Green financing for small businesses

|

| GGGI’s low-interest loans offered to small- and medium-sized enterprises for eco-friendly projects_Photo: Le Toan |

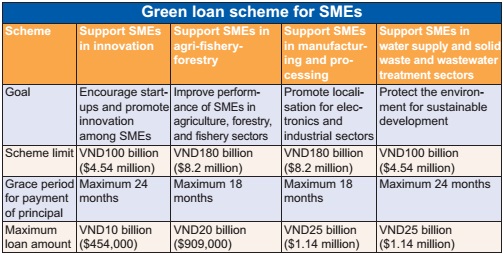

The Global Green Growth Institute (GGGI), in co-operation with the Ministry of Planning and Investment’s Small- and Medium-sized Enterprise Development Fund (SMEDF), last week announced a draft handbook on its green growth priorities for small- and medium-sized enterprises (SMEs).

Under the draft handbook, scheduled to be approved and issued in March 2018, for the first time in Vietnam, local and foreign-owned SMEs are entitled to low-interest loans for their “green” projects – at 5 per cent for a short-term loan and 7 per cent for a long-term loan throughout the loan period. The fund will first focus on three sector groups: agri-fishery-forestry; manufacturing and processing; and water supply and the management and treatment of solid waste and wastewater (see box for details).

Under the Law on Supporting SMEs adopted in June 2017, SMEs refer to firms with no more than 200 employees, maximum total capital of VND100 billion ($4.54 million), and total revenue of the preceding year not exceeding VND300 billion ($13.64 million).

|

An enterprise is considered ‘green’ if it provides green products or services and/or has green production processes. Green products and services must be environmentally-friendly, use resources effectively, and minimise waste production. These considerations should be present in product design, input material, and specifications, or presented in the implementation and nature of services.

Green enterprises eligible for SMEDF’s preferential loans, provided via banks, include those that improve production technology to reduce energy and material consumption, and reduce waste and emissions.

In order to secure the loans, a green enterprise must meet some other conditions in terms of management capacity, credit reputation, job creation, gender factor, high-quality products, use of new materials, innovation, and environmental protection and friendliness.

Truong Vy, project manager of Supply Chain Sustainability in Vietnam for international shoes and clothing manufacturer PUMA, said that the handbook will make it easier for SMEs in Vietnam to access SMEDF loans.

“If enterprises in Vietnam want to join the global value chains and co-operate with big foreign enterprises, they must go green,” Vy said. “For PUMA, all suppliers must meet strict requirements about environmental protection and labour. Some 98 per cent of PUMA’s supply and production chains are emission-free.”

Echoing this view, Adam Ward, GGGI’s country representative for Vietnam, stressed, “Consumers now tend to use products produced by firms that have environmentally friendly production processes. Thus the handbook will help firms to more easily determine and select their projects for the loans.”

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Latest News

More News

- Trung Nam-Sideros River consortium wins bid for LNG venture (January 30, 2026 | 11:16)

- Vietnam moves towards market-based fuel management with E10 rollout (January 30, 2026 | 11:10)

- Envision Energy, REE Group partner on 128MW wind projects (January 30, 2026 | 10:58)

- Vingroup consults on carbon credits for electric vehicle charging network (January 28, 2026 | 11:04)

- Bac Ai Pumped Storage Hydropower Plant to enter peak construction phase (January 27, 2026 | 08:00)

- ASEAN could scale up sustainable aviation fuel by 2050 (January 24, 2026 | 10:19)

- 64,000 hectares of sea allocated for offshore wind surveys (January 22, 2026 | 20:23)

- EVN secures financing for Quang Trach II LNG power plant (January 17, 2026 | 15:55)

- PC1 teams up with DENZAI on regional wind projects (January 16, 2026 | 21:18)

- Innovation and ESG practices drive green transition in the digital era (January 16, 2026 | 16:51)

Mobile Version

Mobile Version