Vietnam boasting buoyant real estate M&A activities

The race for mergers and acquisitions (M&As) in the real estate industry has continuously increased, with foreign investors sealing many deals in recent months.

|

| Vietnam boasting buoyant real estate M&A activities |

CapitaLand Development revealed on July 14 that it was acquiring a prime mixed-use site in Thu Duc district of Ho Chi Minh City, with an estimated gross development value of $720 million. This 8-hectare project will provide 1,100 apartments and will go into operation in 2027.

A couple of weeks previously, Thai retail giant Central Retail also announced that it would invest an additional $869 million in the Vietnamese market, including developing complex projects and commercial centres over the next five years. The group also said that in the coming time, it will maintain the M&A target to accelerate its expansion in the retail real estate sector.

Olivier Langlet, general director of Central Retail Vietnam, said, “We see Vietnam as one of the key strategic markets, with on-year growth reaching revenues of nearly 38.6 billion Thai baht ($1 billion) within 10 years, accounting for 22 per cent of our total revenues,” Langlet said.

At the beginning of this year, the office real estate market for M&As emerged with the acquisition of the Capital Place office building, a Grade A office building in the centre of Hanoi by Viva Land from CapitaLand Development for $550 million. This high-class office project consists of two 37-storey office towers, selected to house the main offices of many multinational corporations in Hanoi.

Particularly in the housing segment, the market also witnessed a series of blockbuster deals. Novaland Group has acquired the Kenton Node project and changed its name to the Grand Sentosa, consisting of more than 1,640 luxury apartments in Nha Be district of Ho Chi Minh City. It took over from Tai Nguyen Construction Production Trading in February.

In June, US investment fund Warburg Pincus announced capital of $250 million into Novaland, aiming to increase its land fund and develop Novaland’s existing projects in strategic locations, to take advantage of the gradually improving infrastructure in the South. Warburg Pincus’ investment in Novaland was in the top five largest transactions in the Asian real estate industry in June, according to GlobalData.

The upper hand

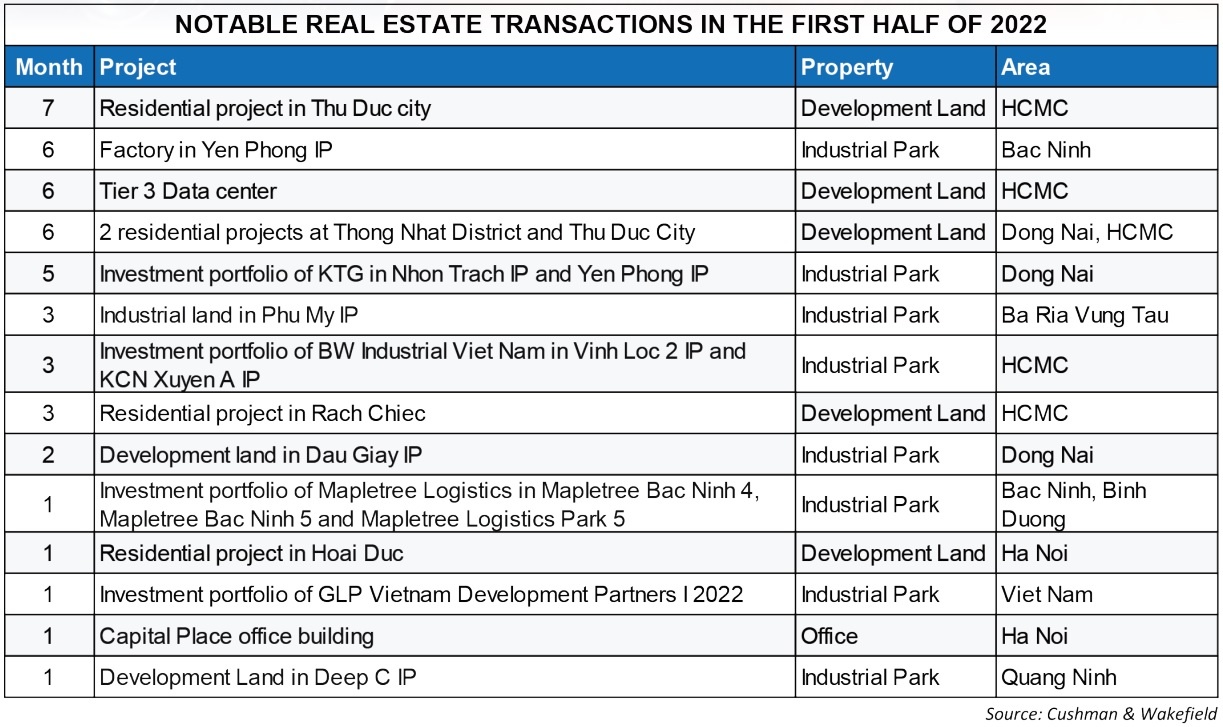

The hottest segment in the market continues to be industrial real estate, accounting for 35 per cent of the total value of transactions with a series of outstanding deals, according to statistics from Cushman & Wakefield Vietnam.

With the brand name of Core5 Vietnam, Vietnam Investment Q Ltd., which is under Indochina Kajima Development, a joint venture between Indochina Capital and Kajima Corporation of Japan, plans to roll out factories and warehouses for lease in current and up-and-coming manufacturing and logistics hubs throughout Vietnam.

The developer’s current portfolio covers 90ha of land, including seven projects in the north of Vietnam and one project in the south. At construction completion, these assets will comprise a total net leasable area of approximately 700,000 square metres and will amount to a total investment cost of nearly $450 million.

Core5 Vietnam’s first project in Vietnam, located in a prime location within Deep C Haiphong 2, will offer nearly 96,000sq.m of net leasable area to the market. Construction of this project will commence imminently and handover of the first factories is set for early 2023.

Elsewhere, major logistics and renewable energy group GLP established GLP Vietnam Development Partners I at the start of the year, with a total investment of over $1.1 billion across six logistics central projects covering an area of up to 900,000sq.m.

Not long after that, CapitaLand Development announced cooperation with Bac Giang People’s Committee. The two sides will promote the development of an urban-industrial-logistics scheme with a total area of more than 400ha across the province and a commitment of $1 billion.

In addition to traditional real estate types, in June, funding in data centre real estate was also announced by Hong Kong-based private investment fund Gaw Capital Partners, with a level-3 data centre over an area of 6,000sq.m in Ho Chi Minh City High-tech Park.

|

Attractive marketplace

Many experts see this as the right time for foreign businesses to accelerate in the race to find negotiating opportunities with the domestic sector in the context that the Vietnamese real estate market is burdened with a lot of pressure on development capital flows.

Oh Dong Kun, general director of Tokyu Corporation in Vietnam, sees the country as one of Asia’s leading vibrant real estate markets, with much changed and expanded over the past 10 years.

“This market is like a growing child; the process of growing up will face many obstacles, but the important thing is whether businesses have enough patience and the potential to change and wait for its development. Vietnam’s growth is the basis for international corporations to continue to expand in Vietnam,” expressed Kun.

That is why after developing a series of residential projects in Binh Duong New City in cooperation with Becamex IDC, Tokyu recently announced the establishment of a joint venture with Danh Khoi Group to implement the Meraki resort apartment project in Ba Ria-Vung Tau. In this development, Tokyu contributes 49 per cent of the investment capital, and the remaining 51 per cent belongs to Danh Khoi.

Kun believed that international corporations will continue to expand their portfolio in Vietnam. However, apart from residential, Tokyu Corporation aims to drive its investment into the office segment, possibly starting in attractive markets such as Ho Chi Minh City and Hanoi and then to the central provinces.

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Related Contents

Latest News

More News

- Construction firms poised for growth on public investment and capital market support (February 11, 2026 | 11:38)

- Mitsubishi acquires Thuan An 1 residential development from PDR (February 09, 2026 | 08:00)

- Frasers Property and GELEX Infrastructure propose new joint venture (February 07, 2026 | 15:00)

- Sun Group led consortium selected as investor for new urban area (February 06, 2026 | 15:20)

- Vietnam breaks into Top 10 countries and regions for LEED outside the US (February 05, 2026 | 17:56)

- Fairmont opens first Vietnam property in Hanoi (February 04, 2026 | 16:09)

- Real estate investment trusts pivotal for long-term success (February 02, 2026 | 11:09)

- Dong Nai experiences shifting expectations and new industrial cycle (January 28, 2026 | 09:00)

- An Phat 5 Industrial Park targets ESG-driven investors in Hai Phong (January 26, 2026 | 08:30)

- Decree opens incentives for green urban development (January 24, 2026 | 11:18)

Tag:

Tag:

Mobile Version

Mobile Version