Industrial property to heat up as it takes on neighbours

|

| Industrial property to heat up as it takes on neighbours, Photo Le Toan |

The prospect of reduced profits and the problem of competition in land rental prices are two pressures that threaten the development of the industrial real estate sector in 2024.

Alex Crane, managing director of Knight Frank Vietnam, said that capital values rates of operating assets were experiencing downward pressure due to high financing costs, shorter land use terms, and the availability of comparatively cheaper locations across Asia.

“Capitalisation rates in Vietnam have increased, generally falling within the range of 9-12 per cent, driven by a surplus of new, high-quality ready-built factories (RBF) and ready-built warehousing (RBW) nationwide. This market correction is reminiscent of the first-generation cycle witnessed in the office sector about 15 years ago,” Crane said.

Despite multiple free trade agreements, rising labour and construction costs are eroding Vietnam’s cost advantage. “While industrial and manufacturing property in Vietnam will continue to be a significant segment, attracting new manufacturers and filling RBFs will present challenges in 2024,” Crane said.

Crane acknowledged the challenges posed by this development boom, particularly in the greater Ho Chi Minh City area, creating an occupier market with rental pressures averaging at $4.50 and $4.70 per sq.m monthly for the south and north, respectively.

“While this trend was anticipated, it doesn’t inherently pose a risk to the market; it simply keeps costs competitive for occupiers in the near term as the market matures and scales up to compete regionally, particularly against Thailand,” Crane said.

The year, impacts will come from the introduction of a global minimum tax (GMT) and higher logistics costs on attracting new manufacturers to Vietnam. Independent economist Lam Pham said this may somewhat impact the overall growth momentum of the industrial real estate segment.

“Preferential policies after the imposition of the GMT will have a strong impact on our business. At the same time, this will also be a factor that significantly affects the calculations of foreign businesses when expanding or pouring new capital into Vietnam,” Lam said.

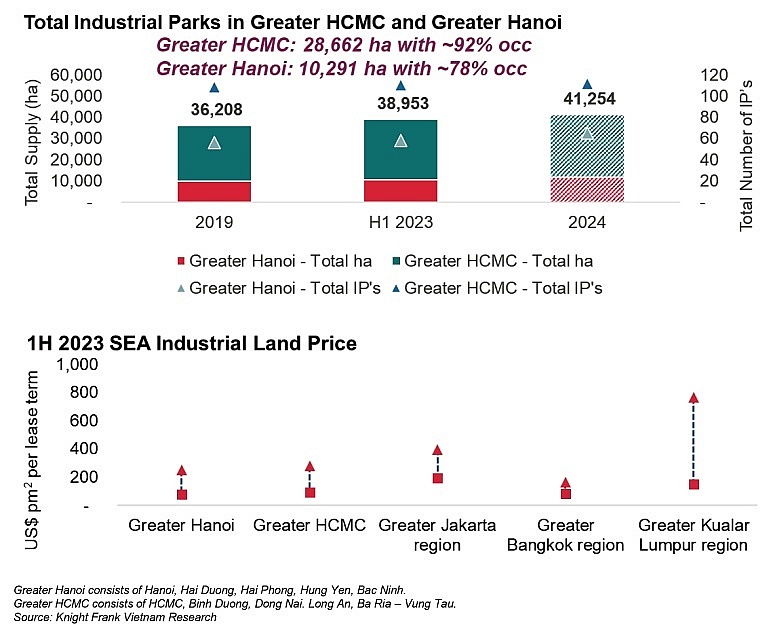

Industrial park occupancy rates in the major economic clusters of greater Hanoi and Ho Chi Minh City stood at a healthy 78 and 92 per cent, respectively, in 2023.

Incoming trends

Meanwhile, the RBF/RBW segment is developing rapidly. The field has strongly attracted foreign investment since 2018, with the number of investors quadrupling. In the suburbs of Ho Chi Minh City alone, the supply of RBWs reached 2.1 million sq.m, contributing to creating a market that favours tenants.

In just the last three months of the year, the southern region welcomed more than 460,000 sq.m of RBWs developed by BWID, LOGOS, Emergent Capital Partners, and Cainiao.

Vietnam’s industrial real estate market will be shaped by two main shifting trends: the spread of investment capital flows to localities and explosive demand for multi-use RBF/RBWs.

Nguyen Van Khoi, chairman of the Vietnam Real Estate Association, said that in the context of the risk of shortage of existing industrial park real estate supply in Hanoi and Ho Chi Minh City, the interest of foreign investors in such markets is increasing.

“These are the driving forces behind a series of projects landing in the provinces of Ba Ria-Vung Tau and Binh Phuoc in the south, Thanh Hoa and Nghe An in the central region, and Haiphong, Hung Yen, and Vinh Phuc in the north,” Khoi said.

Those tier 2 markets are offering more affordable rentals thanks to abundant land available for rent.

“Notably, the ability to connect traffic between tier 2 and tier 1 markets is increasingly improving with the formation of motorway systems, ports and airports. In addition, labour costs in the secondary market are also significantly lower than in the primary market,” Khoi said.

Vu Cuong Quyet, general director of Dat Xanh Mien Bac, said that with coming the strong development of ecommerce, the demand for multi-use RBF/RBWs will explode. “In particular, multi-storey and multipurpose warehouses of 7-8 floors will replace single warehouses,” Quyet said.

The Vietnam E-Commerce Association said that Vietnam’s e-commerce revenue was estimated to reach $39 billion by 2026. For every $1 billion in e-commerce sales, nearly 93,000 sq.m of specialised warehouse space will be needed to increase storage volume and speed of goods transportation.

From there, it is expected that Vietnam will need more than 2.2 million sq.m of warehouse space dedicated to e-commerce by 2026, the association predicted.

|

Emerging segments

Vietnam has also committed to spending and investing in infrastructure, and being among the strongest in the region. The data centre market is also poised for transformation, depending on the easing of regulatory barriers and electricity infrastructure.

According to Savills Vietnam, Vietnam’s data centre market is among the fastest growing in the world. Today, the country has 28 data centre projects with a total capacity of 45 MW, from 44 service providers.

Currently, most companies participating in Vietnam’s data centres segment are domestic telecommunications companies such as Viettel IDC, NTT Global Data Centres, FPT Telecom, CMC, HTC Telecom International, and Vietnam Posts and Telecommunications Group (VNPT).

According to VNPT, the data centre market in Vietnam is ready for a period of stable growth, and is expected to reach just over $1 billion by 2025, a significant increase compared to more than $560 million recorded in 2022. Vietnam currently has around 80 million internet users in 2023, an increase of 8 per cent compared to 2022.

Meanwhile, cold storage is a highly attractive market for businesses. The cold storage market is growing and is expected to reach a value of $295 million by 2025, with a growth rate of about 12 per cent per year, according to the Food and Foodstuff Association of Ho Chi Minh City.

In the short term, the growth of e-commerce platforms and online shopping habits will lead to increasing pressure on the cold storage market, especially as the national average cold storage occupancy rate reached more than 88 per cent by mid-2023, with large markets such as Ho Chi Minh City, and the provinces of Binh Duong, Long An, and Bac Ninh fluctuating at more than 90 per cent, this association added.

| Vietnam's industrial property needs to keep up with new investment wave As a new wave of foreign funds flows into Vietnam, the nation's industrial property segment needs to adapt to satisfy the demand. |

| Industrial real estate witnesses robust growth in Q3 Vietnam's industrial real estate sector has shown remarkable signs of growth in the third quarter of 2023, with substantial new project launches contributing significantly to the market. |

| More investment expected within industrial property Industrial property has been one of the hottest segments for mergers and acquisitions over the last two years. Bich Ngoc spoke with Marco Forster, head of ASEAN Advisory at Dezan Shira & Associates, on his assessment of the sector. |

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Related Contents

Latest News

More News

- More than $40 billion investment recorded in Asia-Pacific commercial real estate (February 18, 2026 | 19:58)

- Keppel co-hosts Home Hanoi Xuan festival in Hanoi (February 14, 2026 | 09:00)

- Saigon Centre gains LEED platinum and gold certifications (February 12, 2026 | 16:37)

- Construction firms poised for growth on public investment and capital market support (February 11, 2026 | 11:38)

- Mitsubishi acquires Thuan An 1 residential development from PDR (February 09, 2026 | 08:00)

- Frasers Property and GELEX Infrastructure propose new joint venture (February 07, 2026 | 15:00)

- Sun Group led consortium selected as investor for new urban area (February 06, 2026 | 15:20)

- Vietnam breaks into Top 10 countries and regions for LEED outside the US (February 05, 2026 | 17:56)

- Fairmont opens first Vietnam property in Hanoi (February 04, 2026 | 16:09)

- Real estate investment trusts pivotal for long-term success (February 02, 2026 | 11:09)

Tag:

Tag:

Mobile Version

Mobile Version