Clock ticking for resurgence of BOT power projects

One build-operate-transfer (BOT) power developer told VIR last week that their project has been delayed for more than one year due to staffing shortages and difficulties acquiring project financing as a result of the coronavirus.

|

| Clock ticking for resurgence of BOT power projects |

“Our project hasn’t started construction yet,” the developer said. “The longer the project is delayed, the more difficult it will become, since the lenders have begun to limit or phase out financial support despite our commitment to using cutting-edge technology.”

Meanwhile, the $2.6 billion BOT Van Phong 1 project can start power generation six months earlier than planned, but investors have since raised concerns over transmission plans, affecting the schedule to become commercial in 2023.

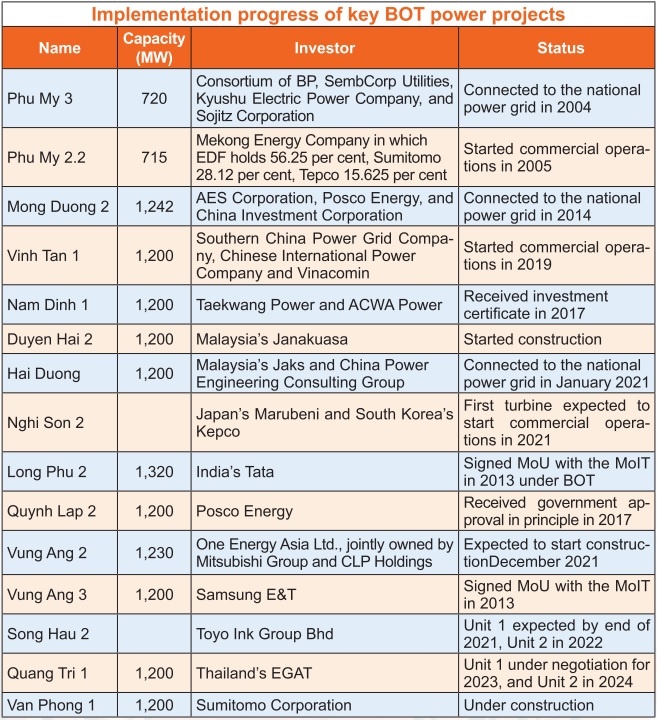

Over the past few decades, there has been a craving for more public-private partnerships in the development of large-scale energy and infrastructure ventures across Vietnam. However, the BOT power sector has moved slowly, with long preparation times (see chart).

Liming Qiao, Asia director of the Global Wind Energy Council, told VIR, “There are projects being carried forward to the Power Development Plan VIII (PDP8) from the revised PDP7, which is because of different challenges facing coal projects. In the past few months, we only see increasing difficulties for coal financing from both public and private financial institutions, rather than any chance of this being alleviated. Thus, the same challenges remain.”

On the contrary, Qiao said, the situation may become even worse, with net zero targets becoming a new consensus in Asia, likely leading to even more delay for some projects attached to PDP8.

In the context of the current global energy crisis, the government is to review power projects under construction for operation before 2025, offer solutions to ensure progress, and proactively remove obstacles in construction investment and operation of power sources.

The Ministry of Industry and Trade (MoIT) admitted at the National Assembly last year that the negotiation of BOT contracts and investment certificate issuance takes time due to the complex involvement of many related ministries. Obstacles have been mainly incentive policies, foreign exchange, and early termination of contracts, among others. It also usually takes a long time for other state management authorities to review and provide comments, and the MoIT is not able to take control of contract negotiation and signing. BOT plants such as Vung Ang 2, Vinh Tan 3, and Long Phu 2 are facing such problems.

In order to push projects on time, the MoIT has suggested that BOT and independent plant developers that miss construction deadlines would face fines, even up to $200,000 for every 60 days behind schedule, but the proposal has not materialised.

In the most recent PDP8 draft, the ministry confirmed that it would not allow any new coal-fired projects and would instead replace them with more environmentally-friendly liquefied natural gas (LNG) sources.

Under the draft, the total installed capacity of the whole power system will come to around 130,000-143,800MW by 2030. Hydropower would account for 17.7-19.5 per cent of the total installed capacity, while coal-fired thermal power will make up 28-31 per cent; oil and gas-fired thermal power (LNG included) at 21-22 per cent; renewable energy at 24-26 per cent; and imports would account for about 3-4 per cent.

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Related Contents

Latest News

More News

- Hermes joins Long Thanh cargo terminal development (February 04, 2026 | 15:59)

- SCG enhances production and distribution in Vietnam (February 04, 2026 | 08:00)

- UNIVACCO strengthens Asia expansion with Vietnam facility (February 03, 2026 | 08:00)

- Cai Mep Ha Port project wins approval with $1.95bn investment (February 02, 2026 | 16:17)

- Repositioning Vietnam in Asia’s manufacturing race (February 02, 2026 | 16:00)

- Manufacturing growth remains solid in early 2026 (February 02, 2026 | 15:28)

- Navigating venture capital trends across the continent (February 02, 2026 | 14:00)

- Motivations to achieve high growth (February 02, 2026 | 11:00)

- Capacity and regulations among British areas of expertise in IFCs (February 02, 2026 | 09:09)

- Transition underway in German investment across Vietnam (February 02, 2026 | 08:00)

Tag:

Tag:

Mobile Version

Mobile Version