HSBC’s fresh report lauds ASEAN's resilient export story

The report also notes that although a slowdown in trade seems unavoidable, ASEAN’s rising market share may offer a longer and smoother runway, and the return of mass tourism is likely to help the region to weather headwinds despite some lingering challenges.

Also, amidst the global recession, many ASEAN economies are witnessing a strong recovery so far in 2022.

HSBC’s new report states that while a sharp rebound in domestic demand offers obvious benefits, it is the external sector – a firm growth pillar over the past two years – which has remained surprisingly resilient.

Commodity exporters like Malaysia and Indonesia have been riding the commodity upcycle. Meanwhile, tech-exposed economies, including Singapore, Malaysia, and Vietnam continue to benefit from the elevated demand for electronics.

That said, after two years of impressive growth, trade is set to fall to moderate levels. There is a risk of a sharp correction in the commodity space and early signs point to weaker demand for electronic products.

While ASEAN is not fully insulated from a trade slowdown, its increasing share of the global export market – the result of multiple years of efforts to attract quality foreign direct investment (FDI) – is likely to provide a buffer. Despite an imminent tech slowdown, Singapore, Malaysia, and Vietnam have climbed the value chain over the years, thanks to the consistent addition of new capacity.

In addition to goods, there are also services exports to consider. The report shows that ASEAN is likely to witness a significant boost, especially in tourism-heavy economies like Thailand and Vietnam. However, global challenges, including the rising cost of living in some parts of the world, could slow the recovery and it may take some time for tourism in the region to reach pre-pandemic levels.

|

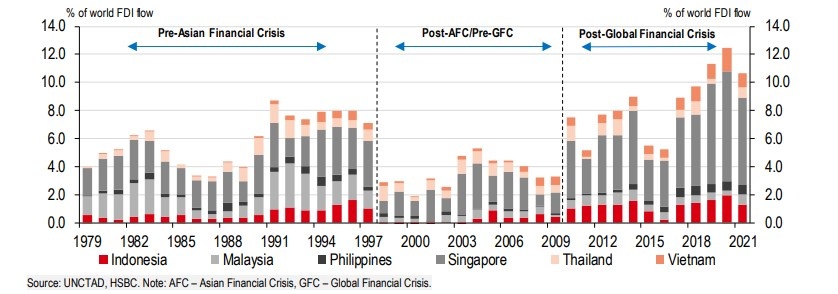

| Despite a global FDI slump during the pandemic, FDI in ASEAN hit historical highs |

According to the fresh report, the past two years of the pandemic led to impressive growth in Asia’s trade. Global demand has surged – from consumer electronics to kitchen utensils and home sports equipment – fueling Asia’s external engine. Even accounting for base effects, exports remained resilient, growing by over 10 per cent in the first half of this year.

ASEAN now accounts for roughly 10 per cent of the world’s FDI share, almost on par with mainland China. The region has gained substantial market shares in certain products, likely providing a cushion against a slowdown in global trade.

| HSBC’s new report indicates that the shift of global demand from goods to services and the ongoing resumption of travel can help ASEAN power through the upcoming headwinds. |

However, the impact is likely to be uneven across the region, with Singapore, Malaysia, and Vietnam relatively better positioned in the near term, and Indonesia offering a compelling structural transformation story.

HSBC’s reports point out that with respect to regional FDI outperformers, Vietnam is standing out. Thanks to Samsung’s $18 billion investment over the past 20 years, Vietnam has been transformed into a key production hub. Its consumer electronics exports have soared to over 30 per cent of total exports, up from less than 5 per cent in 2000.

Strong FDI is likely to provide a buffer to support Vietnam’s move up the value chain.

Since 2006, US tech giant Intel has injected $1 billion into a chip assembly and testing facility in Vietnam, doubling its global share of processor and controller chips in just three years.

Earlier this year, Samsung poured an additional $920 million of investment into Vietnam with the aim of expanding product complexity, including circuit boards and touch sensor modules. Six months later, Samsung is reported to be in the process of testing ball grid array products – a sophisticated type of chip substrate – with plans to enter mass production in July 2023.

However, Samsung is not alone, Apple is accelerating its relocation to Vietnam after the plan was partially disrupted by the pandemic.

After mass-producing AirPods in 2020, Apple is in talks with Vietnam to produce more sophisticated products like the Apple Watch and the MacBook. Indeed, Foxconn – a major Apple supplier – has moved, signing a $300 million MoU with Vietnamese developer Kinh Bac City to expand its production facility in Bac Giang province.

|

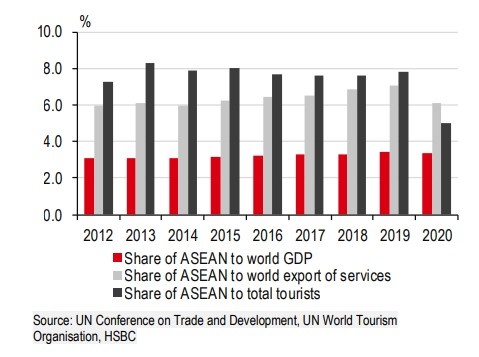

| ASEAN’s share of GDP, services exports, and tourism relative to the world |

|

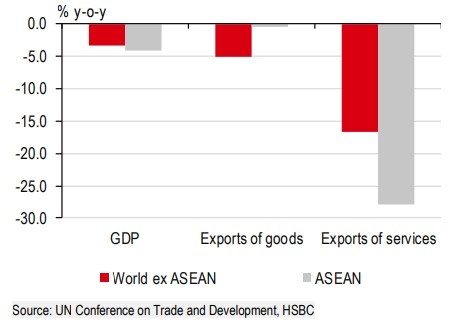

| The export of services in ASEAN contracted much more in 2020 |

According to HSBC’s fresh report, with competitive salaries, scenic natural resources, and a hospitable population, the export of services is a key component of ASEAN’s economy.

Prior to 2020, despite only having around 3 per cent of the world’s GDP, ASEAN’s share of the world’s total export of services stood at a sizeable 7 per cent. The share was even larger at 8 per cent if the number of travellers who go to ASEAN relative to the total number of tourists around the world is factored in.

Things changed, however, when the pandemic struck. As mentioned earlier, demand tilted towards the consumption of goods from services, as households were forced to stay home during lockdowns.

ASEAN’s share of total global economic output remained largely the same but its share of services exports and number of tourists dropped considerably.

In fact, the export of services in ASEAN contracted much more than that in the rest of the world, partly explaining why total economic output in some ASEAN economies contracted slightly more.

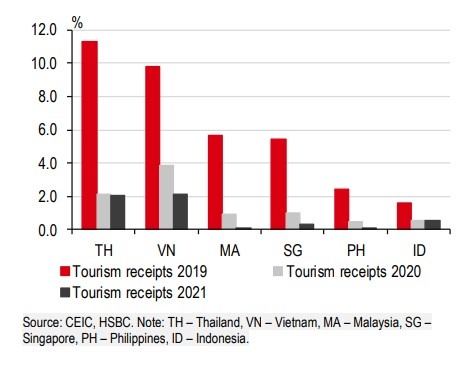

The report states that tourism is a crucial component of ASEAN’s economy but its importance varies across each economy.

Two economies that stand out in terms of tourism receipts as a percentage of GDP are Thailand and Vietnam, accounting for as much as 10 per cent of GDP in 2019. These shares, however, drastically fell in 2020 and 2021, consequently halting leisure-related tourism. Meanwhile, Malaysia and the Philippines hardly had any tourist receipts at all in 2021.

However, since the start of 2022, the region has been accelerating efforts to resume cross-border travel. The flow of tourism is expected to strengthen in the coming time, given the three years of pent-up demand.

|

| Tourism receipts relative to GDP |

|

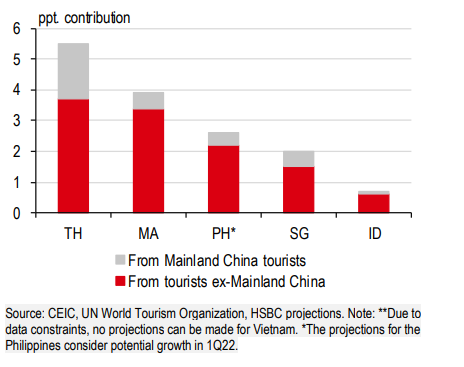

| Potential additional growth due to the normalisation of tourism activities |

Thailand and Malaysia still have a lot more room to grow, given how important tourism was to these economies before the lockdowns.

If tourism returns to normal, Thailand and Malaysia may grow by 5.5 and 3.9 percentage points respectively. However, it is important to note that these projections assume a perfect recovery in which tourism returns to pre-pandemic levels. There is a risk of overestimating the impact that the recovery of tourism may have.

A large portion of tourists in some ASEAN economies are from mainland China. A third of Thailand’s tourism activities, for instance, come from expenditures by these tourists. It is therefore a swing factor that can determine the extent of ASEAN’s tourism recovery.

| Fresh report identifying potential Asia-Pacific unicorns On July 18, KPMG and HSBC released the Emerging Giants in Asia Pacific report, which examines new businesses across the region with strong potential to impact the global business landscape over the next decade. |

| Annual report on FDI in Vietnam released for the first time The Vietnam Association of Foreign-Invested Enterprises has just unveiled its first annual 2021 FDI report to provide a comprehensive assessment of the results of foreign direct investment attraction, the business activities of foreign-invested enterprises, and to analyse the nation's investment environment. |

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Tag:

Tag:

Related Contents

Latest News

More News

- France supports Vietnam’s growing role in international arena: French Ambassador (January 25, 2026 | 10:11)

- Foreign leaders extend congratulations to Party General Secretary To Lam (January 25, 2026 | 10:01)

- Russian President congratulates Vietnamese Party leader during phone talks (January 25, 2026 | 09:58)

- Worldwide congratulations underscore confidence in Vietnam’s 14th Party Congress (January 23, 2026 | 09:02)

- Political parties, organisations, int’l friends send congratulations to 14th National Party Congress (January 22, 2026 | 09:33)

- 14th National Party Congress: Japanese media highlight Vietnam’s growth targets (January 21, 2026 | 09:46)

- 14th National Party Congress: Driving force for Vietnam to continue renewal, innovation, breakthroughs (January 21, 2026 | 09:42)

- Vietnam remains spiritual support for progressive forces: Colombian party leader (January 21, 2026 | 08:00)

- Int'l media provides large coverage of 14th National Party Congress's first working day (January 20, 2026 | 09:09)

- Vietnamese firms win top honours at ASEAN Digital Awards (January 16, 2026 | 16:45)

Mobile Version

Mobile Version