Untapped potential in branded luxury living

|

| The major cities of Vietnam have boomed in terms of real estate in the past decade, becoming a magnet for the wealthy. Photo: Duc Thanh |

According to Savills’ recent global research report update, Vietnam is now among the fastest global growth markets for branded residences.

Major destinations for branded residences, which are usually a partnership between a well-known management brand and a property developer, include Dubai, Miami, and New York, with growth markets listed as Vietnam, the United Kingdom, Morocco, Malaysia, Australia, Saudi Arabia, and Egypt.

Savills Hanoi director Matthew Powell revealed that in 2020, urban areas containing the highest number of branded residences were Miami with 32 projects, Dubai with 29, and New York with 25 projects.

The United Arab Emirates, Mexico, and Brazil are expected to be potential markets with the number of projects expected to increase by 50 per cent compared to the total supply in 2020.

Other markets are recording rapid growth in this area, with at least six new projects to be announced in the near future in Vietnam, the UK, Morocco, Malaysia, Australia, and Saudi Arabia.

“The diversification of investors’ portfolios together with the development of adequate quality and affordable prices will help Vietnam participate in the competition,” said Powell. “Currently, there are only a handful of international managers investing in branded residences in Vietnam, but the market’s potential is real and the demand for this segment is well recognised with the rise of today’s rich and middle class.”

|

Limited supply

Branded residences in Vietnam are showing potential to attract buyers due to the limited supply and increasing demand.

The number of luxury apartments for sale in 2020 in both Hanoi and Ho Chi Minh City were much lower than in 2018 and 2019, due to the slow licensing process of new and expanded projects.

According to CBRE Vietnam, last year the number of apartments launched to the Ho Chi Minh City market was fewer than 17,300 units, a decrease of 35 per cent compared to 2019. This is the lowest level in the past six years and the fifth consecutive year the market has recorded a decline in supply.

In 2020, the Hanoi market recorded approximately 18,000 newly-launched apartments, a decrease of 52 per cent on-year. This is the lowest level in a year since 2015.

Although the selling price is at a historic peak for Vietnamese real estate, in the past 12 months luxury apartments have still recorded fairly high consumption thanks to the possession of prime locations in golden land plots of the city.

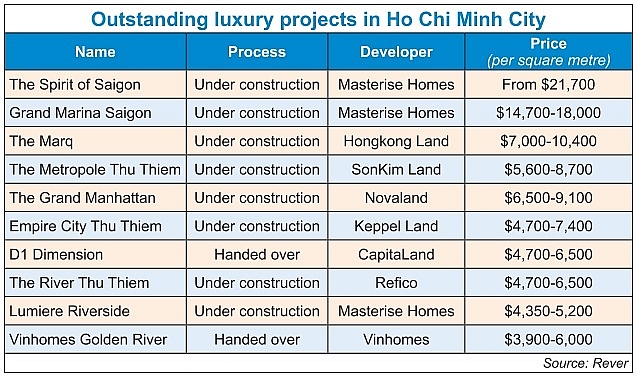

Luxury apartments in Ho Chi Minh City, meanwhile, are now quoted at an average of $7,000 per square metre in Thu Thiem New Urban Area and as much as $12,000 per sq.m in District 1.

The price of luxury apartment units, according to CBRE Vietnam, is increasing from 2 to 7 per cent in 2021 compared to the previous year.

The highest price was assumed by Grand Marina from Masterises Homes at $18,000 per sq.m in an open sale to overseas buyers in Hong Kong last month.

The high-end segment has long been a favourite investment product of the world’s rich, and it is no different in Vietnam.

The 2021 Prosperity Report from real estate consultant Knight Frank said that although the number of people with net worth over $30 million and people with assets of over $1 million in Vietnam decreased slightly in 2020, the number of super-rich people in Vietnam will grow in the next five years.

Specifically, the pandemic had caused numbers of super-rich people in 2020 in Vietnam to fall to 390, 15 people fewer than those in 2019. The number of people with net assets worth over a million dollars also dropped by over 1,000, to just over 20,000 people last year.

However, in the next five years, the growth rate of the rich in Vietnam will still reach 31 per cent, Knight Frank predicts. By 2025, Vietnam will have over 500 people with a net worth of over $30 million and over 25,000 people with more than $1 million in assets.

Competitive prices

For foreign buyers, Vietnam is considered a spotlight as it was one of only a few countries to net positive growth last year. It has also been praised for its stellar pandemic response and prevention measures.

Besides that, real estate prices in Vietnam were still much lower than regional cities like Kuala Lumpur and Bangkok. The price of luxury apartments in the downtown area of Ho Chi Minh City can sit at $5,500-6,500 per sq.m, a small fraction of the price in Hong Kong.

In Bangkok, The Residences at Mandarin Oriental is quoted at around $17,000 per sq.m. A unit at St. Regis is quoted in Property Guru in Singapore with a price of $22,000 per sq.m.

Moreover, Vietnam’s rank has been continuously increasing for the past two years on real estate consultant JLL’s Global Real Estate Transparency Index. Thanks to the development of Hanoi and Ho Chi Minh City, the country’s transparency was ranked 56th globally in 2020, entering the group of “semi-transparent” countries for the first time in a decade.

Hanoi and Ho Chi Minh City also moved to the top 10 most active cities in the world in 2021 with Hanoi in the top three, according to JLL.

A survey carried out at the end of 2020 from the Vietnam Real Estate Research Institute shows that if other segments have strong volatility, luxury real estate in big cities like Hanoi and Ho Chi Minh City has reached good absorption rate because it meets the needs and strict standards of wealthy people.

Although the supply of real estate products fell sharply, luxury products were no exception but the number of successful transactions reached 81 per cent, accounting for 25 per cent of the total real estate market. The absorption rate of the luxury real estate segment alone fluctuates at 70-80 per cent, showing that the room for growth is still large, the institute added.

Despite being an infant property market, Vietnam has become a home for the largest branded residences project to date worldwide for Marriott International, with close to 4,200 residential and officetel units in Ho Chi Minh City developed by domestic developer Masterise Homes. This project is anticipated to include branded units from both JW Marriott and Marriott Hotels.

Besides that, Marriott International is also currently exploring the option of a Ritz-Carlton, its first luxury brand, for another project in Ho Chi Minh City.

Other branded residences managed in Vietnam include Ascott from CapitaLand and Hyatt for the residential part of two projects on Phu Quoc Island and Ho Tram in Ba Ria-Vung Tau.

| Emma Smithson - Regional director of Residences Operation Asia-Pacific, Marriott International

According to our research and discussions with our partners, urban residences, branded or not, will remain a strong area of growth in Vietnam in the coming years and decades. A new generation of young, affluent urban residents is more familiar with the concept of condo accommodation rather than landed property, and they appreciate the flexibility and freedom that this style of living provides. Vietnamese customers are becoming increasingly sophisticated and brand-conscious, and the country’s continued economic growth and accessibility gives us considerable confidence in the potential of the market. Whether we are providing hotels, resorts, or branded residences, we need to be where our customers want to go. Vietnam is a dynamic market with tremendous potential for domestic business travel. A youthful population with rising levels of affluence and disposable income is leading the way. The country continues to show economic resilience, with steady GDP growth of 2.9 per cent in 2020, despite the pandemic-led global downturn. The government’s investments in infrastructure, including new highways and expanded airports, will also help to spur the travel economy in the coming years. |

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Tag:

Tag:

Related Contents

Latest News

More News

- Foreign leaders extend congratulations to Party General Secretary To Lam (January 25, 2026 | 10:01)

- 14th National Party Congress wraps up with success (January 25, 2026 | 09:49)

- Congratulations from VFF Central Committee's int’l partners to 14th National Party Congress (January 25, 2026 | 09:46)

- 14th Party Central Committee unanimously elects To Lam as General Secretary (January 23, 2026 | 16:22)

- Worldwide congratulations underscore confidence in Vietnam’s 14th Party Congress (January 23, 2026 | 09:02)

- Political parties, organisations, int’l friends send congratulations to 14th National Party Congress (January 22, 2026 | 09:33)

- Press release on second working day of 14th National Party Congress (January 22, 2026 | 09:19)

- 14th National Party Congress: Japanese media highlight Vietnam’s growth targets (January 21, 2026 | 09:46)

- 14th National Party Congress: Driving force for Vietnam to continue renewal, innovation, breakthroughs (January 21, 2026 | 09:42)

- Vietnam remains spiritual support for progressive forces: Colombian party leader (January 21, 2026 | 08:00)

Mobile Version

Mobile Version