UOB Vietnam and UOBAM Vietnam launch sustainable investment solutions

According to the UOB ASEAN Consumer Sentiment Study 2022, there has been a significant increase in the number of Vietnamese who are interested in finding out more about sustainable investing.

Nine in 10 Vietnamese feel that financial institutions should provide better information about the benefits of sustainable investing, while 19 per cent of those surveyed are ready to consider sustainable investing if it matches their risk appetite.

Recognising the gap in the market, UOB Vietnam has entered into a strategic partnership with UOBAM Vietnam to bring comprehensive sustainable investment solutions to customers.

After the MoU signing ceremony at the end of November 2022, UOB Vietnam organised an event exclusively for priority customers on May 30. The event was held at the Sheraton Saigon Hotel, with more than 100 guests in attendance.

|

Sharing the cooperation's strategic vision at the event, Paul Kim, head of the Personal Financial Services Division at UOB Vietnam, said, "UOB always does everything it can to bring the best products and services to Vietnamese customers. Through this strategic cooperation with UOBAM Vietnam, we aim to help customers invest effectively with quality investment products sustainably, managed by some of the most experienced financial experts in Vietnam."

To mark the partnership, UOBAM Vietnam introduced two investment solutions tailored to the Vietnamese market with a focus on sustainability and environmental, social, and governance (ESG) standards. These are the United Vietnam ESG Equity Fund (UVEEF) and Trust Portfolio Management Service (SAM).

UVEEF is the first open-ended fund in Vietnam's financial market to apply ESG criteria in parallel with analysis of stock fundamentals. UVEEF invests mainly in blue-chip stocks with strong fundamentals, good growth potential, and high ESG ratings.

In addition, UOBAM also provides the Trust Portfolio Management Service (SAM) for high-end clients, with securities portfolios tailored to their investment goals and personal risk appetite. Applying the ESG investment process and latest risk management standards, UOBAM Vietnam's team of experts directly advise on investment strategies to help customers achieve their sustainable asset growth goals for the long term.

|

The stock market has witnessed several signs of improvement since the volatility of the end of last year. Investment in UVEEF or SAM will help investors keep up with market trends safely and effectively while limiting risk. The professional investment experts at UOBAM aim to help non-specialist investors make investments.

UOBAM Vietnam boasts safe and simple investment procedures so that investors can start investing with a small amount of diversified capital. The investment bank has quickly become one of the top choices in the fund management market. When UOB Vietnam customers have investment needs, they will be connected with experienced investment experts at UOBAM Vietnam to open an account and start making investments based on their own financial goals and risk appetite.

|

UOBAM Vietnam is a subsidiary of Singapore headquartered - UOB Asset Management Ltd - one of Asia's top asset management groups. UOBAM Vietnam has more than 35 years of experience in providing fund management and advisory services to both institutional and retail clients, with over 320 international awards. The bank won seven awards at the 2023 Best of the Best Awards organised by Asia Asset Management. Of all the awards won, the group is proudest of the Best Asset Management House in Asia (20 years) accolade.

With the achievements over the past years and the team of investment experts, UOB Vietnam and UOBAM Vietnam have underlined their commitment to bring customers effective investment solutions. The partnership is one of the bank's efforts to promote a sustainable financial future for customers and the next generation.

| UOB reaffirms long-term commitment to Vietnam with fresh capital injection UOB is reaffirming its long-term commitment to contributing to Vietnam’s economic growth and deepening its support of customers by increasing its charter capital from VND3 trillion to VND5 trillion ($130.43-217.4 million). |

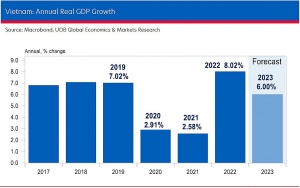

| UOB: Vietnam experiences major setback in Q3 before rebound in Q4 UOB has reported a record decline in the third quarter of 2021 in Vietnam as a consequence of strict social distancing measures, particularly in the south. However, the increasing vaccination rate could help Vietnam's headline GDP growth to rebound to 7 per cent in Q4, which will translate to a 3 per cent increase for 2021. |

| UOB trim GDP growth forecast for Vietnam The strong rebound seen in 2022 is unlikely to be sustainable, with overall growth momentum likely to moderate further in 2023. As a result, UOB has lowered Vietnam’s full-year GDP growth forecast for 2023 to 6 per cent from an earlier call of 6.6 per cent. |

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Tag:

Tag:

Related Contents

Latest News

More News

- Citi sharpens its focus on institutional banking (February 09, 2026 | 19:58)

- SSC steps up engagement with FTSE Russell on market reforms (February 09, 2026 | 17:33)

- IFC considers $50m trade finance guarantee facility for Nam A Bank (February 09, 2026 | 17:28)

- Hoa Phat Agricultural Development debuts shares on HSX (February 06, 2026 | 14:00)

- Vietcap’s VAD 2026 draws strong global investor turnout (February 06, 2026 | 13:30)

- New rules ease foreign access to Vietnam equities (February 05, 2026 | 17:29)

- 0.1 per cent tax proposed on each transfer of digital assets (February 05, 2026 | 17:27)

- Ministry of Finance tightens policy delivery at start of year (February 05, 2026 | 17:26)

- Vietnam steps up market reforms as FTSE Russell reviews upgrade progress (February 05, 2026 | 17:20)

- 2025 profits mixed amid strong energy and farming results (February 05, 2026 | 17:18)

Mobile Version

Mobile Version