UOB recognised among ‘Top 10 Green Services' in Vietnam

The award came in the 'Banking & Finance' category and underscores UOB Vietnam's role as a long-term financial partner in enabling local enterprises to build more resilient, growth models, aligned with environmental, social, and governance (ESG) targets in response to rising sustainability pressures across global supply chains.

|

| Lim Dyi Chang, country head of Commercial Banking, UOB Vietnam |

According to UOB’s 2024 Sustainability Report, Vietnam faces intensifying environmental risks, including record-high temperatures of over 40°C, widespread drought, and recurring flood events, prompting businesses to reassess operational resilience and sustainability priorities.

In response, UOB Vietnam has rolled out a comprehensive suite of green financing solutions tailored to local enterprise needs. These include working capital support for ESG-certified firms, project finance for new renewable developments, and transition financing.

By the end of last year, the bank had supported 19 green finance transactions, aimed at improving resource efficiency, strengthening ESG compliance, and supporting international market integration.

A notable example includes UOB Vietnam’s green trade financing agreement with Nam Viet Corporation (NAVICO) in April 2025, designed to accelerate NAVICO’s Net Zero transition and raise ESG standards across its core export markets in Asia, Europe, the Americas, and the Middle East.

Lim Dyi Chang, country head of Commercial Banking, UOB Vietnam, said, "This recognition validates our long-term commitment to Vietnam’s sustainable growth journey. We combine green financing with practical implementation support to help businesses navigate ESG challenges and build long-term competitiveness."

|

UOB Vietnam has set a target to allocate 30 per cent of new loan disbursements to mid-sized enterprises with clear sustainability objectives for 2025.

The bank is also expanding its green finance offerings across renewable energy, sustainable manufacturing, and smart infrastructure, sectors seen as pivotal to Vietnam’s economic transition.

At the regional level, UOB Group’s sustainable finance portfolio surpassed $41 billion by the end of 2024.

The bank has also formally adopted the Taskforce on Nature-related Financial Disclosures, reinforcing its commitment to global environmental transparency and nature-aligned investment frameworks.

This recognition further strengthens UOB Vietnam’s positioning as a strategic partner in Vietnam’s green economy transformation and highlights its contribution to advancing ESG integration across key sectors.

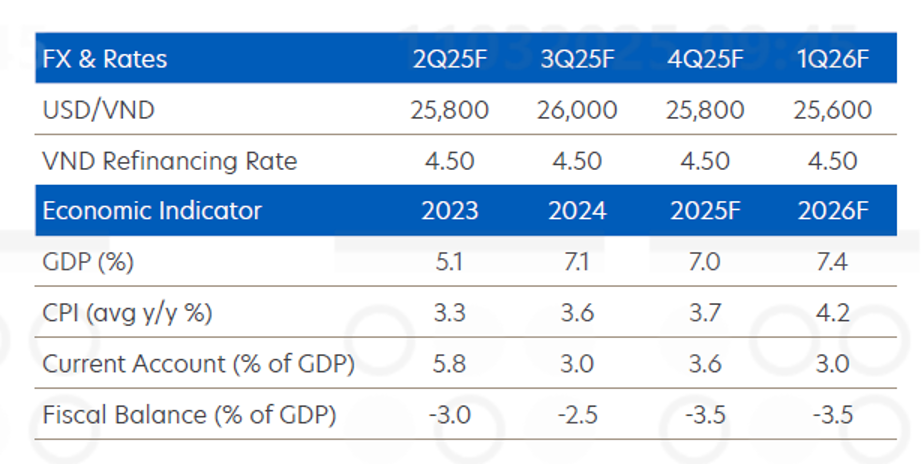

| UOB maintains positive outlook for Vietnam but risks lie ahead The United Overseas Bank (UOB) has maintained its full-year growth forecast for Vietnam at 7 per cent in 2025, assuming first quarter growth of 7.1 per cent. |

| Vietnam EXPO 2025 launches in Hanoi The 34th Vietnam International Trade Fair (Vietnam EXPO 2025) is taking place at the Hanoi International Exhibition Centre (ICE) from April 2-4, attracting hundreds of domestic and international businesses. |

| UOB committed to Vietnam with fresh capital and new headquarters UOB announced on April 8 that it will increase its charter capital of its Vietnamese subsidiary to VND10 trillion ($385 million). |

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Tag:

Tag:

Related Contents

Latest News

More News

- A golden time to shine within ASEAN (February 19, 2026 | 20:22)

- Vietnam’s pivotal year for advancing sustainability (February 19, 2026 | 08:44)

- Strengthening the core role of industry and trade (February 19, 2026 | 08:35)

- Future orientations for healthcare improvements (February 19, 2026 | 08:29)

- Infrastructure orientations suitable for a new chapter (February 19, 2026 | 08:15)

- Innovation breakthroughs that can elevate the nation (February 19, 2026 | 08:08)

- ABB Robotics hosts SOMA Value Provider Conference in Vietnam (February 19, 2026 | 08:00)

- Entire financial sector steps firmly into a new spring (February 17, 2026 | 13:40)

- Digital security fundamental for better and faster decision-making (February 13, 2026 | 10:50)

- Aircraft makers urge out-the-box thinking (February 13, 2026 | 10:39)

Mobile Version

Mobile Version