Cashless transformation requires top payment security

As per Visa’s account, it is a great opportunity for digital payments to override, or leverage, the payment market, worth some $6.1 trillion, when over half (55 per cent) of all transactions in the $11-trillion market in terms of payment volume in the Asia-Pacific are still in cash.

Urbanisation and increasing mobile usage are driving the appetite for digital payments across the Asia-Pacific. Half of the region’s population lives in towns and cities, and more than two thirds (1.3 billion) of the 1.9 billion internet users in the Asia-Pacific access the internet via smartphones, according to the World Bank World Development Indicators.

|

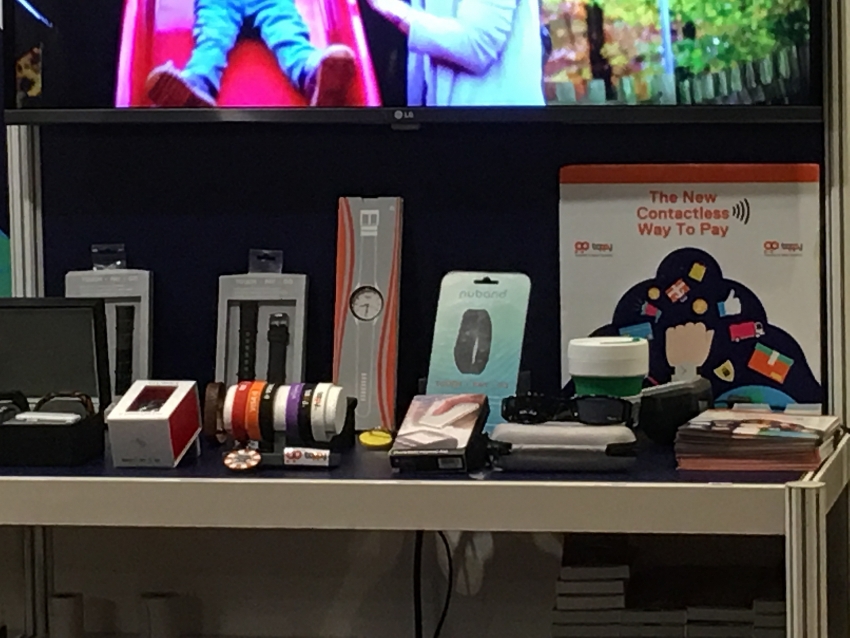

| From cash presented to "contactless" way to pay |

The fast-changing payment ecosystem will now require security measures that do not come at a cost of convenience for both customers and merchants.

“Payment security and convenience were once considered opposing forces. Not anymore. We have reached a point where security is embedded in the process. It does not come at the cost of convenience but, rather, it enables innovation,” stressed Joe Cunningham, head of Risk Asia-Pacific at Visa, at the Visa Asia-Pacific Security Summit held in Singapore on May 15-17.

With that in mind, new innovations are set to enhance the payment experience of consumers and Visa is committed to ensuring that its network operates at the highest level of security available and will continue to steer the industry towards the adoption of strong technologies based on industry-standards, such as EMV chip, tokenisation, and point-to-point encryption.

|

| Cashless transformation requires top payment security |

In Vietnam, around 90 per cent of all transactions are still in cash. However, the increased adoption of mobile and contactless payment technology will see electronic payments continue to penetrate into everyday payment segments like supermarkets, coffee shops, and cinemas, reducing the reliance on cash.

Visa also reinforced the urgence of taking a standards-based approach to innovation and applying a consistent set of principles for security, reliability, and interoperability.

“Visa advocates a standards-based approach to new innovations so all stakeholders in the ecosystem can benefit and participate. We want to promote standards that make it easier for all parties in the payments ecosystem to adopt and deploy new technologies that meet the highest security standards,” noted Cunningham.

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Related Contents

Latest News

More News

- VNPAY and NAPAS deepen cooperation on digital payments (February 11, 2026 | 18:21)

- Vietnam financial markets on the rise amid tailwinds (February 11, 2026 | 11:41)

- New tax incentives to benefit startups and SMEs (February 09, 2026 | 17:27)

- VIFC launches aviation finance hub to tap regional market growth (February 06, 2026 | 13:27)

- Vietnam records solid FDI performance in January (February 05, 2026 | 17:11)

- Manufacturing growth remains solid in early 2026 (February 02, 2026 | 15:28)

- EU and Vietnam elevate relations to a comprehensive strategic partnership (January 29, 2026 | 15:22)

- Vietnam to lead trade growth in ASEAN (January 29, 2026 | 15:08)

- Japanese business outlook in Vietnam turns more optimistic (January 28, 2026 | 09:54)

- Foreign leaders extend congratulations to Party General Secretary To Lam (January 25, 2026 | 10:01)

Tag:

Tag:

Mobile Version

Mobile Version