American groups make progress across Vietnam

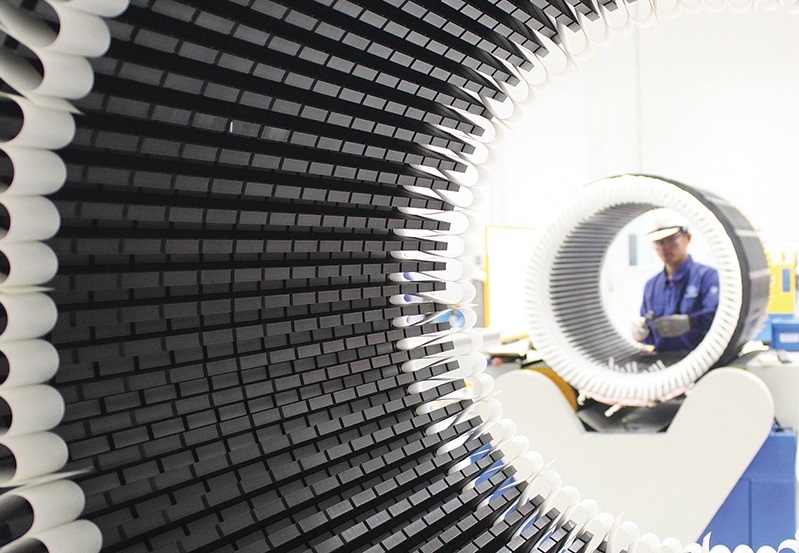

Thanks to the strong ties between the US and Vietnam, both nations can profit from the transfer and usage of tech, know-how, and labour,Photo: Le Toan"> |

| Thanks to the strong ties between the US and Vietnam, both nations can profit from the transfer and usage of tech, know-how, and labour. Photo: Le Toan |

Chad Ovel, who is chairman of AmCham Vietnam in Ho Chi Minh City told VIR, “Growing US investments in Vietnam have shown that the country has recently become one of the most attractive Southeast Asian business environments and economic development destinations.”

One significant factor is Vietnam’s GDP growth of 7.02 per cent last year, and 7.08 per cent in 2018, the highest rate since before the 2008 global financial crisis. With this growth, the country has been able to attract foreign direct investment (FDI) in virtually all sectors, making it an all-rounder for investors from manufacturing, clean energy, aviation, medicine, and pharmaceuticals to real estate, retail, wholesale, and many other vital sectors.

Moreover, with the US-China trade war showing no signs of abating, recent agreements such as the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP) and the EU-Vietnam Free Trade Agreement (EVFTA), inexpensive labour, and a young working population provide a powerful concoction for Vietnam to thrive. Over time, Vietnam has become an ideal investment destination for international groups, including those from the US.

According to the Ministry of Planning and Investment, most of the key business sectors in Vietnam have seen the presence of big US investors, such as oil and gas with ExxonMobil and AES; aviation with Boeing and ADC-HAS; IT with Microsoft, Intel, and HP; electric equipment with General Electric, General Atlantis; and many more.

Ovel cited a study from employment researcher and provider Vietnamworks showing that the country has a highly-educated and industrious workforce. The share of trained workers within working age in 2017 was estimated at 21.5 per cent, higher than 20.6 per cent in 2016. Almost 95 per cent of the labour force is literate, and over 88 per cent were enrolled in secondary school, in which 5 per cent are proficient in English, and over 10 per cent are considered highly skilled.

In addition, Vietnam has a stable currency on the foundation of sustainable credit growth and structural trade surplus. The VND is one of the most stable currencies in Southeast Asia.

Vietnam also has an emerging middle class, estimated to reach 33 million people by end of 2020, with a 91-per-cent home ownership rate, among the highest in Asia.

In light of these favourable indicators, American firms have ramped up business activities in Vietnam. Last week, Qualcomm Vietnam Co., Ltd., a subsidiary of Qualcomm Technologies, Inc., officially opened a new office in Hanoi as well as an Interoperability Testing Laboratory, the company’s first research and development lab in Southeast Asia.

With these new facilities, Qualcomm Technologies further strengthens its commitment to Vietnam and further enables local enterprises to innovate and deliver Vietnamese-made products.

The laboratory will offer state-of-the-art testing capabilities for local partners which include VinSmart, BKAV, and Viettel among others, to develop and produce high-quality devices.

In addition, several of Apple’s manufacturing suppliers, including Wistron Corp., Pegatron, and Inventec, also indicated their plans to diversify production and consider additional manufacturing plants in Vietnam. Most recently, Luxshare Precision Industry, assembler of Apple’s AirPods in Vietnam, began to look for thousands of new workers. Google and Microsoft also expressed intentions to produce Made-in-Vietnam devices within the year, as reported by Nikkei Asian Review.

The trend of large corporations outsourcing operations to reduce expenses and increase market share is nothing new. Two significant changes were the way that companies relocated their factories and the way that countries managed to attract capital inflows. With the government’s accession to the World Trade Organization, competitive costs and receptive investment environment have made Vietnam an ideal location for investors seeking to reduce costs and diversify supply chains.

“By situating the new centres close to traditional hubs in mainland China, investors can reduce costs with minimal interruptions or delays to existing supply chains,” added Ovel of AmCham, adding that Vietnam also stands out in cost reductions on wages, land pricing, and inputs, offering investors a minimum wage 59 per cent of that found in China and 70 per cent of that in Thailand.

Furthermore, Vietnam’s network of trade agreements is among the best that manufacturers will be able to find in a country at this point on the value chain.

The key highlight of US-Vietnam investment and trade relations is the strong will and commitment of both countries to increase their trust and a shared vision of strong economic and political ties.

Evidence of the strong will is the success of the growth in trade, an increase of more than 100 times in 2018 compared to 1995. From 2002 to 2011, a growth rate of 1,200 per cent was achieved, where the total investment of $1.5 billion was recorded in 2011, Vietnam reached more than $20 billion in bilateral trade. The figure stood at $75 billion last year, and $30.7 billion in the first five months of this year. As of May 20, the US had 1,032 valid investment projects in Vietnam, registered at $9.34 billion.

To further bolster economic ties between the two, the United States Agency for International Development (USAID), in collaboration with the Vietnam Chamber of Commerce and Industry (VCCI) and General Department of Vietnam Customs (GDVC), last week launched a report titled “Business Satisfaction and Time Needed to Carry Out Administrative Procedures Through the National Single Window”.

The survey analysis and recommendations from the report are expected to foster substantive reforms of all government ministries which currently process administrative procedures through the National Single Window (NSW) by reducing costs, shortening processing times, and improving overall efficiency.

For the past two years, the USAID Trade Facilitation Program has worked with the GDVC, the VCCI, and other partners on various activities to reduce the time and cost to trade in Vietnam.

The USAID will continue to actively support the Vietnamese government and private sector to undertake reforms and improve the business community’s satisfaction with key trade facilitation tools such as the NSW.

According to the Amcham Vietnam chairman, Vietnam has benefited due to companies moving manufacturing to Vietnam as costs in China started to increase. Vietnam can move up the global value chain by attracting FDI in areas that will facilitate technology transfer, enhance skill sets in the labour market, and improve productivity.

“Going forward, there is a distinct possibility of a bilateral trade agreement being negotiated between Vietnam and the United States, as the Vietnamese government is willing to enter into such negotiations,” Ovel said, adding that some critical sectors for US investors to keep an eye on will be clean energy, aviation, high-tech manufacturing, ICT, waste treatment, and infrastructure.

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Related Contents

Latest News

More News

- VNPAY and NAPAS deepen cooperation on digital payments (February 11, 2026 | 18:21)

- Vietnam financial markets on the rise amid tailwinds (February 11, 2026 | 11:41)

- New tax incentives to benefit startups and SMEs (February 09, 2026 | 17:27)

- VIFC launches aviation finance hub to tap regional market growth (February 06, 2026 | 13:27)

- Vietnam records solid FDI performance in January (February 05, 2026 | 17:11)

- Manufacturing growth remains solid in early 2026 (February 02, 2026 | 15:28)

- EU and Vietnam elevate relations to a comprehensive strategic partnership (January 29, 2026 | 15:22)

- Vietnam to lead trade growth in ASEAN (January 29, 2026 | 15:08)

- Japanese business outlook in Vietnam turns more optimistic (January 28, 2026 | 09:54)

- Foreign leaders extend congratulations to Party General Secretary To Lam (January 25, 2026 | 10:01)

Tag:

Tag:

Mobile Version

Mobile Version