IFC investing in Vietnam to help settle banking issues

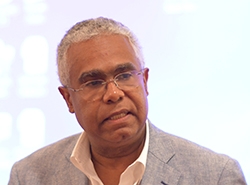

Serge Devieux, IFC Director of Financial Markets Asia shares with VIR’s Ngoc Linh how the corporation will support Vietnam.

Serge Devieux, IFC Director of Financial Markets Asia shares with VIR’s Ngoc Linh how the corporation will support Vietnam.

The Vietnam’s banking sector is in the process of restructuring. As an investor, how do you view the current situation of the banking sector in Vietnam?

We don’t see the Vietnam’s banking system is different from other countries where we are working in. We deal with many financial institutions worldwide, more than 150 countries, which means we have seen lots of issues in many financial institutions and financial systems.

What we do is helping support the systems with investment and advisory. So for us, banking system in Vietnam is following a natural evolution.

What we see is Vietnam has an economy which is growing very fast and Vietnam has a lot of portfolios of investment as well. This is the country in transition and the state-owned sector is still important, both from the enterprise side and also the banking sector side as the country has quite a few state-owned banks. What will happen is that there will be some consolidations as there are currently too many banks in the system.

There will be strengthening of regulations, so we are expecting that accounting norms, transparency, disclosure and recognization of non-performing loans (NPLs) will improve. NPLs have to be cleaned up from the system. What you will see is the creation of mechanisms that we can solve NPLs in the system. It is not a process of one day, one month or one year, it will be taking some time.

We are glad that government has made the very important first steps in recognizing the need for banking sector reforms, such as doing stress testing and categorizing of the banks, but this is the start and more needs to be done quickly and decisively to resolve the situation and strengthen the banking sector. What we have learned in similar situations from around the world is to take decisive actions and to really address the issues upfront will certainly help.

Experience from other countries, most recently and particularly in Eastern Europe where the NPLs from the global crisis were really severe was to focus on insolvency and debt resolution framework, which is certainly critical in addressing some of the NPL and bad asset problems. I think that is the area that could be helpful in Vietnam. Secondly, at the financial institution and bank level, it is critical to look at corporate governance and risk management improvements. Certainly also here there are some opportunities for Vietnamese banks in doing those things. Last but not least, to look at recapitalization and consolidation, and requirement of new capital.

Where do you think Vietnam should start to solve this problem?

Vietnam should start with the recognization of NPLs using the universal methodology that most banking systems and supervisors do to recognize NPLs. And once they are recognized, look at the impact on the capital of the banks because once you have NPLs you have provision for them. As you start provisioning, the capital is going to decrease. If the capital decreases to a level where the bank is in danger in terms of sovereignty, that means you need to do a number of things, you need to restructure NPLs, you need to separate NPLs from the balance sheet of the banks and in certain cases, you need to recapitalize the banks.

At the national level Vietnam also wants to improve legal and regulatory framework for resolving insolvency. If you take international benchmark, for example in Doing Business Report, Vietnam currently stands at 149 out of 189 economies in terms of insolvency, so there is room for improving here, which also helps to overcome the process of restructuring the banking sector.

Our five decades working across the continents with economies similar to Vietnam show the most important lesson learnt is to take the full steps of reforms and act decisively but not just starting and then never ending the process.

IFC has invested in many banks in Vietnam, so how has IFC helped these banks to deal with NPLs?

We have very strict rules to evaluate the banks. We do due diligence and appraisal and by applying specific norms we can help the banks identify the NPLs and recognize where their problems are. When we invest in a bank, we help the banks identify and quantify NPLs. When we invest equity in banks, we become the board members and we also work with the banks to improve risk management systems.

Recently, many investors are getting concerned about the cross-ownership in the banking sector. So what do you think about the cross-ownership in Vietnam? Is it at a dangerous level?

I think the cross-ownership in Vietnam is not particularly and specifically to Vietnam, because it has happened in other systems and it has been cleaned up. So this is something that can be dealt with and something that should not be expanded. It should be contained. It is not in danger now, but I do think this is an important step to prepare situation for investment. So we’ve seen in many places, this is the consequence of many different things. But one of the biggest problems we see is lack of management.

In the long term, what are the consequences of cross-ownership?

In the long term it will affect investors’ perception. We look into investing in an environment with the clarity of rules, transparency and good macroeconomic management. The better governance can be exercised, the more we can apply transparency, the more trust you can generate so that investors continue bringing capital to Vietnam.

How will IFC help Vietnam to deal with cross-ownership in the banking sector?

We are investors. We invested in VietinBank. In the past we invested in ACB and Sacombank. And we are willing to continue investing in Vietnam. We are the long term investors. That means we are concerned but this is not preventing us from really looking at fundamentally sound investment opportunities in the country.

By investing and helping introducing good rules of governance, transparency and disclosure, we can contribute to improving our clients’ performance, and help improve business environment as well. There’s no doubt that efforts have to come from the authority, and this is a cooperation process, where we trust we can help with our global expertise and experience.

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Related Contents

Latest News

More News

- Cashless payments hit 28 times GDP in 2025 (February 04, 2026 | 18:09)

- SSIAM and DBJ launch Japan Vietnam Capital Fund (February 04, 2026 | 15:57)

- Banks target stronger profits, credit growth in 2026 (February 04, 2026 | 15:43)

- Vietnam on path to investment-grade rating (February 03, 2026 | 13:07)

- Consumer finance sector posts sharp profit growth (February 03, 2026 | 13:05)

- Insurance market building the next chapter of protection (February 02, 2026 | 11:16)

- NAB Innovation Centre underscores Vietnam’s appeal for tech investment (January 30, 2026 | 11:16)

- Vietnam strengthens public debt management with World Bank and IMF (January 30, 2026 | 11:00)

- Corporate bond market poised for stronger growth cycle (January 28, 2026 | 17:13)

- Vietnam's IPO market on recovery trajectory (January 28, 2026 | 17:04)

Tag:

Tag:

Mobile Version

Mobile Version