Vietnam outperforms among Asia’s frontier sovereigns: Fitch Ratings

These factors should support Vietnam’s BB rating, which Fitch affirmed in April 2020 while revising the Outlook to Stable from Positive. Nevertheless, the country faces a number of challenges, including contingent liability risks from state-owned enterprises and structural weaknesses in the banking sector.

“Vietnam is one of only four Fitch-rated sovereigns in the Asia-Pacific (APAC) that we expect to post positive economic growth in 2020. Official data show the economy expanded by 0.4 per cent year-on-year in the second quarter of 2020, despite the impact of the coronavirus pandemic on tourism and export demand, in line with our full-year 2.8 per cent growth projection,” Fitch commented.

|

Fitch forecasts that the pace of expansion will accelerate in 2021 as external demand including tourism exports recovers.

The relative strength of Vietnam’s growth momentum owes much to its success in curbing the pandemic. Vietnam had no reported deaths from COVID-19 as of the end of June, according to the World Health Organization. This could reflect a variety of factors, including the effectiveness of the official health policy response.

Vietnam has introduced fiscal stimulus of around VND271 trillion ($11.78 billion) (3.4 per cent of GDP) to help offset the effects of the pandemic. This includes tax deferrals, cuts, and exemptions, as well as cash transfers to affected workers and households, the latter being worth 0.4 per cent of GDP.

Fitch expects the general government debt-to-GDP ratio to rise to around 42 per cent in 2020 from 37 per cent in 2019 but this is still below the 59 per cent median for BB-rated sovereigns.

The State Bank of Vietnam has also loosened monetary policy to support the economy but the lower-interest-rate environment and state pressure on banks to ease lending terms will weigh on bank profitability. Meanwhile, slower economic growth and loan forbearance will add to asset quality problems.

These factors will aggravate the structural weaknesses in the banking sector, such as low capital buffers and under-reporting of problem loans, which have already dragged on the sovereign rating. Slower credit growth may, however, provide some relief on capital.

|

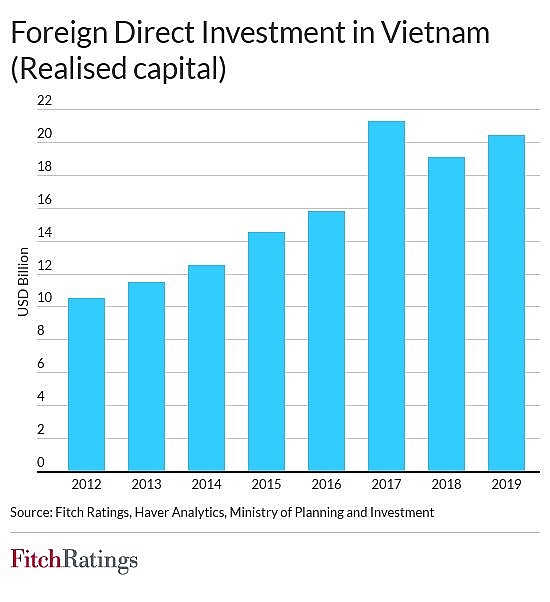

| Foreign Direct Investment in Vietnam (Realised capital) |

Vietnam’s economic outlook remains vulnerable to shifts in external demand. The country has benefitted from trade diversion associated with rising costs in China and the US-China trade war, and early data suggests it made further gains as China’s exports were disrupted by the coronavirus.

Vietnam’s share of US apparel and textile imports rose to 15.5 per cent in the first four months of this year from 12.9 per cent of last year’s same period, according to the US Office of Textiles and Apparel. The country also attracted a healthy $8.7 billion in realised capital investment from overseas in the first half of 2020.

Nonetheless, both textile and apparel exports to the US and realised capital investment were lower year-on-year, illustrating Vietnam’s vulnerability to the evolution and impact of the pandemic. As elsewhere, restrictions remain on inbound tourism and remittances are declining. Tourism directly accounts for about 10 per cent of GDP, with a higher contribution if indirect spillover effects are considered, while remittances were worth over 6 per cent of GDP in 2019.

Vietnam is also susceptible to policy action by its main trade partners. Its National Assembly ratified the EU-Vietnam Free Trade Agreement on June 8 which should underpin stable trade relations with the EU.

However, Vietnam is on the US Treasury’s watch-list of potential currency manipulators and relations with China are complicated by clashing territorial claims in the South China Sea. Nonetheless, our base assumption is that trade ties with both countries will remain stable.

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Tag:

Tag:

Related Contents

Latest News

More News

- New rules ease foreign access to Vietnam equities (February 05, 2026 | 17:29)

- 0.1 per cent tax proposed on each transfer of digital assets (February 05, 2026 | 17:27)

- Ministry of Finance tightens policy delivery at start of year (February 05, 2026 | 17:26)

- Vietnam steps up market reforms as FTSE Russell reviews upgrade progress (February 05, 2026 | 17:20)

- 2025 profits mixed amid strong energy and farming results (February 05, 2026 | 17:18)

- Cashless payments hit 28 times GDP in 2025 (February 04, 2026 | 18:09)

- SSIAM and DBJ launch Japan Vietnam Capital Fund (February 04, 2026 | 15:57)

- Banks target stronger profits, credit growth in 2026 (February 04, 2026 | 15:43)

- Vietnam on path to investment-grade rating (February 03, 2026 | 13:07)

- Consumer finance sector posts sharp profit growth (February 03, 2026 | 13:05)

Mobile Version

Mobile Version