UOB: USD likely to weaken against the VND

|

However, Fed chair Jerome Powell managed to sooth frayed nerves as he highlighted that policy is on balance restrictive and the Fed is not looking at hiking rates.

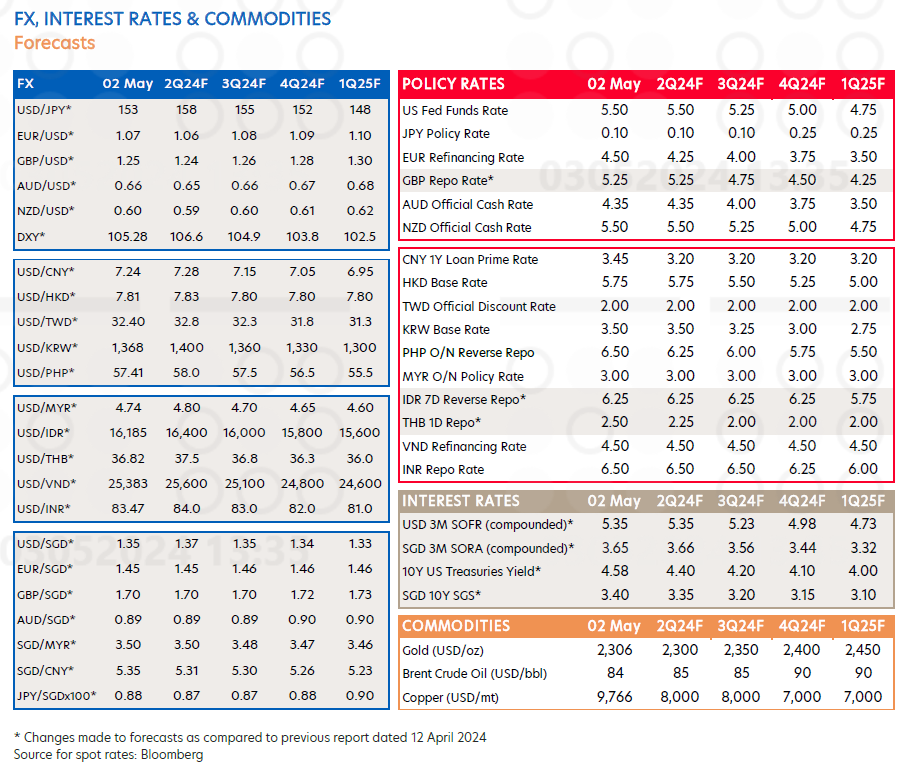

Overall, the macroeconomic team of UOB maintains expectations of 2x25 basic points cuts across 2024, in September and December, although the risk is still tilted towards the Fed delaying cuts even further.

In the foreign exchange space, the impact of a later start to the Fed’s easing cycle on the USD is clear. It is all but certain that the USD is likely to stay strong, at least in the second quarter of 2024.

However, consistent with the view of lower US rates going forward, UOB reiterated that USD would begin to weaken, starting later in the third quarter of the year. The key risk to the bearish USD view is that the Fed keeps its rates unchanged.

UOB expects Asian foreign exchange to stay weak for the remainder of the second quarter of 2024. UOB's expectation of an eventual Asian foreign exchange recovery is still intact, albeit starting from the third quarter instead. The key risk to the cautiously positive view on Asia foreign exchange is a sudden Chinese Yuan (CNY) devaluation.

In Vietnam, the USD/VND rate traded at a new high above 25,463 in April alongside broad USD strength against Asian peers. With receding Fed rate cut expectations, the USD/VND rate is likely to stay elevated for a while longer. The State Bank of Vietnam said it had intervened in the foreign exchange markets in April and this may help to keep volatility in check.

Beyond near-term external headwinds, UOB expects the VND to draw support from resilient fundamentals and the subsequent recovery of the CNY. UOB's updated USD/VND forecasts are 25,600 in the second quarter, 25,100 in the third, 24,800 in the fourth quarter of 2024, and 24,600 in the first quarter of next year.

| State Bank of Vietnam to keep policy rates steady in 2024: UOB With the pace of economic activities on the mend and inflation rates already easing below the target level, the State Bank of Vietnam (SBV) will maintain its refinancing rate at the current level of 4.5 per cent to support economic recovery, the United Overseas Bank (UOB) said in a report. |

| Economy set for further rebound in Q4 Vietnam’s GDP growth accelerated further to 5.33 per cent on-year in the third quarter (Q3), from 4.14 per cent in Q2. This was due to improvements in trade, manufacturing, and domestic activities, after an underperforming first half of 2023, according to the United Overseas Bank (UOB). |

| GDP growth in first quarter to ease to 5.5 per cent: UOB UOB (United Overseas Bank) has maintained its growth forecast for Vietnam at 6 per cent for 2024 and expects GDP growth to ease to 5.5 per cent in the first quarter, due to the Lunar New Year holiday effect. |

| Vietnam’s fiscal policy can perform a stronger role High interest rates elsewhere have led to consumption and export issues. Suan Teck Kin, head of Research at UOB, shared with VIR’s Nhue Man his prospects on Vietnam’s development and its monetary policies to face to the impact of activity involving China and the United States. |

| Monetary policy governance requires thorough consideration: official As the governance of the monetary policy has to concurrently guarantee multiple targets, including reducing interest rates, expanding credit, stabilising foreign exchange rates, and ensuring credit institutions’ safety, thorough consideration is needed before any steps are taken, Deputy Governor of the State Bank of Vietnam (SBV) Dao Minh Tu. |

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Tag:

Tag:

Related Contents

Latest News

More News

- Private capital funds as cornerstone of IFC plans (February 20, 2026 | 14:38)

- Priorities for building credibility and momentum within Vietnamese IFCs (February 20, 2026 | 14:29)

- How Hong Kong can bridge critical financial centre gaps (February 20, 2026 | 14:22)

- All global experiences useful for Vietnam’s international financial hub (February 20, 2026 | 14:16)

- Raised ties reaffirm strategic trust (February 20, 2026 | 14:06)

- Sustained growth can translate into income gains (February 19, 2026 | 18:55)

- The vision to maintain a stable monetary policy (February 19, 2026 | 08:50)

- Banking sector faces data governance hurdles in AI transition (February 19, 2026 | 08:00)

- AI leading to shift in banking roles (February 18, 2026 | 19:54)

- Digital banking enters season of transformation (February 16, 2026 | 09:00)

Mobile Version

Mobile Version