VPG expands main business into real estate development

|

| VPG expands main business into real estate development |

Haiphong's real estate industry has begun to attract many Investors because of the locality's infrastructure development. Since expanding its business into real estate in 2017, VPG has successfully implemented a number of projects in Haiphong, most notably the Viet Phat South city project in Vinh Niem Ward. The project has a total investment of $18.9 million and handed over all 174 low-rise apartments.

|

| Viet Phat South city project in Vinh Niem ward, Le Chan district, Hai Phong city |

In the future, VPG continues to invest in developing more real estate projects in Haiphong and, at the same time, expand the business to other provinces and cities. In the next coming time, VPG works on three projects with a total investment of $82.6 million.

In Haiphong, VPG is proposing to adjust and supplement inland waterway ports and logistics terminals at the riverbank under the planning of Do Nong Industrial cluster in Le Thien commune, An Duong district. The project covers an area of 46.8 hectares, with an estimated total investment of $28.7 million.

Along with that, VPG plans to implement the Viet Phat Inland Water Port project in Kim Thanh district, Hai Duong province on an area of 9.75 hectares. The project aims to become a gathering point for the transhipment of goods and trade of building materials.

For the residential real estate segment, VPG is preparing to deploy 2.48ha in Bac Tu Liem district, Hanoi to implement the Viet Phat Housing project. Total investment in this project is up to $34.7 million. Implementation time is estimated up to two years. Currently, the company is submitting a proposal to Hanoi People's Committee, and it is expected that by the end of the first quarter of 2022, the investment will be approved.

In addition, Viet Phat Real Estate JSC – a related company – is expanding many projects in strategic locations in Haiphong, including an industrial park in Tien Lang District, Haiphong with an area of 410ha.

Coke and iron ore continue to play the leading role

Although expanding into real estate, the main business of iron ore and coke still takes an important role in VPG's business results.

In the first nine months of 2021, VPG's revenues reached more than $133 million, 2.1 times higher than in the previous year. In which, revenues from coking coal and iron ore accounted for nearly 94 per cent of total revenues.

After deducting expenses, the company reported a profit after tax of approximately $15.6 million. In the first nine months of 2021, VPG achieved a sudden growth thanks to the sharp increase in iron ore and coke prices. As for iron ore, although the current price has dropped sharply from the peak of July, there has been a strong increase in the first half of the year.

Coke, on the contrary, continuously increased sharply in the last period of the year after China announced to limit coal imports from Australia. In 2021, the company sold about 550,000 tonnes of iron ore and 200,000 tonnes of coke.

In the mineral business market, VPG is an important supplier of Iron ore and coke for large factories such as Hoa Phat Hai Duong Steel JSC, Hoa Phat Dung Quat Steel JSC, and Den Thai Nguyen Metallurgical JSC. At the same time, it is also a supplier of coal for thermal power plants and large steel factories such as Thai Nguyen Iron and Steel JSC and Hoa Phat Hai Duong Steel JSC.

Prospects to become a leading supplier of coal and iron ore

One of the factors that helped Viet Phat to become a supplier for steel mills is that the products are always guaranteed in terms of quality and stability. Raw iron ore products have been preliminarily refined at the company's own factory through production lines with modern technology. VPG's products include non-magnetic iron ore, magnetic iron ore, titanium ore, and sulphur bran.

In the upcoming time, VPG will continue to orient itself to become the leading raw material supplier for steel factories with the goal of supplying about one million tonnes of iron ore. In addition, VPG is also expected to supply about 50,000-80,000 tonnes of finished steel for large projects and works.

In addition to steel factories, VPG is also a partner in supplying coal for thermal power plants. In the next 10 to 20 years, the coal-fired power industry will continue to be developed and account for a large proportion of the structure of electricity production. Therefore, total coal demand for thermal power is expected to remain high, although the current forecast is lower than in the past.

It is expected that by 2030, the thermal power industry will need about 150 million tonnes of coal. Therefore, coal imports in the coming time will account for an increasingly large proportion of the national import-export balance. Grasping the trend, VPG is still maintaining the relationship with foreign partners who have long-standing brands around the world in coking coal such as Sumitomo Co., Ltd., BHP Billiton, and Wel-Hunt.

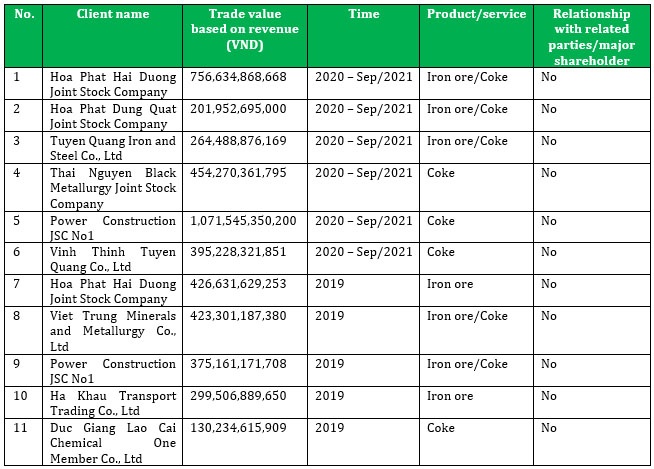

List of VPG’s major customers since 2019

|

| Source: Viet Phat Import-Export Trading Investment JSC |

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Tag:

Tag:

Related Contents

Latest News

More News

- An Phat 5 Industrial Park targets ESG-driven investors in Hai Phong (January 26, 2026 | 08:30)

- Decree opens incentives for green urban development (January 24, 2026 | 11:18)

- Public investment is reshaping real estate’s role in Vietnam (January 21, 2026 | 10:04)

- Ho Chi Minh City seeks investor to revive Binh Quoi–Thanh Da project (January 19, 2026 | 11:58)

- Sun Group launches construction of Rach Chiec sports complex (January 16, 2026 | 16:17)

- CEO Group breaks ground on first industrial park in Haiphong Free Trade Zone (January 15, 2026 | 15:47)

- BRIGHTPARK Entertainment Complex opens in Ninh Binh (January 12, 2026 | 14:27)

- Ho Chi Minh City's industrial parks top $5.3 billion investment in 2025 (January 06, 2026 | 08:38)

- Why Vietnam must build a global strategy for its construction industry (December 31, 2025 | 18:57)

- Housing operations must be effective (December 29, 2025 | 10:00)

Mobile Version

Mobile Version