Drug giants gaining with fresh products

|

Traphaco JSC, the country’s second-largest publicly traded drugmaker, on December 9 kicked off the commercialisation of new products as a result of the technology transfer from South Korea’s Daewoong.

Kim Dong Hyu, deputy general director of Traphaco, said, “The technology transfer is a big step which will bring about important values to Traphaco, not only in terms of revenue growth and financial efficiency but also strengthens Traphaco’s position in the market.”

The cooperation with Daewoong is one of the key activities of Traphaco for the next five years, aiming to increase total revenues by 13.3 per cent and pre-tax profit by 15 per cent. The technology transfer will cover 70 products. The target is within reach as Daewoong is one of the leading manufacturers and distributors of prescription drugs in South Korea.

In the first phase, the transfer covers medication for liver, cardiovascular, and stomach illnesses. The second phase, which began in August, focuses on products with high market potential and treatment efficiency.

Besides Daewoong, Traphaco is intensifying cooperation and partnerships, especially with South Korean pharma firms to diversify its portfolio of products, focusing on ties with those capable of competing in tenders and the hospital channel, thus increasing the market share of the eastern medicine segment.

The drugmaker, which now has South Korean leadership, boasts three big shareholders – State Capital Investment Corporation (35.67 per cent), Magbi Fund Ltd. (24.99 per cent), and Super Delta Pte., Ltd (15.12 per cent).

Like Traphaco, DHG Pharmaceutical JSC is offering new products from its two production lines meeting Japanese GMP standards as certified by the Japan Pharmaceuticals and Medical Devices Agency. This year, DHG made 100 products eligible for the hospital channel from the lines, thus enabling the company to gain a competitive edge in tenders and revenue generation.

With Japan’s Taisho as the main foreign shareholder with 51.01 per cent, the company plans to develop two more production lines focusing on cardiovascular diseases and diabetes which are increasing in Vietnam.

General director of DHG Masashi Nakaura said, “The year marked a decade of innovations as DHG has been striving to supply international-standard drugs to people. Driving this growth momentum, we plan to recruit talents in 2022 and upgrade the company’s image to an international one with a vision of stable growth of 6-7 per cent annually in the next five years.”

Elsewhere, Imexpharm (IMP), Vietnam’s fourth-biggest publicly traded drugmaker, announced its new Cephalexin 500mg produced at its high-tech Binh Duong factory, which was granted market authorisation in Spain. The factory meets EU-GMP standards. IMP is also seeking EU-GMP recognition for its IMP 4 factory in a move to venture further into the ethical drugs segment, which is expected in 2022. SK Investment Vina III Pte., Ltd. is now the biggest foreign stakeholder of IMP with 29.42 per cent.

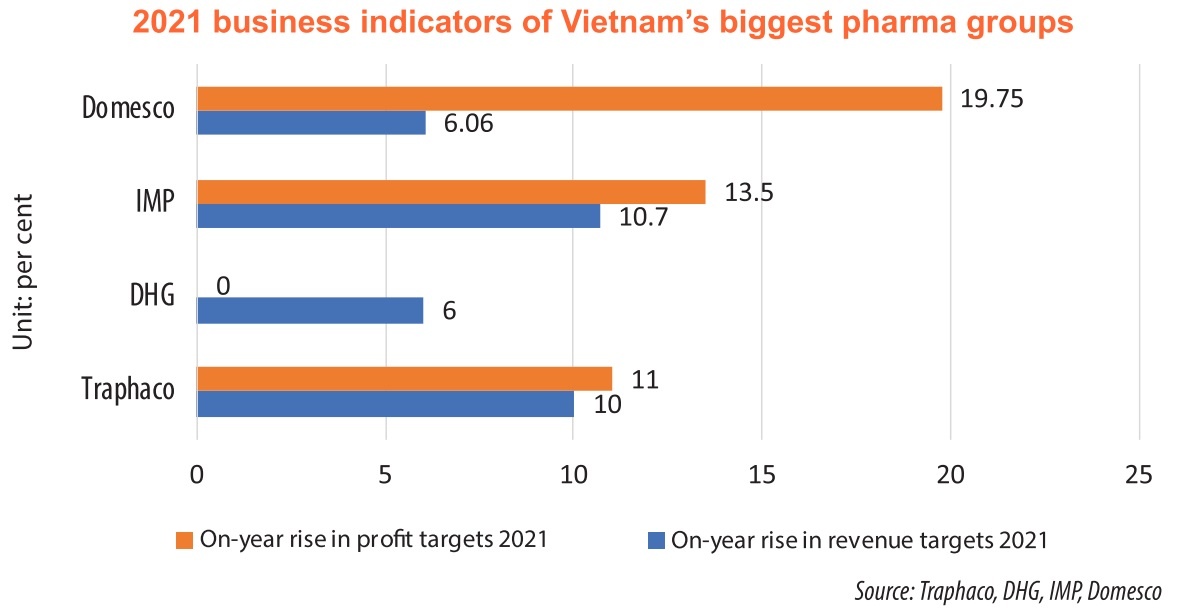

The change in business strategy has greatly contributed to the company’s improvements in the business result. In the first nine months of 2021, Traphaco made revenues of nearly $69.6 million, and after-tax profits of $8.51 million, up 21.9 per cent and 38.5 per cent on-year respectively. The result mostly comes from self-produced drugs. Traphaco expects that new products from the technology delivery can further increase revenues from next year.

Similarly, DHG fetched an after-tax profit of $26.34 million, up 14.5 per cent on-year.

However, not all drugmakers shared such results. IMP saw its net revenues fall 1.4 per cent on-year to $37.83 million, while its pre-tax profit decreased by 7.3 per cent.

Industry insiders said that pharma companies will face challenges to achieve whole-year growth targets set earlier this year. Global interruption in supply chains, rising global transportation costs, and a high rise in cost for ingredients due to the prolonged pandemic are possible barriers.

Vietnam’s pharmaceutical industry experienced low growth at 3 per cent in 2020, according to SSI Securities Corporation. In early 2021, Fitch Ratings forecast that the industry would grow 8.7 per cent this year. However, the pandemic caused a standstill in the industry performance in the third quarter.

In addition, local pharma giants are facing stiff competition from imported pharmaceuticals. According to a report from the General Department of Vietnam Customs in 2020, Vietnam imported $3.3 billion worth of pharmaceuticals, up 7.4 per cent on-year.

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Related Contents

Latest News

More News

- Masan Consumer names new deputy CEO to drive foods and beverages growth (February 23, 2026 | 20:52)

- Myriad risks ahead, but ones Vietnam can confront (February 20, 2026 | 15:02)

- Vietnam making the leap into AI and semiconductors (February 20, 2026 | 09:37)

- Funding must be activated for semiconductor success (February 20, 2026 | 09:20)

- Resilience as new benchmark for smarter infrastructure (February 19, 2026 | 20:35)

- A golden time to shine within ASEAN (February 19, 2026 | 20:22)

- Vietnam’s pivotal year for advancing sustainability (February 19, 2026 | 08:44)

- Strengthening the core role of industry and trade (February 19, 2026 | 08:35)

- Future orientations for healthcare improvements (February 19, 2026 | 08:29)

- Infrastructure orientations suitable for a new chapter (February 19, 2026 | 08:15)

Tag:

Tag:

Mobile Version

Mobile Version