VinaCapital expects economy to boost stock market in 2022

|

| Michael Kokalari, chief economist, VinaCapital |

We believe that the strong economy should also propel the stock market higher this year, which follows last year’s 36 per cent surge in the VN-Index. That surge was driven by a circa 35 per cent increase in the consensus earnings estimate for 2021 of stocks listed on the Ho Chi Minh Stock Exchange as well as a 60 per cent jump in the number of retail trading accounts in Vietnam.

We expect investor participation in the stock market to continue growing vigorously in the years ahead. Despite the large number of stock market accounts opened over the last 18 months, the proportion of Vietnamese who invest in the stock market is still fairly small. If Vietnam follows a similar trajectory as Taiwan (which we believe is likely), the number of stock market investors is likely to increase three-fold over the next ten years.

Next, despite last year’s remarkable rise in corporate earnings, we expect a further 26 per cent increase in earnings this year. We observe that bull markets that are driven by earnings growth are healthier and more sustainable than those driven mainly by P/E multiple expansion.

We also observe that many of Vietnam’s retail investors, who currently account for circa 90 per cent of the daily trading volume on the stock market, seem focused on trading with a short-term view. For that reason, active fund managers with a proper investment methodology that anticipate stock and/or sector rotations and accurately anticipate the earnings growth of individual companies are well positioned to outperform the VN-Index.

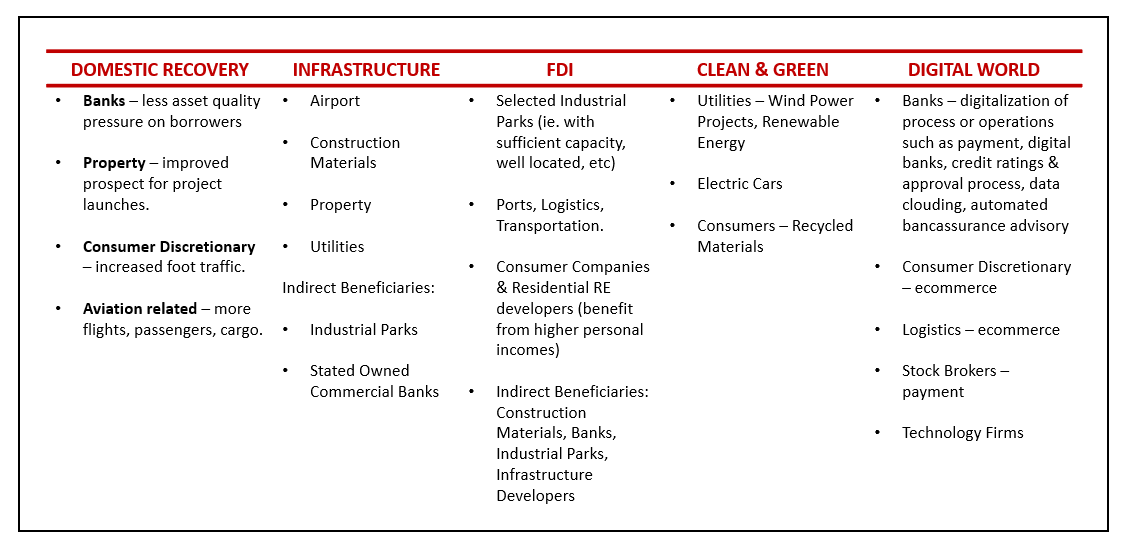

Our current investment strategy remains focused on identifying stocks and sectors that benefit from the economic recovery that is already underway in Vietnam, including consumer discretionary, financials, and real estate. In addition, since Vietnam’s long-term growth drivers have remained intact despite the pandemic, we also continue to focus on stocks and sectors that are beneficiaries of foreign investment inflows, infrastructure development, clean energy, and digitalisation.

The table below summarises the sectors that we expect to benefit from these five investment themes in 2022. We are particularly focused on the banking sector (which has a circa 30 per cent weighting in the VN-Index), property (which has a 23 per cent weighting), and consumer discretionary stocks (which have a circa 3 per cent weighting), which should benefit from both cyclical and secular tailwinds this year.

|

Banks’ earnings are likely to grow by about 30 per cent this year, driven by 14 per cent credit growth, and the fact that Vietnam’s banks are less likely to be impacted by COVID-19 in 2022. Specifically, asset quality issues should have less of an impact on banks’ earnings, and we do not expect banks to sacrifice profitability to help support the economy again in 2022.

Furthermore, two ongoing trends will support Vietnamese banks’ profitability in 2022: an improving loan mix (that is more retail and loans), and lower funding costs, driven by a higher contribution from low-cost current account savings account sources.

In addition, the Government’s non-performing loan forbearance measures will enable banks to spread their loan losses from COVID-19 over three years, which will support banks’ profitability this year.

We should note, however, that we are not overly concerned about asset quality issues. We estimate that more than one-third of the loan losses that banks could eventually suffer from the pandemic have already been provisioned against, as well as the fact that a high proportion of loans are backed by real estate collateral – and property prices continued to climb over the last two years.

Finally, although we are quite optimistic about the overall prospects of the banking sector, we expect earnings growth of individual banks to vary from circa 6 per cent to circa 50 per cent, partly because the State Bank of Vietnam will allocate credit growth quotas based on asset quality, which varies widely among Vietnamese banks (we expect credit growth to average 14 per cent this year).

In addition, there are many idiosyncratic factors that could impact both earnings and share prices, including bancassurance deals with foreign insurance companies (which typically entail generous up-front payments) and turn-around/restructuring stories.

Next, we expect the earnings of real estate development companies to grow by nearly 25 per cent in 2022, driven by a near-doubling of sales/pre-sales of new housing units following a drop of more than 50 per cent in 2021 because of the lockdowns, as well as legal/regulatory issues that are now starting to be addressed and resolved. In addition, the earnings of real estate firms that have recurring revenues are also set to rise this year.

Continued enthusiasm for investing in real estate – thanks in-part to the low deposit rates banks pay savers – should ensure that property prices continue to increase in 2022 (we estimate that apartment prices in Hanoi and Ho Chi Minh City rose by about 10 per cent in 2021).

We believe that the continued increase in real estate prices and pent-up demand to purchase homes to live in or for investment purposes will drive the above-mentioned, anticipated jump in the pre-sales of new housing units in 2022.

Finally, consumer spending should continue rebounding in 2022. We believe the pandemic has accelerated the trend of consumers shopping in the modern retail channel as well as e-commerce. That said, incomes were severely hit during the pandemic, so some consumers are likely to shift to cheaper products, resulting in some non-essential or high-end goods not recovering to their pre-pandemic sales levels this year.

One key conclusion of all of the above is that even though Vietnam’s stock market was up 36 per cent in 2021, dispersion among sectors and stocks was quite high. We expect that there will continue to be winners and losers in 2022, which is a compelling reason for investors to trust a professional investment manager with their equity investments.

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Related Contents

Latest News

More News

- State-owned stocks rally as reform expectations lift market sentiment (January 23, 2026 | 23:40)

- Fitch upgrades Vietnam's long-term senior secured debt instruments (January 23, 2026 | 23:35)

- Fitch Ratings upgrades Vietnam’s senior secured long-term debt rating to BBB- (January 23, 2026 | 16:30)

- Accountants enter 2026 downbeat on global economic prospects (January 22, 2026 | 20:21)

- Korea Development Bank gains approval to open Vietnam branch (January 22, 2026 | 20:14)

- VPBank strengthens auto supply chain finance with Suzuki partnership (January 21, 2026 | 18:14)

- Retail stocks poised for growth as consumption recovery and policy tailwinds align (January 21, 2026 | 10:07)

- Key factors to watch in the stock market in early 2026 (January 20, 2026 | 11:42)

- Dragon Capital Vietnam Fund Management shares debut on UPCoM (January 19, 2026 | 14:47)

- Vietnam’s private capital market enters selective recovery phase (January 19, 2026 | 11:49)

Tag:

Tag:

Mobile Version

Mobile Version