Tough spot for steel ventures as pandemic cuts off progress

|

| Tough spot for steel ventures as pandemic cuts off progress |

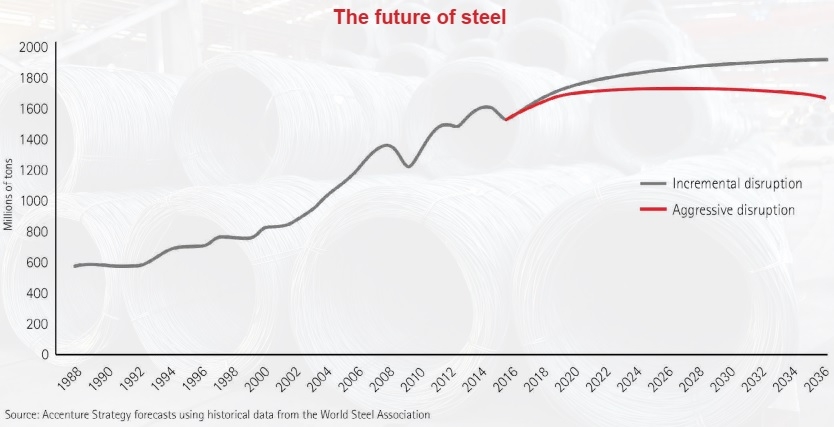

According to a World Steel Association report, global production in the industry witnessed a fall in the first seven months of 2020, with crude steel production for the 64 countries reporting to the association sitting at 152.7 million tonnes in July, a 2.5 per cent decrease compared to 156.7 million tonnes in July last year.

In response to the slower demand at home and abroad, a number of giant steelmakers such as Nippon Steel Corporation and Tata Group said they will possibly halt the production of further blast furnaces to cope with the situation amid the ongoing coronavirus pandemic. And while Vietnam is relatively better off than many in terms of the pandemic, it will not be an exception to steel industry impacts. The World Steel Association also noted recovery is on trend but the steel picture remains less rosy than in other areas.

Locally-invested Hoa Sen Group is set to withdraw its capital contribution from the $10 billion Ca Na steel complex in the central coastal province of Ninh Thuan, instead looking to focus on other areas such as plastics and corrugated iron. Insiders remarked that it would be a wise move for Hoa Sen, but it would not be easy to find investors for the project anytime soon. Hoa Sen used to bet on this project. Constructing the steel complex was planned to help Hoa Sen overtake Hoa Phat as the largest Vietnamese steel producer, following only Taiwanese Hung Nghiep Formosa Ha Tinh Steel Co., Ltd., which has an annual capacity of 7.5 million of tonnes in its first phase.

The Ca Na steel complex is set to be carried out towards 2031 in multiple stages and will have final capacity of 16 million tonnes a year, including long and flat steel.

COVID-19 has bitten into the profits of Formosa Plastics Group, which operates a $10.5 billion steel and port complex in the central province of Ha Tinh. Although there is no official data from the company, a provincial report said that in the first half of the year, Formosa’s production output and consumption of steel billets and finished steel products fell sharply because the price of finished steel products continues to decline while raw material prices continue to move in the opposite direction.

The initial impact of the pandemic also caused problems. Facilities suffered shutdowns for maintenance and repair of hot-rolled machinery for 20 days in January and 10 days in February. Over the first six months, it is estimated that the Formosa steel facility’s billet output hit 2.67 million tonnes (down 12.7 per cent) and steel output was 1.96 million tonnes (down 18.3 per cent) over the same period in 2019.

The Formosa steel facility is now capable of producing 7.1 million tonnes of crude steel per year, but the slowing growth of the company has reduced the index of industrial production for Ha Tinh.

Last year, Formosa announced that it could increase its capacity in both 2021 and 2023 after its first blast furnace went into use in 2017 and the second came a year later. However, the current pandemic has ensured the moves are currently a non-starter.

Besides the slowing demand, Nguyen Van Sua, former chairman of the Vietnam Steel Association (VSA), said that the industry currently endures other problems such as the difference between the domestic demand and production capacity, as well as the competition created when other countries use trade remedies to protect their domestic production.

However, locally- invested Hoa Phat is one of few steelmakers reaping profits despite COVID-19. In the first seven months of 2020, it exported 160,000 tonnes of high-quality roll steel, up 2.3 per cent on-year. The key export markets were the United States, Japan, Canada, China, South Korea, and Singapore. It will export 30,000 tonnes in this September and October to Kenya and Ghana.

The VSA suggested that the local authorities should be wary of accepting a new steel project in order to avoid the unbalanced supply and demand as well as trade disputes between nations. The VSA also said that it is necessary to consider many factors when adopting a steel project.

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Tag:

Tag:

Related Contents

Latest News

More News

- VinaCapital launches Vietnam's first two strategic-beta ETFs (February 26, 2026 | 09:00)

- PM sets five key tasks to accelerate sci-tech development (February 26, 2026 | 08:00)

- PM outlines new tasks for healthcare sector (February 25, 2026 | 16:00)

- Citi report finds global trade transformed by tariffs and AI (February 25, 2026 | 10:49)

- Vietnam sets ambitious dairy growth targets (February 24, 2026 | 18:00)

- Vietnam, New Zealand seek level-up in ties (February 19, 2026 | 18:06)

- Untapped potential in relations with Indonesia (February 19, 2026 | 17:56)

- German strengths match Vietnamese aspirations (February 19, 2026 | 17:40)

- Vietnam’s pivotal year for advancing sustainability (February 19, 2026 | 08:44)

- Strengthening the core role of industry and trade (February 19, 2026 | 08:35)

Mobile Version

Mobile Version