Steel groups take on EU’s carbon rules

|

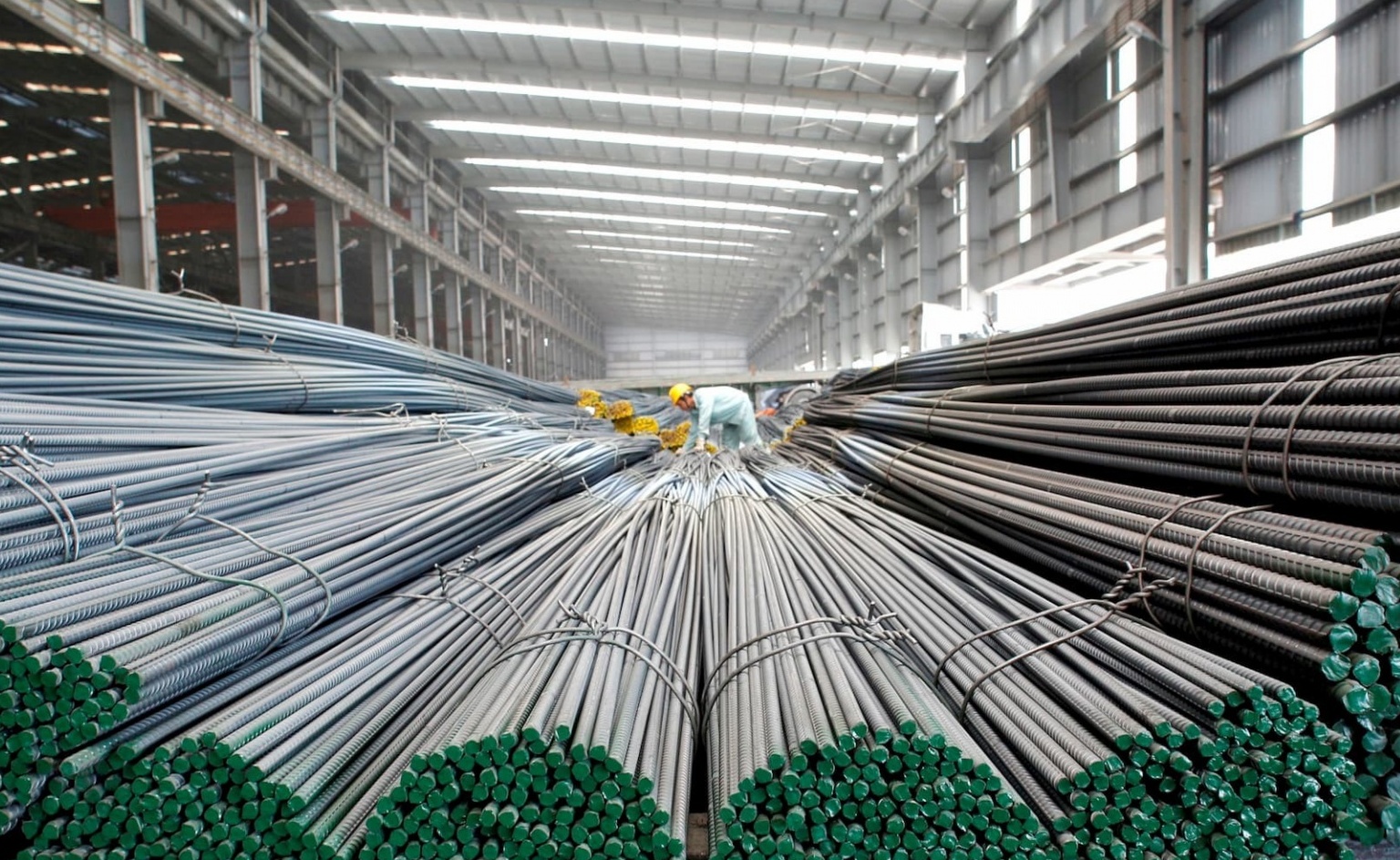

| Steel groups take on EU’s carbon rules, Photo: Le Toan |

Last week, the European Parliament voted to adopt a regulation on the mechanism (CBAM) after negotiators had reached a provisional agreement on the text in December last year.

The CBAM will start as a reporting obligation during a transitional period starting on October 1. Beginning in 2026, financial adjustments on imports of iron, steel, cement, aluminium, fertilisers, electricity, and hydrogen will be phased in over a nine-year period.

Declaration requirements are forecasted to create barriers for exporters in general, especially steel manufacturers, as the EU is one of the top export markets for Vietnamese steel products.

A representative of a foreign-invested steel company told VIR that one of their partners in the EU has already asked the company to send reports about greenhouse gas (GHG) inventory from Scope 1 to Scope 3 emissions (see Box) so that they can prepare data for reports regulated by the CBAM.

“However, at present, our company can only address GHG inventory at scopes 1/2. Besides that, another barrier is the lack of specific guides from the authorities for GHG inventory for the steel sector in particular. Thus, we are not sure about our report’s accuracy,” the representative said.

Under reporting obligations from October this year to 2025, importers do not have to pay for their exceeded emissions compared to the permitted threshold, but businesses must prepare to report information on product volumes and their emissions, the cost of payment for domestic carbon pricing. From 2026, the payment will be made under the appraisal of the intermediate party with strict rules.

However, in Vietnam, local manufacturers can currently only provide data about CO2 emissions during the operation process, while the CBAM also requires the emissions data of input materials.

The EU will give priority to using the actual emissions measured by enterprises. If such enterprises cannot fully determine their emissions or lack the declaration on indirect emissions, the CBAM will use the average default emission level for each country or group of countries, issued by the European Commission.

Dinh Quoc Thai, general secretary of the Vietnam Steel Association (VSA), told VIR that the mechanism will directly affect the export of Vietnamese steel products to the EU. The EU is the second-largest export market after the ASEAN region for steel products, accounting for 18.37 per cent of total sales. According to Thai, the EU accounts for 16 per cent, or roughly 1.3 million metric tonnes, of the total quantity of steel Vietnam exported in 2022.

“When the CBAM is in place, EU importers must collect information regarding carbon emissions from exporters and report them to EU authorities. This procedure is very difficult and can potentially become a barrier. Nations like South Korea are already trying to consider measures to simplify this procedure,” Thai said.

Many VSA members have proposed that the authorities should simplify such procedures for receiving and reporting data relating to CO2 emissions. “Simultaneously, there should be detailed guidance on how to verify carbon emissions and submit data to entities related to these emissions,” Thai said.

The production of emissions is a significant issue for the steel industry in Vietnam. According to the Energy Efficiency and Sustainable Development Department (EESDD) under the Ministry of Industry and Trade (MoIT), the emission intensity of factories utilising electric arc furnace technology in Vietnam is 1.5–2 times higher than the global average. This is a result of the high proportion of fossil fuels used in electricity generation.

Large factories, such as Formosa Hung Nghiep or Hoa Phat Group, emitted approximately 21 million MT of CO2 to produce 10 million MT of steel, as indicated in a 2020 report by the EESDD. It was anticipated at the time that the steel industry as a whole will emit approximately 122.5 million MT of CO2 by 2025 and about 132.9 million MT by 2030, accounting for roughly 17 per cent of the nation’s total emissions.

The UK and the EU remain the spotlight markets of Vietnam thanks to free trade deals. Last December, Hoa Phat signed its first contract to export 10,000 tonnes of wire rod steel to Europe. This was the first order of long steel products to be exported to this region, with Hoa Phat already exporting such products to North America, Asia, Africa, and Australia.

Along with Hoa Phat, Hoa Sen and Nam Kim are also exporting steel to the EU.

Before December 2025, importers will have to submit a CBAM report containing information on the goods within the scope of the mechanism, which includes the quantity of each type of good expressed in megawatt-hours or tonnes, total embedded emissions subject to clarification in the EU Commission’s implementing acts, and any carbon price due in the country of origin for the embedded emissions in the imported goods, taking into account rebates and other forms of compensation. The deadline for the report will be one month after the end of each quarter.

| Scope 1 emissions are defined as those that a company makes directly, such as by running its boilers or vehicles. Scope 2 emissions are those that a company makes indirectly, such as the electricity or energy it buys for heating and cooling buildings that are produced on its behalf. Scope 3 emissions represent all the emissions associated not with a company itself, but the emissions that a company is indirectly responsible for up and down its value chain, such as from buying products from its suppliers, or its products when customers use them.Source: World Economic Forum |

| Tran Cong Hau - International sales manager Austdoor Group JSC The EU is a market where we have plans to export our products, thus we pay attention to the CBAM and its regulations. We also expect to have a specific guide for manufacturers to make GHG inventory. At present, the company is proactive in applying modern technology to create environmentally friendly products to mitigate emissions. In addition to investing in expanding the scale and production capacity, Austdoor focuses on researching and constantly diversifying product lines to continue entering new markets. A feature of our priority strategies is to focus on investing in digital transformation in production and business operations to enhance customer experience. We will soon apply resource management software to optimise applications to support partners, customers, and management. To respond to the CBAM, steel producers need to assess, evaluate, and decide on a technologically and economically viable way to lower their carbon footprint. Dr. Chu Hoang Long - Senior lecturer Australian National University The impact of this new mechanism on Vietnam’s GDP should be modest in scale. However, the steel sector here is different. From 2017 to 2021, the total export turnover of steel products to the EU was an average of $1.1 billion, accounting for 12 per cent of the total export turnover of Vietnam’s goods to this market. According to our calculation, once the CBAM is applied here, steel manufacturers will suffer a fee level of $100-200 million, which is not a small figure for most manufacturers. If steel manufacturers do not seek solutions to reduce its negative impacts, their steel products will lose competition capacity in the EU market. Thus, manufacturers need to watch developments by starting to plan for the CBAM and prepare for emission reporting requirements. It is also necessary to cooperate with the government to adopt decarbonisation policies such as carbon pricing and boosting renewable energy uptake. |

| Steel industry awaits indication of progress The steel sector across Vietnam continues to face a variety of challenges to its growth prospects from multiple angles. |

| Steel fortunes limited by real estate uncertainties Increasing numbers of steel mills seek income flow through property investment, but executing this approach on a significant scale remains tricky. |

| Steel prices decline steadily for almost a week As a result of the recent over dependence on the real estate market, steel prices are anticipated to decline further in 2023 before witnessing a recovery next year. |

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Related Contents

Latest News

More News

- Masan Consumer names new deputy CEO to drive foods and beverages growth (February 23, 2026 | 20:52)

- Myriad risks ahead, but ones Vietnam can confront (February 20, 2026 | 15:02)

- Vietnam making the leap into AI and semiconductors (February 20, 2026 | 09:37)

- Funding must be activated for semiconductor success (February 20, 2026 | 09:20)

- Resilience as new benchmark for smarter infrastructure (February 19, 2026 | 20:35)

- A golden time to shine within ASEAN (February 19, 2026 | 20:22)

- Vietnam’s pivotal year for advancing sustainability (February 19, 2026 | 08:44)

- Strengthening the core role of industry and trade (February 19, 2026 | 08:35)

- Future orientations for healthcare improvements (February 19, 2026 | 08:29)

- Infrastructure orientations suitable for a new chapter (February 19, 2026 | 08:15)

Tag:

Tag:

Mobile Version

Mobile Version