Hopes build that lower steel prices can boost consumption

|

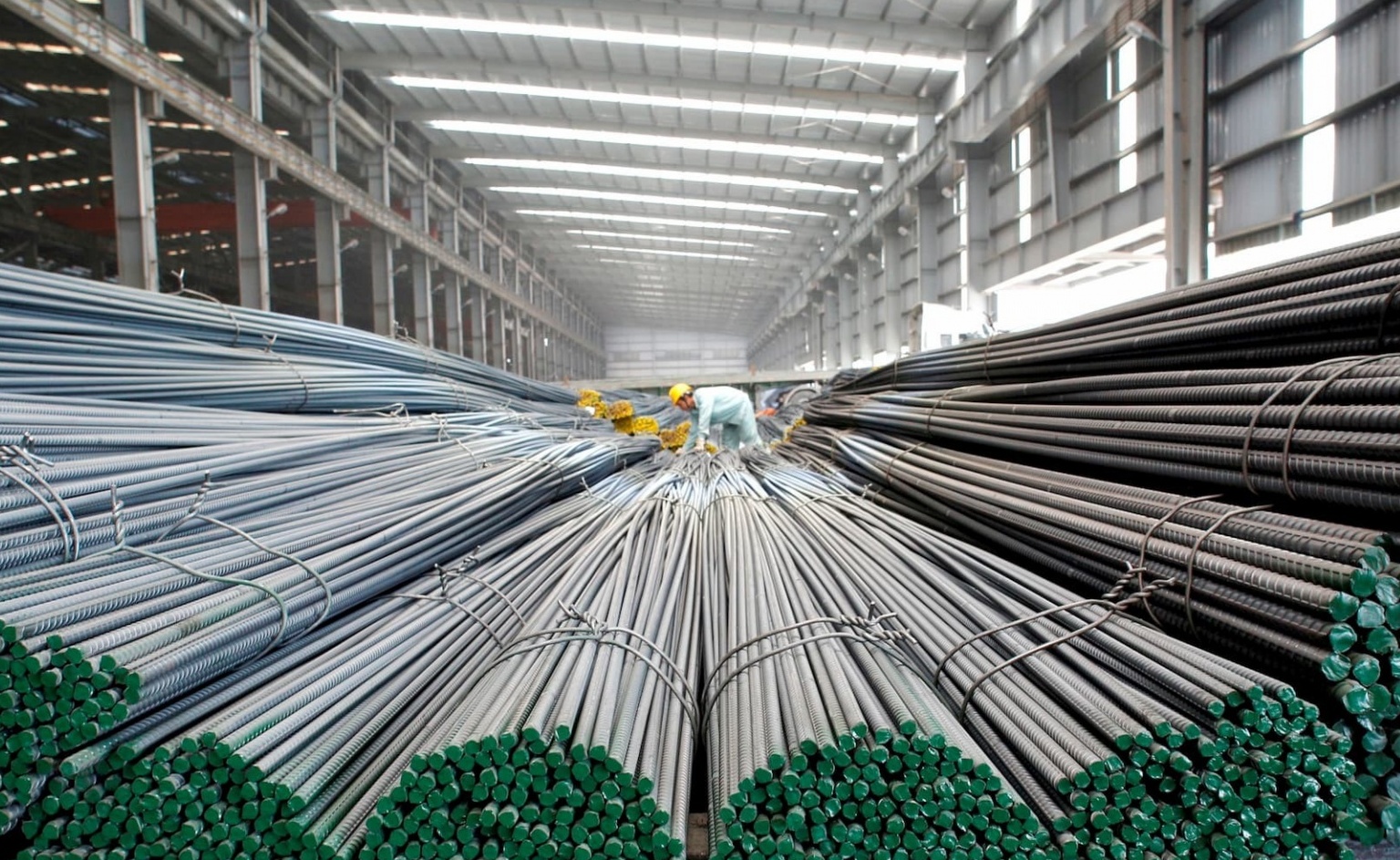

| Some major groups are concentrating on manufacturing goods such as hot-rolled coil, photo Le Toan |

The price of steel is decreasing on both the international and domestic markets. According to the Shanghai Futures Exchange, global steel prices have fallen continuously since March 30, from $610 to $578 per tonne on April 18. According to SteelOnline.vn, the price of Pomina Steel coil dropped by $27.2 to $720 per tonne, and the price of rebar fell by $30.6 to $717.9 per tonne. Domestic prices have also dropped in a similar fashion.

SteelOrbis, as of 10 days ago, noted that “influence from the Chinese market” also had an impact on billet prices in Southeast Asia. The price per tonne of Chinese-origin billet has decreased by $15 since the beginning of April and by $10 since the end of last week. “The ongoing slump in China compounds the price uncertainty in Southeast Asia,” the website remarked.

“The lack of demand will persist for at least two months longer,” Duong Duc Quang, deputy general director of the Mercantile Exchange of Vietnam (MXV), told VIR.

According to Quang, approximately 60 per cent of steel is used in civil construction. According to him, this will continue to be a “substantial barrier to purchasing power”, so consumption growth will be limited in the short term, at least through the second quarter.

“As a result of high interest rate pressures in many of the world’s largest economies, global trading activity is still relatively quiet,” Quang remarked.

Therefore, Vietnam’s steel exports also encounter obstacles. According to information provided by the World Steel Association (WSA), global primary steel production in February was 1 per cent less than in February 2022. March data has not yet been released.

According to the MXV, the price of input materials on the global market, such as steel billet and particularly iron ore, which account for approximately 36 per cent of the cost of steel products, has substantially chilled and continues to fall.

The drop in the cost of steel and billets has prompted production companies to anticipate a slight increase in consumption, although not a total reversal of fortunes. According to Vu The Duyet, an analyst at Vietcombank Securities (VCBS), consumption volume in 2023 will remain “dismal”.

“There are three reasons for the limited consumption volume. Firstly, the steel industry can initially rely on public investment. Due to the small proportion of steel in public investment, its contribution is “not genuinely significant” at this time,” Duyet said.

According to VCBS, total construction steel consumption will decline by roughly 4 per cent in 2023 before rebounding by 7 per cent in 2024, when the recovery of the building sector will be the primary growth driver.

“Secondly, the domestic real estate market is also ailing. Only four housing ventures were licensed in the southern provinces in Q4 last year. The record-low number of new licenced projects in the country in 2022 indicates that construction demand in 2023 will be extremely weak,” Duyet added.

In addition, export output is anticipated to remain low given that the economies of the United States, the EU, and China have all shown signs of weakness.

The third reason is that consumption will continue to be challenging in the future, as the steel industry’s business results will continue to be negative. According to VCBS data, a handful of significant steel companies had to partially cease operations. In particular, Pomina Steel, Hoa Phat, and numerous other enterprises in the steel industry shut down their furnaces in Q4 of 2022 and partially reopened them earlier this year.

The production of construction steel reached 2.7 million MT in the first quarter of 2023, a drop of 23 per cent from the same period in 2022. Sales of construction steel reached 2.6 million MT, a decrease of 28.5 per cent compared to the same period in 2022; while exports reached 422,000 MT, a fall of 41 per cent.

The WSA predicted that global steel demand will increase by approximately 1 per cent in 2023 as a result of public investment and a managed energy shortage. Particularly, the ASEAN region will lead the development of steel consumption due to its strong infrastructure investment orientation.

According to the VSA, this will continue to be the primary export market for Vietnamese steel in the future.

According to the proposed strategy to for the nation’s steel industry to 2030 by the Ministry of Industry and Trade (MoIT), the overall demand of Vietnam’s manufacturing sectors could reach $310 billion between now and 2030. In which, automotive manufacturing and mechanical design for industrial activities comprise the majority of the economy.

The MoIT believes this will be a substantial market for the domestic steel industry, particularly for high-quality fabricated steel and stainless steel for the manufacturing sector.

Hoa Phat Group announced in March that it will concentrate on manufacturing goods such as hot-rolled coil used in the production of galvanised steel sheets, container shells, and steel pipes for the naval construction and auto-shell industries. Chairman Tran Dinh Long stated that the group will regulate production based on market conditions, with a focus on developing high-quality steel.

In addition, steel companies have greater expectations due to the government’s economic stimulus programme. Specifically, there is a support initiative of $5 billion in tax credits for the social housing market and the construction of at least one million social housing units. As of March, according to the Ministry of Construction, the nation had completed over 300 social housing projects in urban areas with a construction scope of approximately 157,000 units.

In the meantime, the MXV indicated that the State Bank of Vietnam’s interest rates have been lowered to support the economy and that demand will increase, particularly in the second half of this year.

“This will be one of the primary factors boosting steel demand,” said Quang of the MXV.

| Steel prices decline steadily for almost a week As a result of the recent over dependence on the real estate market, steel prices are anticipated to decline further in 2023 before witnessing a recovery next year. |

| Steel industry awaits indication of progress The steel sector across Vietnam continues to face a variety of challenges to its growth prospects from multiple angles. |

| Steel fortunes limited by real estate uncertainties Increasing numbers of steel mills seek income flow through property investment, but executing this approach on a significant scale remains tricky. |

| Steel groups take on EU’s carbon rules Steel manufacturers in Vietnam are anxious about the procedures for receiving and reporting data related to carbon emissions for the upcoming application of the EU’s Carbon Border Adjustment Mechanism. |

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Related Contents

Latest News

More News

- A golden time to shine within ASEAN (February 19, 2026 | 20:22)

- Vietnam’s pivotal year for advancing sustainability (February 19, 2026 | 08:44)

- Strengthening the core role of industry and trade (February 19, 2026 | 08:35)

- Future orientations for healthcare improvements (February 19, 2026 | 08:29)

- Infrastructure orientations suitable for a new chapter (February 19, 2026 | 08:15)

- Innovation breakthroughs that can elevate the nation (February 19, 2026 | 08:08)

- ABB Robotics hosts SOMA Value Provider Conference in Vietnam (February 19, 2026 | 08:00)

- Entire financial sector steps firmly into a new spring (February 17, 2026 | 13:40)

- Digital security fundamental for better and faster decision-making (February 13, 2026 | 10:50)

- Aircraft makers urge out-the-box thinking (February 13, 2026 | 10:39)

Tag:

Tag:

Mobile Version

Mobile Version