Financial institutions opting more into eKYC convenience

|

| Financial institutions opting more into eKYC convenience |

Last week, VietinBank became the latest financial institution joining the rush of banks taping into digital identity verifications, known as electronic Know Your Customer (eKYC) through its VietinBank iPay Mobile application.

The bank has applied cutting-edge AI technology in eKYC implementation such as image data reading and facial recognition to transform traditional customer onboarding processes into fully digitalised and secured ones that massively reduce overheads and time-consuming efforts.

Earlier this month, Shinhan Bank Vietnam officially launched the online eKYC service on its SOL Mobile Banking platform with various outstanding features that enable customers to save time and simplify conventional bank account opening procedures.

This is a significant step for Shinhan Bank on its digital transformation journey to bring optimal convenience and enhance user experiences.

A representative of Shinhan Bank Vietnam said, “With the launch of eKYC on our SOL Mobile Banking platform, we are moving forward in our digital transformation journey to become a fully digitalised bank and enhance the application of advanced technologies to our existing products and services to better serve customers and support them to complete their financial plans effectively.”

Meeting demand

Identity verifications can now be carried out thanks to the support of AI, such as face-matching technologies to identify if a customer’s face is matching their photo on identity documents. Additionally, instant personal information checks and video calls allow bank appraisers to have real interactions with customers, which give greater reliability against traditional facial verification processes.

Customers can now also open an online account and register for e-banking services without going to a branch while ensuring security standards. Such an eKYC system helps corporate customers to automate processes, shorten the verification time, and simplify admission processes, thereby saving costs and bringing satisfaction to customers.

Some major lenders have long prepared for the approval and adoption of eKYC services, including LienVietPostBank, Military Bank, BIDV, Viet Capital Bank, OCB, and MSB.

Nguyen Hung, CEO of TPBank, said that his bank reported nearly 30,000 new registrations since the inception of its eKYC services, equivalent to 85 per cent of its traditional counterpart.

“This shows that these technologies have met customers’ demands for convenience, speed, and safety. More importantly, it demonstrates the new accessibility of our banking services, which could help our bank achieve greater operational efficiency and scalability, increase financial access to remote communities, and enhance convenience without expanding the branch network,” Hung told VIR.

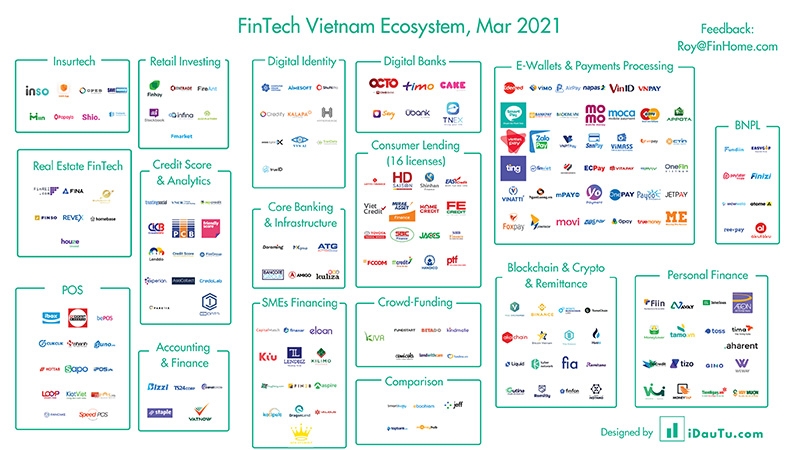

On the other hand, eKYC services have been applied to support fintech and other digitally-led banks to offer a continuous multi-channel experience for customers.

OCTO – a digital bank application developed by the Malaysian CIMB Bank, a leading banking group in ASEAN with 13 million customers across 15 countries, has launched eKYC services for customers to open a bank account and apply for a Visa debit card within minutes.

SmartPay has become one of the first e-wallets in Vietnam applying eKYC functionalities for customers registering with the least amount of paperwork and in a short period of time. The fintech solution has joined forces with other lenders, including VPBank, Viet Capital Bank, and CIMB.

TNEX – the digital-only bank of Vietnamese lender MSB enlisted eKYC services as a significant element to bolster its identity verifications without in-person meetings since its very first day of operation.

Following suit

In January, be Group, the developer of the be ride-hailing app, and VPBank officially introduced Cake digital bank, a new solution for e-banking. One of the most notable features on Cake is the eKYC system which helps customers settle contracts digitally with just their digital signatures. An account can be opened in just two minutes without having to visit a teller.

Both local and foreign consumer finance firms also implement eKYC services to strengthen their synergies and lift the unsecured loan market to a next level.

FE Credit, the consumer finance subsidiary of VPBank, has been paying special attention to digital applications on both front-end and back-end services. These efforts have been put in place in a bid to optimise costs and reduce face-to-face interactions during times of social distancing.

“Furthermore, the application of eKYC services has been implemented in accordance with loan approval processes, applying conversational AI to customer services. All of these efforts are meant to reach customers more quickly and effectively across all sales processes, loan processing, and other customer-related services,” said an FE Credit representative.

Other major finance companies also follow suit, such as Home Credit, Lotte Finance, Mirae Asset Finance, and Shinhan Finance.

“At Home Credit, we are taking adequate measures to maintain social distancing. We are closely watching the business environment for improved financial solutions. As part of the same initiative, our company has introduced online KYC services for Home Credit Loan,” said a company representative.

Meanwhile, Mirae Asset Finance aims to optimise processes through the deployment of AI and big data applied on its My Finance app. The company also applies e-contracts and e-signing solutions, so that customers can complete online procedures to shorten their processing time. Hence, instead of applying traditional consumer loan procedures that take three to five days, borrowing through My Finance in the future is expected to take only 60 minutes to receive cash immediately.

“The deployment of eKYC services is likely to create huge benefits for cashless transactions, increase the user experience, and help banks to reduce paperwork and storage space. Moreover, recent regulations also removed obstacles for traditional banks in the competition with fintech companies, such as MoMo, Grab Moca, or Zalo Pay,” noted Phung Anh Tuan, managing partner at VCI Legal Vietnam.

| On December 4, the State Bank of Vietnam issued Circular No.16/2020/TT-NHNN amending Circular No.23/2014/TT-NHNN guiding the opening and usage of payment accounts, which came into force on March 5. Circular 16 stipulates some measures that can be taken into account while deploying eKYC services to open and use an individual’s bank account. In addition, based on its technological conditions, the bank shall evaluate risks and decide transaction limits, provided that the total value of the debit transactions does not exceed VND100 million ($4,350) per month per customer. Banks may apply a higher threshold for these transactions on the occasion that they perform video calls to collect, inspect, and verify a customer’s identity, which has the same effectiveness as meeting in person, as well as adopting technologies for inspecting and collating customer’s biometric characteristics with such data from the government database. Source: VCI Legal Vietnam |

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Related Contents

Latest News

More News

- VNPAY and NAPAS deepen cooperation on digital payments (February 11, 2026 | 18:21)

- Vietnam financial markets on the rise amid tailwinds (February 11, 2026 | 11:41)

- New tax incentives to benefit startups and SMEs (February 09, 2026 | 17:27)

- VIFC launches aviation finance hub to tap regional market growth (February 06, 2026 | 13:27)

- Vietnam records solid FDI performance in January (February 05, 2026 | 17:11)

- Manufacturing growth remains solid in early 2026 (February 02, 2026 | 15:28)

- EU and Vietnam elevate relations to a comprehensive strategic partnership (January 29, 2026 | 15:22)

- Vietnam to lead trade growth in ASEAN (January 29, 2026 | 15:08)

- Japanese business outlook in Vietnam turns more optimistic (January 28, 2026 | 09:54)

- Foreign leaders extend congratulations to Party General Secretary To Lam (January 25, 2026 | 10:01)

Tag:

Tag:

Mobile Version

Mobile Version