Car industry remains flat

Do Tien Dung, chairman of the Board of Directors at Hang Xanh Motors Service JSC (Haxaco), said that the company counted $3.04 million in profit in Q1 last year.

However, they are just trying to break even in Q1 due to a sharp fall in the demand, and the situation may spread until the end of Q2.

|

| Most car dealers saw a flat business in the year to date |

Consumers have been cautious due to very high borrowing costs.

In addition, the quiet stock market and real estate market have badly affected people’s purchasing power.

A source from Huyndai Thanh Cong reported that for the year to date, auto dealers have launched diverse incentives to attract buyers, yet demand for autos has dwindled amid surging borrowing cost and lowered incomes.

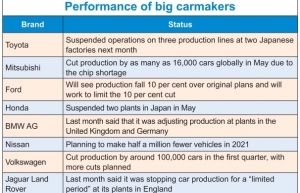

Saigon General Service Corporation (Savico) commented that the threat of global economic recession, high inflation and shortage of chipsets and semiconductors would result in auto supply volatilities.

| Stagnant auto registration in the past two months has also exacerbated the situation, exerting pressure on businesses. |

Meanwhile, stiff competition persists between dealers, alongside high interest rates and sliding demand.

It might take up to six months for the auto market to reach a sounder footing.

Savico expects a drop of 25 per cent in its post-tax profit in 2023, falling to $19 million compared to 2022.

The Vietnam Automobile Manufacturers Association's (VAMA) figures show that local motor vehicle sales revenue was down 25 per cent on-year in the first two months this year, in whichtourism coaches shed 28 per cent, commercial vehicles were down 10 per cent, and specialised vehicles took a 47 per cent plunge.

The sale revenue of domestic assembled cars went down 38 per cent, and that of imported vehicles slid 3 per cent.

In fact, auto sales began to show signs of going down from late 2022.

Last December, VAMA members sold a total 35,301 units, down 3 per cent compared to the previous month and more than 24 per cent lower on-year.

The Vehicle Importers Vietnam Association assumes that auto makers are struggling to cope with escalating inventory due to an unexpected fall in demand.

Stagnant auto registration in the past two months has also exacerbated the situation, exerting pressure on businesses. All 12 VAMA members face a conundrum with their inventories.

By the end of 2022, the inventory value at Haxaco was at $46.2 million, up 1.8-fold compared to one year ago.

Similarly, Savico saw inventory value reaching $7.83 million, up 1.8-fold, and that of City Auto JSC approximated $20.7 million, up 1.4-fold.

Haxaco chairman Dung has attributed the company’s soaring inventory to two factors. First, Haxaco, the major Mercedes-Benz dealer in Vietnam, imported a big volume of cars to receive a bonus given by the Mercedes-Benz plant. This bonus contributed a large part to the company’s profit picture last year.

Second, many Mercedes-Benz car lines have increased in price from January so that the company has imported a large car volume to drive down the price.

Haxaco aims to lower its inventory value to about $26 million in late Q1.

The Ministry of Finance and the Ministry of Industry and Trade are considering the possibility of a 50 per cent registration fee reduction for domestically assembled and manufactured cars.

| Auto trade issues persist amid rise in consumption Amid a rise in car consumption, a wide range of giant automakers have had to cut production or close facilities due to the global semiconductor shortage that is affecting price and delivery times. |

| Auto firms urged to have suitable business plans amid COVID-19 Automobile producers are observing the complex changes of the second wave of the COVID-19 pandemic to adjust their businesses. |

| Honda Vietnam’s motorcycle sales down, auto sales up in June Motorcycle sales of Honda Vietnam decreased 3 percent in June, while its auto sales expanded 17 percent, the company unveiled on July 10. |

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Related Contents

Latest News

More News

- Masan Consumer names new deputy CEO to drive foods and beverages growth (February 23, 2026 | 20:52)

- Myriad risks ahead, but ones Vietnam can confront (February 20, 2026 | 15:02)

- Vietnam making the leap into AI and semiconductors (February 20, 2026 | 09:37)

- Funding must be activated for semiconductor success (February 20, 2026 | 09:20)

- Resilience as new benchmark for smarter infrastructure (February 19, 2026 | 20:35)

- A golden time to shine within ASEAN (February 19, 2026 | 20:22)

- Vietnam’s pivotal year for advancing sustainability (February 19, 2026 | 08:44)

- Strengthening the core role of industry and trade (February 19, 2026 | 08:35)

- Future orientations for healthcare improvements (February 19, 2026 | 08:29)

- Infrastructure orientations suitable for a new chapter (February 19, 2026 | 08:15)

Tag:

Tag:

Mobile Version

Mobile Version