BOT procedure roadblocks hindering venture progress

In late July, the Ministry of Transport (MoT) sent a dispatch to the Ministry of Justice seeking the latter’s consensus in allowing VINA2 Investment and Construction JSC to transfer its stake in a project to one corporate entity and an individual investor outside the project’s consortium.

VINA2 is one of three investors in a BOT project on the renewal and upgrading of National Highway 38’s road section connecting the national highways No.1 and No.5.

This is also the first time a stake transfer at a BOT-related enterprise has taken place between a legal entity and individual investor.

This rare case began a year ago when the project developer first sought approval from the MoT to allow VINA2 to transfer its entire 31 per cent stake to Vo Phi Hai, who would hold 28 per cent of the stake, and to Investment Mining Port JSC (IMPORT) that will keep the remaining 3 per cent.

In the dispatch, the MoT assumed that the stake transfer to Hai is simply a capital restructuring step of the project enterprise, as after the move two remaining businesses in the contractor consortium (IMPORT with 40 per cent stake and Licogi 16 with 29 per cent) still have full financial, technical, and governance capacity to continue to implement the project contract.

In addition, leveraging the investors’ commitment, the stake transfer does not alter the apparatus as well as the personnel involved in the project’s operation and management, while it also still complies to the contract regulations.

“Hence, after the transfer, the parties acquiring the stake still ensure the financial, technical, and government capacity to carry out this contract as well as other relevant contracts,” noted an MoT executive.

Tran Chung, chairman of the Vietnam Association of Road System Investors (VARSI), told VIR that it was regretful that such a straightforward case took around a year to settle.

“Capital contribution, divestment, or transfer deals depend on the investors’ business plans in each particular period. Stake transfer at BOT projects during exploitation to either corporate or individual investors then needs to be swiftly handled, avoiding opportunities being missing out on when getting the approval,” said Chung.

He also proposed to create more space for stake transfers of BOT project investors, gearing towards constituting a more attractive financial market to coax more investors into transport infrastructure development.

|

| BOT procedure roadblocks hindering venture progress |

The plan to renew and upgrade the National Highway No.38’s road section connecting the national highways No.1 and No.5 was granted an investment certificate by the Ministry of Planning and Investment in 2014. In late 2017, construction was completed and the MoT approved the implementation of toll collection, along with road operation and maintenance from 2018.

Through an official document, Luu Quang Lam, board chairman of the project developer, reaffirmed that members of the investment consortium and associated lenders have all agreed to the stake transfer.

According to the Law on Public-Private Partnership Investment, financiers are allowed to transfer their stake to other investors and their capital contribution to each other. Simultaneously, the transition provision of the law also greenlights further implementation of regulations in the project’s contract.

Stake transfer is then based on the project’s contract and relevant regulations at the time of contract signing.

| New BOT approaches bring investment opportunities As Vietnamese invesstors are moving to accelerate corporate bond issuances and new business models to raise funds for transport initiatives to ease reliance on bank loans, more opportunities are coming for international ventures. |

| Future outlined for BOT projects on back of PPP Law Over the past few years, investors have not been much inclined towards build-operate-transfer (BOT) transport projects in Vietnam, while the number of schemes with financial constraints has increased. According to the Ministry of Transport, in 2011-2015 around 88 BOT transport projects were implemented, but the number in 2015-2020 was far lower. It is challenging to raise capital for such large-scale projects. |

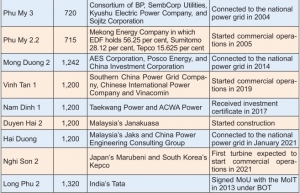

| Clock ticking for resurgence of BOT power projects A series of build-operate-transfer power projects are lagging behind set schedules, bringing more challenges for the upcoming national master plan to meet power supply issues. |

| Building PPP mechanisms in sci-tech venture investment Vietnam’s sci-tech market has seen improvements in business and investment activities, but more efforts are urged to keep up with international trends. Tran Van Tung, Deputy Minister of Science and Technology, talked to VIR’s Minh Anh about the solutions to move forward. |

| SBV warns about increasing bad debts, cross-ownership, and risks of BOT projects The State Bank of Vietnam (SBV) earlier this week reported on the evaluation of the execution of Resolution No.42/2017/QH14 on piloting bad debt settlement of credit organisations at the 15th National Assembly session. |

| Numerous BOT projects report poor revenues A total of 19 build-operate-transfer (BOT) projects reported revenues lower than 70 per cent, and three of these reported revenues lower than 30 per cent compared to their financial plans, according to the Ministry of Transport (MoT). |

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Related Contents

Latest News

More News

- Hermes joins Long Thanh cargo terminal development (February 04, 2026 | 15:59)

- SCG enhances production and distribution in Vietnam (February 04, 2026 | 08:00)

- UNIVACCO strengthens Asia expansion with Vietnam facility (February 03, 2026 | 08:00)

- Cai Mep Ha Port project wins approval with $1.95bn investment (February 02, 2026 | 16:17)

- Repositioning Vietnam in Asia’s manufacturing race (February 02, 2026 | 16:00)

- Manufacturing growth remains solid in early 2026 (February 02, 2026 | 15:28)

- Navigating venture capital trends across the continent (February 02, 2026 | 14:00)

- Motivations to achieve high growth (February 02, 2026 | 11:00)

- Capacity and regulations among British areas of expertise in IFCs (February 02, 2026 | 09:09)

- Transition underway in German investment across Vietnam (February 02, 2026 | 08:00)

Tag:

Tag:

Mobile Version

Mobile Version