HSBC mulls sale of Canada unit

"We are currently reviewing our strategic options with respect to our wholly owned subsidiary in Canada," the London-based lender said in a statement.

|

| HSBC mulls sale of Canada unit, Source: HSBC |

"Amongst the options being explored is a potential sale of HSBC Group's 100-percent equity stake in HSBC Bank Canada."

The division is worth around $9.0 billion, according to the Financial Times.

"HSBC Bank Canada is a very strong business and Canada's leading international bank," the company added.

The news comes as the HSBC faces calls from its largest shareholder, China's Ping An Insurance, to separate Asian and Western operations.

Ping An, which has a 9.2-percent stake, reportedly wants it to spin off Asian activities to unlock shareholder value amid tensions between China and the West.

However, HSBC has hinted that it wants to retain its current structure, while continuing a pivot to Asia.

HSBC in August posted rising first-half net profit and appeared to rebuff Ping An's calls.

Profit after tax rose 14 percent to US$8.3 billion in the reporting period.

It also outlined plans to return to quarterly dividends next year.

The lender was among a number of major banks to cancel dividends early in the pandemic after a de facto order from the Bank of England -- a move that upset some Hong Kong investors.

| HSBC H1 pre-tax profit falls, dismisses calls for split HSBC bank on Monday said pre-tax profit fell in the first half, and appeared to rebuff calls to spin off its Asian activities on the eve of a key shareholder meeting. |

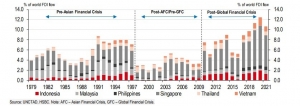

| HSBC’s fresh report lauds ASEAN's resilient export story On September 20, HSBC released a fresh report depicting ASEAN’s exports for the year to date which underlines the bloc’s resident export performance, largely thanks to an extended tech cycle and high commodity prices. |

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Tag:

Tag:

Related Contents

Latest News

More News

- Vietnam sets ambitious dairy growth targets (February 24, 2026 | 18:00)

- Masan Consumer names new deputy CEO to drive foods and beverages growth (February 23, 2026 | 20:52)

- Myriad risks ahead, but ones Vietnam can confront (February 20, 2026 | 15:02)

- Vietnam making the leap into AI and semiconductors (February 20, 2026 | 09:37)

- Funding must be activated for semiconductor success (February 20, 2026 | 09:20)

- Resilience as new benchmark for smarter infrastructure (February 19, 2026 | 20:35)

- A golden time to shine within ASEAN (February 19, 2026 | 20:22)

- Vietnam’s pivotal year for advancing sustainability (February 19, 2026 | 08:44)

- Strengthening the core role of industry and trade (February 19, 2026 | 08:35)

- Future orientations for healthcare improvements (February 19, 2026 | 08:29)

Mobile Version

Mobile Version