Expectations for Vietnam’s new path

|

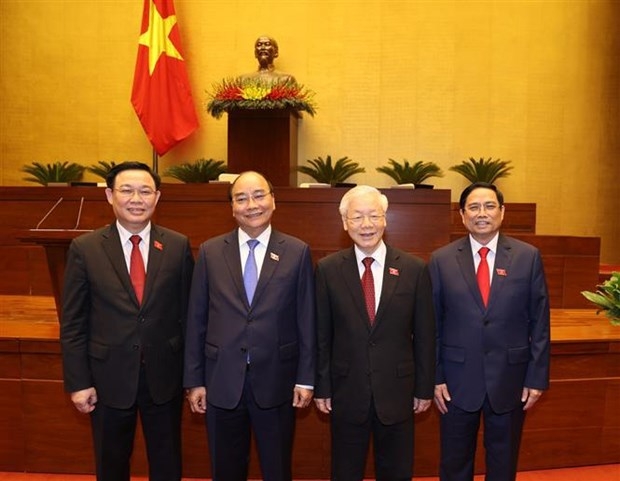

| Newly-elected Vietnamese leaders. Photo: VNA |

| Ivo Sieber - Swiss Ambassador to Vietnam

Vietnam’s remarkable progress combined with Switzerland’s long-term engagement has resulted in a partnership that makes me proud to look back on. Vietnamese-Swiss relations have developed strongly over the past 50 years. Over the past three decades, cooperation extended dynamically beyond the political and the multilateral sphere to technical and economic cooperation, trade and investment, and more. At the same time, trade and investment flows have steadily increased. Today Vietnam is the only ASEAN country with a positive balance of trade in goods with Switzerland. Effective last year, Swiss direct investment in Vietnam amounted to more than $1.72 billion, and in excess of 100 Swiss companies are active here. Despite the constraints of the pandemic, we have a series of activities planned. Fortunately, the Vietnamese government’s exceptional management of the pandemic offers us many possibilities. If the travel situation permits, we hope to undertake a high-level political visit to Vietnam this year to underscore and strengthen our excellent relations. Marko Walde - Chief representative, Delegation of German Industry and Commerce in Vietnam

With a trade volume of almost $16.6 billion in 2020, triple the figure of 2011, Germany is the most important trade partner of Vietnam in the EU. Over 500 German companies are represented in Vietnam and have created around 47,000 qualified jobs here. German enterprises also show optimism about Vietnam’s economy in the medium and long term. Via our AHK World Business Survey, we see that half of the survey participants expect a further development of their companies in Vietnam in 2021. There is still room for improvement. German investors in Vietnam have pointed out major risks to their development in Vietnam, namely economic policy framework, trade barriers/preference, legal certainty, exchange rates, and shortage of skilled workers. According to our experts, local companies should improve their competitive advantages as soon as possible. Vietnam should adjust policies to speed up development of supporting industries in terms of educating high-quality workforce and improving digitalisation. It should also develop competitive industry clusters in order to attract new investments. Carlyle A. Thayer - Emeritus professor, University of New South Wales

Vietnam has set an ambitious goal to become a developed, high-income socialist-oriented economy. But before that, Vietnam is set to surpass low-middle-income developing nation status by 2025. To this end, Vietnam should aim to achieve several goals over the next five years: mitigating the impact of the coronavirus by quickly vaccinating Vietnam’s population; implementing a stimulus package to get enterprises stricken by the pandemic back into production; and restoring reliable supply chains and meeting obligations under numerous free trade agreements. Vietnam should aim to achieve high economic growth rates above 6 per cent per annum over the next five years. This will lay the foundation for Vietnam to shift towards a digital economy and e-commerce. In addition, it is clear from the Political Report and other economic reports that sustainable development is now viewed as integral to economic development. I expect party leaders to pursue the objective of sustainable development with the same commitment as they showed to the anti-corruption campaign. John Fering - Regional managing director, Cargill Animal Nutrition South East Asia

Cargill appreciates Vietnam’s long term commitment to foreign investment and believes further liberalisation of its legal system to further align commercial statues with international norms is welcome and will assist in attracting more foreign investment to the benefit of the Vietnamese economy. Vietnam’s commitment to free trade agreements over many years is to be commended and an ongoing focus on global free trade is demonstrating the country’s rapid integration into the global economy. Like the Vietnamese government, Cargill wishes this focus to continue. As one of the leading animal nutrition companies and major suppliers of grain and oil seeds in Vietnam, Cargill is highly committed to the Vietnamese market. While we are expanding our business portfolio here by adding protein business in 2018 and ongoing investments in swine genetics and animal nutrition specialties, we welcome any investment and improvements by the new Vietnamese cabinet in the country’s agricultural supply chains. Yun Liu - Economist, HSBC

Despite external resilience, the recovery in the domestic demand has stalled, given prolonged re-imposition of strict social distancing measures. Indeed, Vietnam’s mobility indicators have dropped, leading to dampened growth in services. Coupled with ongoing concerns over a weak labour market, incoming data is likely to point to slowing consumption. Still, as COVID-19 has been brought under control, the domestic demand is likely to revive in due course. Overall, we revise down Vietnam’s 2021 growth to 6.6 per cent, accounting for a weaker-than-expected recovery in the first quarter. That said, given an upswing in the tech cycle, consistent foreign direct investment inflows, and multiple free trade agreements, Vietnam still boasts one of the brightest growth prospects in Asia. We expect Vietnam’s inflation to average around 3 per cent in 2021. With inflation being less of a concern, the central bank has more flexibility to keep its monetary policy unchanged in 2021. Laurent Genet - General director, Audi Vietnam

The new president’s achievements as prime minister, together with the rest of the government, have seen Vietnam move up collectively in worldwide recognition. Free trade agreements, e-government, healthtech, fintech, and Industry 4.0 already constitute milestones for the new government to further develop infrastructure, education, and environment protection in its fast-growing megacities. COVID-19 vaccinations must now accelerate to repeat the successful prevention policy swiftly implemented for all in Vietnam. Companies dependent on tourism need priority support, and the middle-income trap and fast-ageing population are threats that require management. Creating favourable conditions for foreign investors, and ensuring a level playing field for both Vietnamese and foreign companies, will make Vietnam a vibrant country for all. Supporting environmentally-friendly mobility solutions with incentives – for example to electric vehicles buyers and investors in building charging stations networks – will also improve living conditions for the whole population. Vietnam’s golden period is now happening, which we can see with Audi car sales in the first quarter of 2021 and the building of our new flagship in Ho Chi Minh City. Takeshi Masuyama - Regional head of Vietnam, MUFG Bank Ltd.

As Vietnam embarks on its leadership change this year, the new government will be instrumental in guiding the country onwards in achieving the goals set out in the 10-year strategy and 2045 vision outlined recently. MUFG Bank with the business community therefore harbours high hopes for new opportunities and upcoming achievements as the country accelerates its development agenda. There are many initiatives that the government can undertake to spur growth and investment. For instance, to further promote M&A, revision of applicable laws and regulations towards international standards would greatly encourage foreign investors. Federico Vasoli - Managing partner, dMTV Global

Whilst our firm suffered a reduction in turnover in 2020, our exposure to Vietnam and Singapore allowed us to be at profit and to experience a significant rebound in the second half of the year and an excellent start of 2021. The future is uncertain, but having a foot in Vietnam is a plus. This country oozes energy and its new leadership, with the confirmation of top figures, grants stability. The previous leadership also made significant reforms to laws on enterprises, investment, securities, construction, and more. This trend should not stop and, while the reforms’ rationale is generally to be praised, much more is still needed to simplify procedures and digitalise public administration. |

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Related Contents

Latest News

More News

- VIFC in Ho Chi Minh City officially launches (February 12, 2026 | 09:00)

- VNPAY and NAPAS deepen cooperation on digital payments (February 11, 2026 | 18:21)

- Vietnam financial markets on the rise amid tailwinds (February 11, 2026 | 11:41)

- New tax incentives to benefit startups and SMEs (February 09, 2026 | 17:27)

- VIFC launches aviation finance hub to tap regional market growth (February 06, 2026 | 13:27)

- Vietnam records solid FDI performance in January (February 05, 2026 | 17:11)

- Manufacturing growth remains solid in early 2026 (February 02, 2026 | 15:28)

- EU and Vietnam elevate relations to a comprehensive strategic partnership (January 29, 2026 | 15:22)

- Vietnam to lead trade growth in ASEAN (January 29, 2026 | 15:08)

- Japanese business outlook in Vietnam turns more optimistic (January 28, 2026 | 09:54)

Tag:

Tag:

Mobile Version

Mobile Version