans in Vietnam, according to CEO Jeffrey David Perlman. “The success of projects in Vietnam, including Ho Tram in Ba Ria-Vung Tau and the Metropole Hotel in Hanoi, will be symbols of success in cooperation between the two countries. The fund’s leaders and I will continue to support and advise Vietnamese ministries and sectors on tariff solutions that benefit the people and businesses of the two countries,” he said.

Warburg Pincus boasts over $80 billion worth of assets under its management. Since 2013, it has invested more than $2 billion in Vietnam, creating more than 40,000 jobs.

According to investors, there are several key factors driving their ambitions in the local market. They include the young workforce with an average age lower than the US and Europe, a strong network of more than five million overseas Vietnamese living and working abroad, and the nation’s STEM education capabilities.

“Assuming we can attract only 0.1 per cent of the five million overseas nationals, Vietnam could have 5,000 people returning to develop an entire ecosystem of resources with young people in the country,” said Truong of Nvidia.

Some of the most well-known American players have been to Vietnam to study or expand projects here. In March, the biggest-ever delegation of 60 US companies sought new investment opportunities, including Pacifico Energy, Meta, Boeing, Dow Chemical, Apple, Intel, Coca-Cola, Nike, and Amazon. US businesses are interested in making investment and expansion in green and digital transformation, energy, semiconductors, AI, aviation, finance, telecoms, healthcare, food processing, consumer goods manufacturing, and more.

The International Monetary Fund on April 22 predicted that the global economy would slow down sharply this year, due to the impact of US tariff policy, along with a wave of global instability. It forecast global growth will slow to 2.8 per cent this year, half a percentage point lower than their January forecast.

In an effort to ease the negative impacts, Prime Minister Pham Minh Chinh on April 22 chaired a meeting with relevant ministries and agencies on preparing for negotiations, promoting balanced, stable, and sustainable trade relations with the US.

Dr. Phung Duc Tung, director of the Mekong Development Research Institute, said that investment inflows from the US may shift to other countries in Asia.

“Vietnam needs to negotiate tariffs at a level that can compete with countries in the Southeast Asian region and India. That will be the premise for attracting foreign investment,” Tung said.

| US investors keen on Vietnam’s rapid rise American investors are ramping up their interest in Vietnam in order to mitigate the risks of the ongoing US-China trade dispute, as well as capitalise on one of the fastest-growing economies in the ASEAN bloc. Thanh Van and Bich Ngoc report. |

| American groups make progress across Vietnam Vietnam, as one of the fastest-growing economies in the ASEAN bloc, is becoming more appealing to American investors. |

| American investors eyeing Vietnam's logistics sector With investment opportunities widening in logistics, some US players in the sector have expressed interest in penetrating the Vietnamese market. |

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Tag:

Tag:

Related Contents

Latest News

More News

- Site clearance work launched for Dung Quat refinery upgrade (February 04, 2026 | 18:06)

- Masan High-Tech Materials reports profit: a view from Nui Phao mine (February 04, 2026 | 16:13)

- Hermes joins Long Thanh cargo terminal development (February 04, 2026 | 15:59)

- SCG enhances production and distribution in Vietnam (February 04, 2026 | 08:00)

- UNIVACCO strengthens Asia expansion with Vietnam facility (February 03, 2026 | 08:00)

- Cai Mep Ha Port project wins approval with $1.95bn investment (February 02, 2026 | 16:17)

- Repositioning Vietnam in Asia’s manufacturing race (February 02, 2026 | 16:00)

- Manufacturing growth remains solid in early 2026 (February 02, 2026 | 15:28)

- Navigating venture capital trends across the continent (February 02, 2026 | 14:00)

- Motivations to achieve high growth (February 02, 2026 | 11:00)

Mobile Version

Mobile Version