Citi Vietnam chief shared views at the Interbank Off-Site Workshop

The workshop covered several key topics, including the carbon credit market, AI and digital assets, corporate bonds, and market outlook.

|

| Minh Ngo (second from right) at the Market Outlook section |

During the market outlook session, panellists analysed the Federal Reserve's anticipated monetary policy for the second half of the year and its potential effects on Vietnam's financial markets and capital flows.

Minh Ngo made some significant points about the recent economic outlook from the US, citing July's employment data as a sign of the weakening labour market there, with the unemployment rate rising to 4.3 per cent alongside a more notable slowing in payroll job growth.

"With policy rates firmly in restrictive territory and Fed officials increasingly focusing on employment as part of their dual mandate, Citi's economists predict that the Fed will initiate a cutting cycle with 50 basis point reductions in September and November, followed by 25 basis point cuts at each subsequent meeting, eventually bringing the policy rate down to 3 to 3.25 per cent by mid-2025," said Minh.

Emerging markets are expected to receive more investment, but the magnitude could be blunted by the result of the presidential election.

Despite the challenges posed by external factors, there are several positive economic trends in Vietnam that can bolster confidence.

The country has seen promising growth in its manufacturing sector, driven by a diversification of supply chains as companies adopted the ‘China+1’ or ‘China +2’ strategy.

This shift has the potential to attract increased foreign direct investment, further strengthening Vietnam's economic foundation.

Additionally, Vietnam's strong agricultural sector continues to demonstrate resilience, with exports of key products like rice and coffee setting records.

The government's commitment to upgrading infrastructure and enhancing trade agreements aims to improve connectivity and open new markets for Vietnamese goods, which bodes well for long-term economic growth.

Risks to the VND could also re-emerge, given the non-negligible possibility of an accelerated escalation of global trade tensions.

Vietnam’s export structure shares similarities with China’s and includes components of China's electronics supply chain, meaning despite the recent strength of the VND, Citi experts remain cautious on Vietnam’s balance of payments outlook.

| Citi Vietnam planting trees as part of community goals Citi celebrated its 19th annual Global Community Day (GCD) in June, a yearly campaign aimed at serving communities worldwide through volunteer campaigns. |

| Vietnam tries to buck trends in M&A Despite a slump in global merger and acquisition transactions, Vietnam witnessed a significant uptick in large transactions in the first half of 2024, with robust deal flow in key sectors and the rise of strategic acquisitions. |

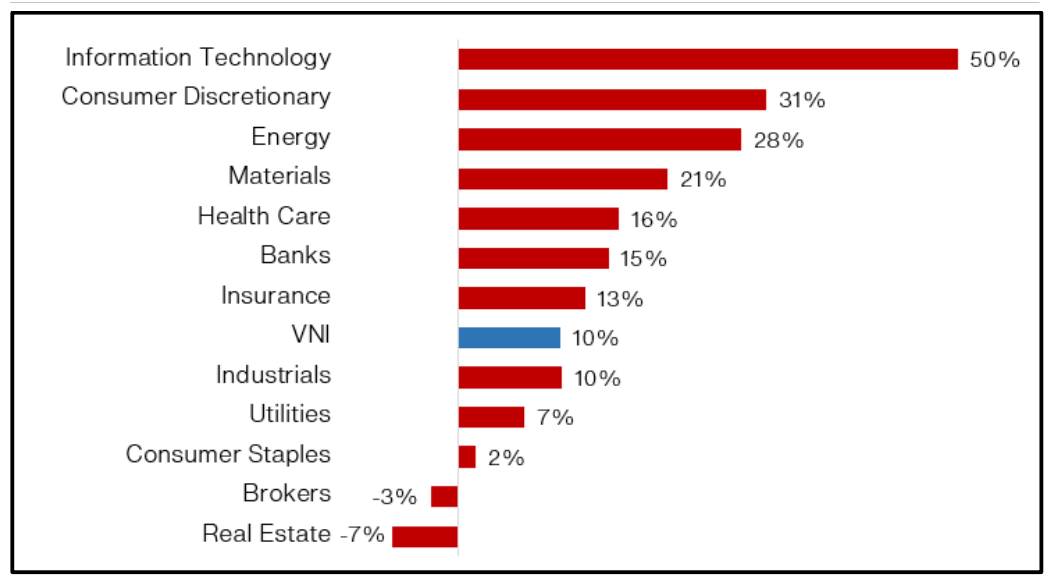

| Vietnam's stock market remains resilient in 2024 Vietnam's stock market continues to show resiliency in 2024 with the VN-Index up about 10 per cent year-to-date, driven by an expected 19 per cent increase in 2024 earnings, and strong buying by local retail investors. |

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Tag:

Tag:

Related Contents

Latest News

More News

- Raised ties reaffirm strategic trust (February 20, 2026 | 14:06)

- Sustained growth can translate into income gains (February 19, 2026 | 18:55)

- The vision to maintain a stable monetary policy (February 19, 2026 | 08:50)

- Banking sector faces data governance hurdles in AI transition (February 19, 2026 | 08:00)

- AI leading to shift in banking roles (February 18, 2026 | 19:54)

- Digital banking enters season of transformation (February 16, 2026 | 09:00)

- IFC to grant $150 million loan package for VPBank (February 13, 2026 | 09:00)

- Nam A Bank forms position as strategic member at VIFC through three key partnerships (February 12, 2026 | 16:39)

- Banks bolster risk buffers to safeguard asset quality amid credit expansion (February 12, 2026 | 11:00)

- VNPAY and NAPAS deepen cooperation on digital payments (February 11, 2026 | 18:21)

Mobile Version

Mobile Version