Vietnam's stock market remains resilient in 2024

|

According to a report released by VinaCapital on July 31, the rebound in earnings growth from a 5 per cent drop last year to 19 per cent growth this year is supported by an acceleration in Vietnam's GDP growth from 5.1 per cent in 2023 to an expected 6.5 per cent in 2024.

The enthusiasm of local investors to buy stocks stems from the fact that deposit rates in Vietnam are still below 5 per cent – even for 12-month deposits – and that the country's real estate market is still somewhat frozen, making the stock market and gold attractive to local investors.

Further to that point, retail investors dominate stock market trading in Vietnam, accounting for 90 per cent of daily trading value on average this year, absorbing an estimated $2.4 billion worth of Vietnamese stocks that foreign investors have sold year-to-date (following $1 billion last year).

Foreign investor selling has been prompted by profit taking, concerns about the circa 4 per cent year-to-date depreciation of the VND, and because some foreign investors are taking a "wait and see" approach in light of recent political developments in the country.

The report also pointed out that a quarter of foreign selling transpired via exchange-traded fund (ETF) redemptions, including the dissolution of Blackrock's iShares Frontier ETF, which was liquidated in June (monthly foreign net sales of Vietnamese stocks hit a record-high in June, driven in part by the liquidation of the ETF). In the aftermath of that foreign selling, the proportion of Vietnam's stock market owned by foreign investors fell to its lowest level in a decade.

However, selling linked to the liquidation of that ETF has now finished, and some sophisticated foreign investors have been taking advantage of foreign selling to increase their long-term strategic investments in Vietnam. For example, Capital Group, Fidelity, and other foreign institutional investors reportedly bought a large stake in ACB, Vietnam's leading retail lender, earlier this year.

Michael Kokalari, chief economist of VinaCapital, said, "We expect earnings growth to accelerate from an estimated 9 per cent on-year in the first half of 2024 to 33 per cent in the second half of 2024, driven in part by the nascent recovery of the country's real estate market. The initial thawing in Vietnam's real estate market started in December 2023, and the ongoing recovery has gained considerable momentum since then. We estimate that real estate transaction activity surged by about 40 per cent on-year in the first half of 2024, driven by pent-up demand and a series of laws to revive the market recently enacted by the government."

"Consequently, we expect the earnings of real estate developers (excluding Vinhomes) to surge 80 per cent this year. Furthermore, a healthier real estate market should support banks earnings' by boosting credit growth and reducing asset quality concerns /credit costs. The recovery of Vietnam's real estate sector is likely to further accelerate next year, which is one of the reasons that VN-Index earnings will grow by another 17 per cent in 2024," he added.

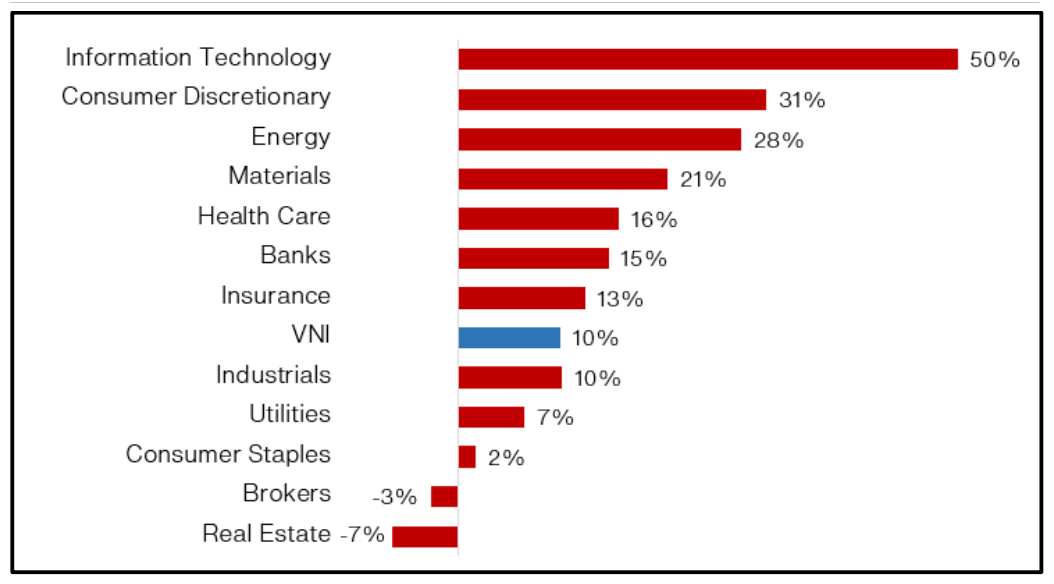

The wide variation in the performance of the sectors in Vietnam's stock market is typical and presents ample opportunities for active managers. For example, funds are overweight in the IT sector, which is being buoyed by global enthusiasm for AI-related stocks.

|

| Sector performance (per cent year-to-date) |

Consumer discretionary stock prices have also performed well this year because the earnings of those companies are expected to grow 55 per cent after having dropped by 42 per cent last year.

This rebound stems from the fact that domestic consumption (excluding foreign tourists) was very weak in 2023 (when the sluggish real estate market and layoffs at FDI factories weighed heavily on Vietnamese consumer spending) but has recovered this year. Similar idiosyncratic factors explain the performance dispersion among other sectors.

| Opportunities for individual stocks to surge in second half Stocks in sectors such as telecommunications technology, finance, chemicals, and steel will be particularly favoured by individual investors in the last six months of this year. |

| Vietnam and Australia bodies forge stock market partnership Vietnam's State Securities Commission (SSC) on August 2 signed an MoU with the Australian Securities and Investments Commission (ASIC) in Sydney, marking a significant milestone in the collaborative efforts between the two regulatory bodies. |

| Vietnam and Singapore ink MoU to promote development of stock markets The Singapore Exchange signs a Memorandum of Understanding (MoU) with the Vietnam Exchange to boost the development of Singaporean and Vietnamese stock markets. |

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Tag:

Tag:

Related Contents

Latest News

More News

- Banks roll out God of Wealth Day promotions (February 26, 2026 | 17:10)

- VinaCapital launches Vietnam's first two strategic-beta ETFs (February 26, 2026 | 09:00)

- Banking sector targets double-digit growth (February 23, 2026 | 09:00)

- Private capital funds as cornerstone of IFC plans (February 20, 2026 | 14:38)

- Priorities for building credibility and momentum within Vietnamese IFCs (February 20, 2026 | 14:29)

- How Hong Kong can bridge critical financial centre gaps (February 20, 2026 | 14:22)

- All global experiences useful for Vietnam’s international financial hub (February 20, 2026 | 14:16)

- Raised ties reaffirm strategic trust (February 20, 2026 | 14:06)

- Sustained growth can translate into income gains (February 19, 2026 | 18:55)

- The vision to maintain a stable monetary policy (February 19, 2026 | 08:50)

Mobile Version

Mobile Version