UOB becomes bank of choice for aspiring ASEAN consumers

At a UOB corporate day, themed "Building the Future of ASEAN" on August 14, UOB published a report on its business in terms of income, geographical presence, and asset mix. UOB has strengthened its position as a top regional bank and card issuer, gaining over 10 million consumers across Southeast Asia, a 20 per cent increase over the past year, while leading in retail banking and digital payments.

|

| Wee Ee Cheong, deputy chairman and CEO of UOB |

“Megatrends are creating new growth avenues across ASEAN countries, including the digital revolution, the transition to net zero, and the rise of the middle class. With these megatrends, the region will be a dynamic playing field for the next big wave of development. UOB is fully committed to our key markets in ASEAN, to grow together with the region,” said Wee Ee Cheong, deputy chairman and CEO of UOB.

A larger franchise has fuelled more strategic partnerships, enabling UOB to offer customers unique lifestyle experiences, ranging from shopping, dining, travel, and entertainment, with more than 1,000 deals across the region.

UOB is successfully capitalising on the growing trends of consumer spending and cross-border payments within ASEAN. The bank’s card fee income grew by 66 per cent over the past year, particularly in areas like online shopping, dining, and travel.

A UOB representative stated that the bank is a pioneer in developing emerging payment services such as scan-to-pay, which grew by 45 per cent, and peer-to-peer transfers, which increased by 90 per cent, contributing to the push towards cashless payments in the region.

UOB’s engines of growth lie in wealth management, cards, current account savings, and ASEAN-4, with its omnichannel strategy as a key strength, differentiated by a strong focus on customer centricity. Customers using the omnichannel possess 16 per cent more products and perform 18 times more transactions than traditional customers.

Revenue from each omnichannel customer is twice that of traditional customers, contributing more than half of the bank’s total revenue.

The UOB representative also shared a clear roadmap for the coming years regarding continuously innovating its digital banking platform with UOB TMRW. As part of its strategic reshape, the bank is developing the next generation of UOB TMRW to expand across the region, focusing on balancing enhanced security with improved consumer experience.

The goal is to upgrade engagement and digital service capabilities across Southeast Asia, ensuring consumers enjoy seamless interactions with the bank. UOB is also optimising the omnichannel experience, integrating physical and digital touchpoints to create a more cohesive and efficient banking experience.

| GDP growth in first quarter to ease to 5.5 per cent: UOB UOB (United Overseas Bank) has maintained its growth forecast for Vietnam at 6 per cent for 2024 and expects GDP growth to ease to 5.5 per cent in the first quarter, due to the Lunar New Year holiday effect. |

| UOB Vietnam partners with Betrimex on sustainability On April 12, United Overseas Bank (Vietnam) Limited (UOB Vietnam) signed a green trade finance facility agreement with Ben Tre Import Export Joint-Stock Corporation (Betrimex) on sustainable coconut production. |

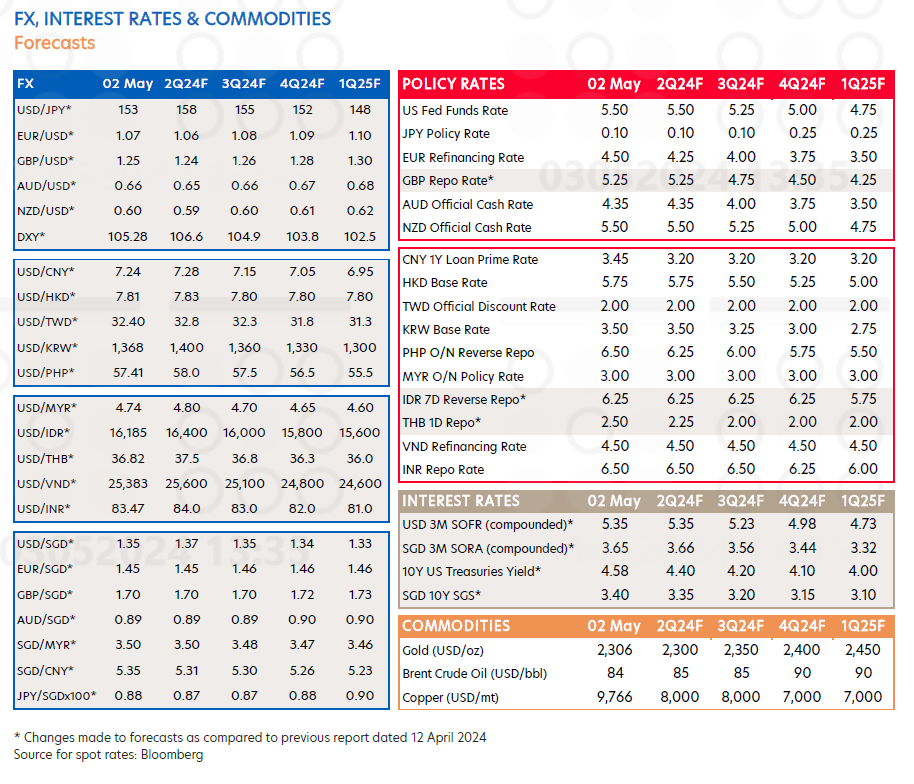

| UOB: USD likely to weaken against the VND The latest Global FX and Rate Outlook from UOB Global Economics and Markets Research dated May 3 expects the USD to weaken from the third quarter of 2024. This comes after the latest Federal Open Market Committee, held April 30–May 1, and its statement conceding a lack of progress towards the 2 per cent inflation objective since the start of the year. |

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Related Contents

Latest News

More News

- Miza Nghi Son green bond marks milestone for sustainable finance (January 19, 2026 | 09:51)

- Higher 2026 growth target puts pressure on credit framework (January 19, 2026 | 09:00)

- VN-Index could reach 2,040 points in 2026 (January 16, 2026 | 16:41)

- Vietnam’s corporate bond market set for a more positive 2026 (January 15, 2026 | 14:10)

- Foreign sentiment towards Vietnam turns more positive (January 15, 2026 | 11:08)

- Wealth management faces skills gap as investor confidence lags (January 13, 2026 | 10:23)

- HDBank completes $100 million international green bond scheme (January 12, 2026 | 16:28)

- Vietnam’s IPO market eyes revival in 2026 (January 09, 2026 | 17:28)

- Brokerage competition tightens as market shares narrow (January 09, 2026 | 15:19)

- Banks set for selective hiring in 2026 (January 08, 2026 | 10:56)

Tag:

Tag:

Mobile Version

Mobile Version